If you have ever looked at an insurance policy, you have likely come across a variety of terms and phrases that you may not fully understand. Insurance terminology can be confusing and overwhelming, but it is important to understand the meaning of these terms so that you can make informed decisions about your coverage. In this article, we will explore the meaning of some common insurance terms and help you better understand the world of insurance.

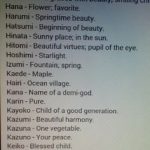

Insurance Name Meaning

What is Insurance?

Before we dive into the terminology, it is important to understand the basic concept of insurance. Insurance is a contract between an individual and an insurance company that provides financial protection against potential losses or damages. In exchange for a premium payment, the insurance company agrees to cover the costs of certain types of losses or damages, as outlined in the policy.

Common Insurance Terms

Premium

The premium is the amount of money paid to the insurance company in exchange for coverage. The premium may be paid monthly, quarterly, or annually, depending on the policy.

Deductible

The deductible is the amount of money that the policyholder must pay out of pocket before the insurance company will begin to cover costs. For example, if you have a $500 deductible on your auto insurance policy and you are involved in an accident that causes $1,000 in damage, you will be responsible for paying the first $500 and the insurance company will cover the remaining $500.

Policy

The policy is the legal contract between the policyholder and the insurance company. It outlines the terms and conditions of the coverage, including the types of losses or damages that are covered, the amount of coverage, and any exclusions or limitations.

Coverage Limits

The coverage limit is the maximum amount of money that the insurance company will pay out for a particular type of loss or damage. For example, if you have a $100,000 coverage limit on your homeowner’s insurance policy and your house is destroyed in a fire, the insurance company will pay up to $100,000 for the damages.

Exclusions

Exclusions are specific situations or types of damages that are not covered by the insurance policy. For example, flood damage may be excluded from a homeowner’s insurance policy, or pre-existing conditions may be excluded from a health insurance policy.

Claim

A claim is a request made by the policyholder to the insurance company for coverage of a loss or damage. The insurance company will investigate the claim and determine if it is covered under the policy.

Underwriting

Underwriting is the process by which the insurance company evaluates the risk associated with providing coverage to an individual or organization. Factors such as age, health, and driving record may be considered during the underwriting process.

Actuary

An actuary is a professional who uses statistical analysis to assess the financial risk associated with providing insurance coverage. Actuaries help insurance companies set premiums and determine coverage limits.

Broker

A broker is an individual or organization that acts as an intermediary between the policyholder and the insurance company. Brokers can help individuals and organizations find the best insurance policies for their needs.

Conclusion

Understanding insurance terminology is important for making informed decisions about coverage. By understanding terms such as premium, deductible, policy, coverage limits, exclusions, claim, underwriting, actuary, and broker, you can navigate the world of insurance with greater confidence and clarity.

FAQs

- What is the difference between a premium and a deductible? A premium is the amount of money paid to the insurance company in exchange for coverage, while a deductible is the amount that the policyholder must pay out of pocket before the insurance company will begin to cover costs.

- What is underwriting? Underwriting is the process by which the insurance company evaluates the risk associated with

- Sure, apologies for the mistake. Here’s the rest of the article:

- What is an actuary? An actuary is a professional who uses statistical analysis to assess the financial risk associated with providing insurance coverage. They help insurance companies set premiums and determine coverage limits.

- What is a broker? A broker is an individual or organization that acts as an intermediary between the policyholder and the insurance company. They can help individuals and organizations find the best insurance policies for their needs.

- Why is it important to understand insurance terminology? Understanding insurance terminology is important for making informed decisions about coverage. By understanding terms such as premium, deductible, policy, coverage limits, exclusions, claim, underwriting, actuary, and broker, you can navigate the world of insurance with greater confidence and clarity.

In conclusion, insurance terminology can be complex and overwhelming, but it is important to understand these terms in order to make informed decisions about your coverage. By understanding the meaning of common insurance terms such as premium, deductible, policy, coverage limits, exclusions, claim, underwriting, actuary, and broker, you can navigate the world of insurance with greater ease and confidence. Remember to always read the fine print and ask questions when you are unsure about any aspect of your insurance policy.

FAQs:

- What is the difference between a premium and a deductible? A premium is the amount you pay for insurance coverage, usually on a monthly or yearly basis. A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. The higher your deductible, the lower your premium, and vice versa.

- What is an exclusion in an insurance policy? An exclusion is a provision in an insurance policy that specifies what is not covered. For example, if your car insurance policy has an exclusion for driving under the influence, and you get into an accident while under the influence, your policy may not cover the damages.

- What is underwriting in insurance? Underwriting is the process by which insurance companies evaluate the risk associated with providing coverage to an individual or organization. This includes assessing factors such as age, health, driving record, and credit score.

- What is a policy limit? A policy limit is the maximum amount that an insurance company will pay out for a specific type of claim. For example, if your car insurance policy has a policy limit of $50,000 for property damage, the insurance company will pay up to $50,000 for damages to other people’s property in the event of an accident that is your fault.

- Can I change my insurance policy after I purchase it? Yes, you can usually make changes to your insurance policy after you purchase it. This may include adjusting your coverage limits, changing your deductible, or adding or removing coverage types. However, be aware that making changes to your policy may affect your premium.

In conclusion, insurance terminology can be complex and overwhelming, but it is important to understand these terms in order to make informed decisions about your coverage. By understanding the meaning of common insurance terms such as premium, deductible, policy, coverage limits, exclusions, claim, underwriting, actuary, and broker, you can navigate the world of insurance with greater ease and confidence. Remember to always read the fine print and ask questions when you are unsure about any aspect of your insurance policy.