Cash App Partner Bank is a bank that collaborates with Cash App to provide financial services. With their partnership, Cash App users can enjoy the convenience of banking services, including direct deposit and other features offered by the Partner Bank.

In addition, Cash App Partner Bank ensures secure transactions and efficient customer service to enhance the overall banking experience for users.

How Cash App Partner Bank Works

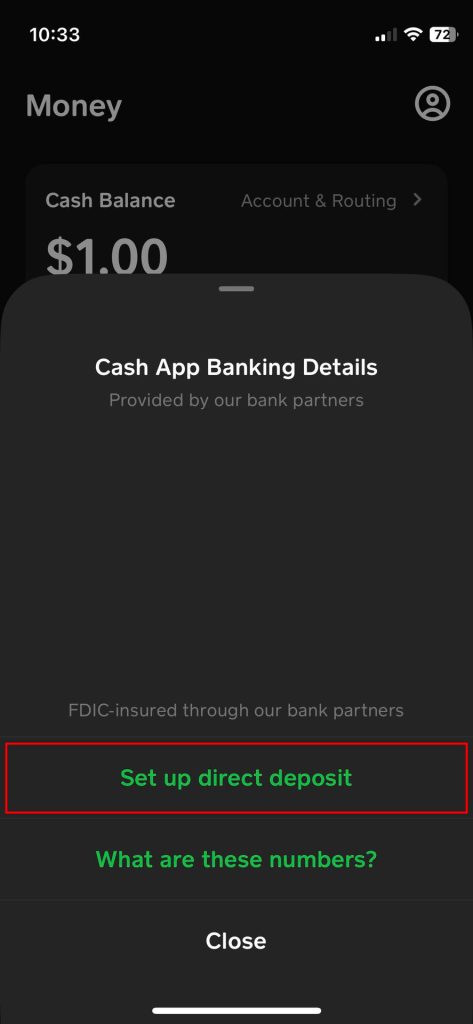

With the increasing popularity of Cash App as an innovative digital payment platform, it has collaborated with traditional banks to enhance its services. Cash App partnered with various banks to provide users with a more seamless and efficient banking experience. This partnership enables Cash App users to link their accounts to a partner bank, allowing them to access banking features such as direct deposit, savings accounts, and debit cards.

By partnering with banks, Cash App can leverage the infrastructure and expertise of the banking industry while offering its users a more comprehensive financial solution. This collaboration also ensures that funds deposited in users’ Cash App accounts are securely held in partner bank accounts, providing an added layer of trust and security.

By combining the convenience of a digital payment platform with the reliability of traditional banking services, Cash App partner bank offers users a comprehensive and efficient solution for their financial needs.

Benefits Of Partnering With Cash App

Partnering with Cash App’s partner bank comes with a range of benefits, including seamless transactions, secure transfers, and access to a user-friendly mobile banking platform. Experience the convenience and reliability of Cash App’s trusted banking services today.

Partnering with Cash App offers numerous benefits for businesses looking for seamless integration with a user-friendly interface. Cash App’s platform provides increased accessibility to banking services for both customers and partners. With its intuitive interface and easy navigation, users can conveniently access and manage their finances, making transactions hassle-free.

Moreover, partnering with Cash App ensures enhanced security features for all transactions. Cash App prioritizes the safety and protection of user information, employing robust encryption technology to safeguard sensitive data. This ensures that both businesses and customers can trust in the security of their financial transactions, mitigating the risk of fraud or unauthorized access.

| Benefits | Partnering with Cash App |

| Seamless Integration | Easy integration with Cash App’s user-friendly interface |

| Increased Accessibility | Access to banking services made more convenient for users |

| Enhanced Security | Robust encryption technology ensures secure transactions |

Partnering with Cash App not only streamlines financial processes but also provides a secure environment for conducting transactions. Experience the benefits of a seamless integration and enhanced security with Cash App as your trusted partner.

The Process Of Partnering With Cash App

To become a partner bank with Cash App, banks must meet certain eligibility criteria. This includes having a valid banking license and being regulated by a recognized regulatory authority. Once the eligibility criteria are met, there are several steps involved in the partnership process. First, banks need to submit an application to Cash App, providing details about their banking operations and services. The application is then reviewed by Cash App to assess if the bank aligns with their partnership requirements. If approved, the next step involves the integration of the bank’s systems with Cash App’s infrastructure to enable seamless transactions for Cash App users. Meeting regulatory requirements is of utmost importance in this partnership process. Cash App, being a financial service provider, prioritizes compliance with regulations to ensure the security and trust of its users. Therefore, partner banks must diligently adhere to the regulatory guidelines set forth by their regulatory authority. By meeting these requirements, partner banks can offer their customers the convenience of seamless integration with Cash App’s ecosystem, expanding their reach and providing added value to their banking services.

The Impact Of Cash App Partner Bank On Customers

The Cash App Partner Bank has revolutionized the banking experience for customers by providing a simplified and convenient platform. With expanded financial services and options, users can enjoy a wide range of banking functionalities seamlessly integrated into the Cash App.

From managing transactions to handling funds, the Cash App streamlines all financial activities within one app. This not only saves time but also eliminates the need for multiple banking applications. Users can securely send and receive money, deposit checks, invest in stocks, and even get a loan directly from the Cash App.

The convenience of having a partner bank integrated into the app has transformed the way people manage their finances. Whether it’s tracking expenses, setting up automatic savings, or accessing their account from anywhere, the Cash App Partner Bank offers a seamless and hassle-free banking experience for users.

Cash App Partner Bank Vs. Traditional Banking

The rise of digital payment solutions like Cash App in recent years has presented an interesting alternative to traditional banking. One key difference between Cash App Partner Bank and traditional banking lies in the account features and fees.

With Cash App Partner Bank, users can enjoy a range of convenient digital features such as instant peer-to-peer transfers, mobile check deposits, and contactless payments. In comparison, traditional banking may require manual processes for these transactions, which can be time-consuming and less efficient.

Cash App Partner Bank also stands out with its minimal fees. Unlike traditional banks that often charge monthly maintenance fees and transaction fees, Cash App Partner Bank offers a more transparent fee structure. Users can benefit from no monthly maintenance fees and can enjoy fee-free transactions for the majority of Cash App services.

Another noteworthy aspect is the integration of digital solutions into the traditional banking model. While traditional banks have started to embrace online banking platforms, they may still have limitations in terms of user experience and innovation. Cash App Partner Bank, on the other hand, is built with a customer-centric approach, adapting to changing customer preferences and needs.

Ultimately, whether individuals opt for Cash App Partner Bank or traditional banking will depend on their unique financial requirements and personal preferences. However, with its array of digital features, minimal fees, and customer-centric approach, Cash App Partner Bank offers a compelling alternative for those seeking a more streamlined and convenient banking experience.

Credit: www.12newsnow.com

Future Developments And Opportunities For Cash App Partner Banks

With the rapid advancements in technology and financial innovation, there are exciting future opportunities for Cash App partner banks. The potential for further collaborations and partnerships is immense, enabling these banks to expand their reach and services to previously unbanked populations. By leveraging the power of Cash App’s platform, partner banks can tap into a vast user base and provide them with seamless banking experiences.

The partnership between Cash App and these banks opens up new avenues for growth and development. Through strategic alliances, banks can offer innovative financial products and services, ranging from digital wallets to peer-to-peer payments. This collaboration also presents an opportunity to enhance financial inclusion and bring banking services to underserved communities.

As the demand for convenient and accessible banking solutions continues to rise, the future holds immense potential for Cash App partner banks. By embracing technological advancements and forging strong partnerships, these banks can capitalize on the growing needs of the market and establish themselves as leaders in the digital banking landscape.

Success Stories: Cash App Partner Bank Case Studies

Success Stories: Cash App Partner Bank Case Studies

Real-life examples of how Cash App partner banks have benefited customers

Demonstrating the effectiveness and potential of the collaboration

In today’s digital age, financial institutions are constantly seeking innovative ways to provide enhanced services to their customers. Cash App, a popular mobile payment platform, has successfully partnered with various banks to offer a seamless and convenient banking experience. These collaborations have resulted in numerous success stories, each highlighting the positive impact on customers’ financial lives.

Through these partnerships, Cash App has been able to leverage the expertise of established banks while integrating their cutting-edge technology. This synergy has led to improved customer satisfaction and increased accessibility to financial services. The real-life examples of customer success stories serve as a testament to the effectiveness of these collaborations.

The partnership between Cash App and its partner banks has revolutionized the way people manage their finances. Whether it’s seamless fund transfers, hassle-free bill payments, or easy access to loans, the collaboration has made banking more convenient and efficient.

By constantly evolving and strengthening these partnerships, Cash App aims to continue delivering innovative solutions that empower individuals to take control of their financial well-being.

Conclusion: The Growing Role Of Cash App Partner Bank

The growing role of Cash App Partner Bank is revolutionizing the banking industry through collaborative efforts. These banks are empowering customers with convenient and secure financial solutions. By partnering with Cash App, banks are able to leverage its technological advancements and user-friendly interface to offer a seamless banking experience. With the increasing popularity of cashless transactions, Cash App partner banks are well-positioned to cater to the evolving needs of their customers.

These partnerships open up a world of future potential and opportunities for both Cash App and partner banks. By combining their resources and expertise, they can develop innovative solutions to meet the changing demands of the digital economy. Cash App partner banks have the advantage of tapping into Cash App’s extensive user base, allowing them to reach a broader audience and expand their customer base.

In conclusion, Cash App partner banks are reshaping the banking landscape with their collaborative efforts, providing customers with enhanced financial services and driving the growth of the digital banking industry.

Frequently Asked Questions On Cash App Partner Bank

What Is A Cash App Partner Bank?

A cash app partner bank is a financial institution that collaborates with the cash app to provide banking services, such as issuing debit cards and facilitating transactions. Partner banks play a crucial role in ensuring the smooth functioning of the cash app.

How Can I Find Out If My Bank Is A Cash App Partner?

To determine if your bank is a cash app partner, you can check the list of partnering banks on the cash app’s website or contact your bank directly. Partner banks are usually listed in the app’s settings or on the cash app’s official website.

What Are The Benefits Of Using A Cash App Partner Bank?

Using a cash app partner bank offers several advantages. Firstly, it allows you to link your bank account directly to your cash app, making it easier to transfer funds between the two. Additionally, partner banks often provide enhanced security measures and customer support for cash app users.

Can I Still Use The Cash App If My Bank Is Not A Partner?

Yes, you can still use the cash app even if your bank is not a partner. However, you may experience certain limitations, such as delayed transfers between your cash app and bank account. It’s recommended to link a partner bank for a seamless and efficient cash app experience.

Conclusion

To sum up, teaming up with a partner bank has truly revolutionized the Cash App experience, offering users more convenience, security, and financial services at their fingertips. By integrating seamlessly with the app, this partnership empowers users to manage their money with ease, access direct deposit, and enjoy the benefits of a traditional bank account without the hassle.

With Cash App’s dedication to innovation and user-centric approach, the collaboration with partner banks ensures a brighter future for the digital banking landscape. Experience the power of this partnership and take control of your financial journey with Cash App today.

- Get free Medical tips from Health experts