Yes, Chime is an online bank that provides digital banking services and products. Chime is an online bank that offers a range of digital banking services and products.

With Chime, users can access their accounts, make deposits, and manage their finances entirely online. As an online bank, Chime eliminates the need for physical branches, allowing customers to handle their banking needs conveniently from their mobile devices or computers.

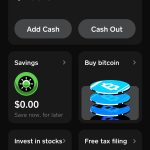

Chime offers features like fee-free checking and savings accounts, early direct deposit, and a user-friendly mobile app. Additionally, Chime provides customers with access to over 60,000 fee-free ATMs nationwide through partnerships with popular ATM networks. Chime’s online banking platform aims to provide a seamless and accessible experience for users, making it a popular choice for individuals seeking an alternative to traditional brick-and-mortar banking.

Is Chime A Legitimate Online Bank?

Chime, a digital banking platform, has gained a strong reputation and credibility in the banking industry. With its innovative approach and user-friendly interface, Chime has become increasingly popular among online banking users. The company has rapidly grown its customer base by offering a range of features that meet the needs of modern consumers. Chime provides a mobile banking app, no hidden fees, early access to direct deposits, and a unique savings feature called the “Automatic Savings” where the spare change from transactions is saved. Additionally, Chime prioritizes security by implementing advanced encryption techniques and multifactor authentication. With its partnerships with established financial institutions, Chime ensures that customer funds are FDIC-insured up to $250,000. Chime’s commitment to transparency and customer satisfaction has earned it a legitimate standing in the online banking industry.

How Chime Works As An Online Bank

Chime is a popular online bank that offers a range of features and functionalities. To get started, you can sign up for a Chime account easily through their website or mobile app. The sign-up process is straightforward and only takes a few minutes to complete.

Once you have created your Chime account, you can enjoy various features and functionalities. Chime provides a mobile app that allows you to manage your finances conveniently. The app’s interface is user-friendly, providing a seamless user experience.

With Chime, you can track your spending, make mobile payments, and set up automated savings. The bank also offers early direct deposit, allowing you to receive your paycheck up to two days in advance.

Whether you’re looking for a simple way to manage your money or want to take advantage of innovative banking features, Chime is worth considering. Sign up today and experience the convenience of online banking with Chime.

The Benefits Of Using Chime As Your Online Bank

Chime is an online bank that offers numerous benefits, such as no hidden fees, early access to direct deposits, and automatic savings features. With Chime, you can take control of your finances conveniently and efficiently.

Fee-free banking and no hidden charges: Chime offers a refreshing alternative to traditional banks by providing fee-free banking services. With Chime, you won’t have to worry about monthly maintenance fees, minimum balance requirements, or overdraft fees. It’s all about simplicity and transparency.

Early direct deposit and faster access to funds: Chime allows you to get paid up to two days earlier with direct deposit. It means you can access your funds sooner, helping you meet your financial obligations and goals without any delay.

Savings account and automatic savings features: Chime offers a high-yield savings account that helps you grow your money faster. With automatic savings features, you can effortlessly save money with every debit card purchase or when you get paid. It’s a convenient way to build your savings automatically.

Financial planning tools and budgeting assistance: Chime provides a range of financial planning tools and budgeting assistance to help you manage your money effectively. From setting up savings goals to monitoring your spending habits, Chime gives you the tools you need to take control of your finances.

Chime’s Security Measures And Customer Support

Chime is an online bank that prioritizes the security of its customers’ financial data. With a strong focus on encryption, Chime ensures that sensitive data is protected from unauthorized access. The platform offers robust security measures, including two-factor authentication and biometric login options, which add an extra layer of protection to users’ accounts. By implementing these features, Chime aims to mitigate the risk of fraudulent activities and safeguard its customers’ funds and personal information.

Apart from its security measures, Chime also provides efficient customer support services. The bank is committed to assisting its users with any inquiries or issues they may encounter. Chime’s customer support team is readily available to address concerns and provide timely assistance through various channels, including email, phone, and live chat. This ensures that customers can easily reach out and receive the help they need when they need it. With its commitment to security and customer support, Chime strives to offer a seamless and reliable online banking experience to its users.

Chime’s Limitations And Drawbacks

Chime, an online bank, does have some limitations and drawbacks worth considering. These include a lack of physical branch locations, limited customer support options, and potential service interruptions due to online-only operations. Nonetheless, Chime offers convenient banking features such as mobile banking, early access to direct deposits, and no hidden fees, making it a popular choice for many.

| Cash deposit limitations and lack of physical branches |

| Chime, being an online bank, has certain limitations and drawbacks that may not be suitable for everyone’s needs. One of the major limitations is the lack of physical branches, which means you won’t have the convenience of walking into a branch to deposit cash. Chime primarily relies on electronic transfers, so if you frequently deal with cash, this could pose a challenge for you. |

| Limited options for transferring funds to external accounts |

| Chime’s transfer options to external accounts are somewhat limited. While you can easily transfer funds between your Chime accounts, transferring to non-Chime accounts may have restrictions. This can be problematic if you frequently need to move money to accounts outside of Chime, such as investment accounts or accounts with other banks. |

| Incompatibility with certain third-party apps and services |

| Due to its unique banking structure, Chime may not be compatible with all third-party apps and services. Some financial management and budgeting apps may not sync properly with Chime, limiting your ability to track your finances holistically. This can be a drawback if you heavily rely on specific financial tools for managing your money. |

Chime’s Integration With Other Financial Products

Chime, the popular online bank, offers a seamless integration with a variety of other financial products, making it a convenient choice for users. One of its notable partnerships is with Pay Friends, a payment platform designed to simplify peer-to-peer money transfers. This collaboration allows Chime users to effortlessly send and receive money from their friends and family.

In addition, Chime is compatible with popular mobile payment platforms such as Apple Pay, Google Pay, and Samsung Pay. This means that users can conveniently make purchases using their Chime account through these platforms.

Chime also offers a range of credit-building opportunities, including its Credit Builder feature. This feature allows users to gradually build a positive credit history by making microloans and repaying them on time. By responsibly utilizing Chime’s credit-building tools, users can improve their credit scores over time.

Comparing Chime With Other Online Banks

When considering online banking options, it is important to assess the features, fees, customer satisfaction, account options, benefits, user experience, and additional features of different banks. Chime and Ally Bank are two popular choices for online banking.

| Features | Chime | Ally Bank |

|---|---|---|

| Fee-Free | Yes | Yes |

| ATM Access | 55,000+ ATMs | 55,000+ ATMs |

| Overdraft Protection | Yes | Yes |

| Cashback Rewards | Optional | No |

Similarly, Chime and Varo Bank are worth comparing when it comes to account options and benefits. Both offer fee-free banking, high-interest savings accounts, and early direct deposit capabilities. However, Chime does not offer joint accounts, while Varo Bank does.

Lastly, Chime and Simple Bank can be compared in terms of user experience and additional features. Chime offers a seamless and user-friendly mobile app with built-in budgeting tools and automatic savings features. Simple Bank, on the other hand, provides a visually appealing interface with intuitive expense tracking and shared accounts.

Chime’s Future Prospects And Expansion Plans

Chime, an online banking platform, has been gaining momentum in the financial industry with its promising future prospects and expansion plans. The company has exhibited a strong growth trajectory, attracting a significant customer base with its user-friendly interface and innovative banking solutions. Chime’s success can be attributed to its solid financial backing, which has provided the necessary resources for expansion and development. Chime aims to continue its growth by introducing new features and services to enhance the customer experience. The platform constantly evolves to meet the changing needs of its users, ensuring a competitive edge in the online banking industry. However, Chime is not without potential challenges and competition. As the popularity of online banking grows, other companies are also vying for market share. Chime will need to stay ahead of the curve by continuously improving its offerings and maintaining customer trust. Overall, Chime’s future looks promising as it strives to be a leading player in the online banking sector, backed by its expansion plans, commitment to innovation, and strong financial foundation.

Credit: www.cnbc.com

Frequently Asked Questions On Is Chime An Online Bank

Is Chime A Legitimate Online Bank?

Yes, Chime is a legitimate online bank. It is a financial technology company that provides online banking services with no physical branches. Chime is FDIC insured, which means your deposits are protected up to $250,000.

What Are The Benefits Of Using Chime As An Online Bank?

Using Chime as an online bank offers many benefits. You can access your account anytime, anywhere through the mobile app. Chime has no monthly fees, overdraft fees, or minimum balance requirements. They also provide early direct deposit, allowing you to get paid up to two days early.

How Does Chime’s Fee-free Overdraft Feature Work?

Chime’s fee-free overdraft feature, called SpotMe, allows eligible members to overdraft their accounts without incurring any fees. When you make a purchase that exceeds your available balance, Chime will cover the amount up to a certain limit. You’ll just need to repay the negative balance when your next deposit comes in.

How Safe Is Chime For Online Banking?

Chime takes security seriously. They use encryption and secure technology to protect your personal information. Chime also offers account alerts to notify you of any suspicious activity. Additionally, as an FDIC-insured bank, your deposits with Chime are protected up to the maximum amount allowed by law.

Conclusion

To sum up, Chime offers a convenient and accessible online banking platform that comes with a range of useful features. With no hidden fees, early access to paychecks, and an intuitive mobile app, Chime stands out as a reliable option for those seeking an online banking experience.

While there are some limitations to consider, Chime’s user-friendly interface and commitment to innovation make it worth considering for your banking needs. So, if you’re looking for a hassle-free and modern way to manage your finances, give Chime a try.