Cash App is connected to Lincoln Savings Bank and Sutton Bank. A popular mobile payment service, Cash App offers its users the ability to send and receive money, as well as make purchases and investments.

With its strong connection to Lincoln Savings Bank and Sutton Bank, Cash App provides a secure and convenient platform for managing your finances. These partnerships allow Cash App to offer various features, such as the ability to link your bank account, receive direct deposits, and withdraw funds.

Whether you’re sending money to a friend or making a purchase online, Cash App ensures a seamless transaction experience through its partnership with these trusted banks.

Credit: www.gobankingrates.com

Cash App utilizes banking services not only to facilitate transfers but also to offer additional features such as sending money internationally and depositing funds into Bitcoin wallets. By leveraging the infrastructure and expertise of banks, Cash App ensures a reliable and secure payment experience for its users.

Banks Associated With Cash App

Cash App has partnered with several major banks to facilitate its services. These banks include Wells Fargo, JPMorgan Chase, Citibank, and Bank of America. By collaborating with these financial institutions, Cash App ensures that its users can seamlessly link their bank accounts to the app for convenient transactions.

Cash App carefully selects partner banks based on their reputation, security measures, and compatibility with the app’s system. The chosen banks have a strong track record in providing reliable and secure banking services to their customers. This strategic selection process enables Cash App to deliver a smooth and trustworthy experience to its user base.

Benefits of Partnering with Banks for Cash App:

Partnering with banks offers numerous benefits for Cash App and its users. Firstly, it allows for instant bank transfers, ensuring that funds are readily available in the app. Additionally, collaborating with established banks enhances the app’s security measures, protecting user information and financial data. Furthermore, by leveraging the infrastructure of partner banks, Cash App can provide a broader range of financial services and features to its growing customer base.

Ensuring Security And Reliability

With Cash App, security and reliability are of utmost importance. Cash App ensures the protection of user information through various measures. Firstly, all data transfers are encrypted using industry-standard SSL technology, which safeguards personal and financial data from unauthorized access. Additionally, Cash App implements advanced fraud detection systems to identify and prevent fraudulent transactions. This includes monitoring account activity, analyzing patterns, and employing machine learning algorithms to detect any suspicious or fraudulent behavior.

Cash App is connected to various banks to ensure the smooth and secure processing of transactions. These bank connections are essential for conducting transactions seamlessly, as they allow funds to be transferred between user accounts reliably. Cash App establishes partnerships with reputable banks to guarantee the safety and efficiency of its services. By working with trusted financial institutions, Cash App offers users peace of mind, knowing that their transactions will be processed securely and without any complications.

Cash App’s Banking Integration

Seamless Integration With Partner Banks

Cash App offers a seamless integration with partner banks, providing users with a range of banking services and features. Through this integration, users can link their Cash App account to their bank account and enjoy a convenient banking experience.

Partner banks on Cash App offer a variety of features to enhance the banking experience. These features include:

- Instant transfers: Users can enjoy instant transfers between their Cash App account and their linked bank account, allowing for quick access to funds.

- Mobility: The partnership with banks enables users to access their bank account through Cash App, providing a mobile banking solution.

- Balance inquiries: Users can check their bank account balance directly within the Cash App application.

- Transaction history: Cash App allows users to view the transaction history of their linked bank account, making it easy to track and manage finances.

- Security: Partner banks on Cash App prioritize the security of user information, ensuring a safe and protected banking experience.

With the seamless integration of Cash App and partner banks, users can enjoy the convenience of banking services directly within the application, making it a comprehensive financial solution.

Banking Services Available On Cash App

Cash App offers a seamless and easy-to-use digital banking experience to its users. With multiple partner banks, Cash App provides a range of banking services that are accessible and convenient for users.

Digital Banking Options For Cash App Users

Through its banking partners, Cash App enables its users to enjoy a variety of digital banking options. Users can link their Cash App accounts to partner banks to access essential banking features such as direct deposit, mobile check deposit, and bill payment services.

Mobile Features Offered By Partner Banks

Cash App’s partner banks also provide a host of mobile banking features to enhance users’ banking experience. These features include mobile account management, balance inquiries, transaction history, and fund transfers all through the Cash App platform.

Accessibility And Convenience Of Banking Services On Cash App

By connecting with partner banks, Cash App ensures the accessibility and convenience of banking services for its users. Users can perform banking tasks anytime and anywhere from their smartphones, eliminating the need for traditional brick-and-mortar bank visits.

With Cash App, users can seamlessly integrate their banking needs into their daily lives, making it easy to manage finances and access essential banking services with just a few taps on their mobile devices.

Connecting Cash App To Your Preferred Bank

Connecting your Cash App to your preferred bank is a seamless process that offers numerous benefits. By linking your existing bank account to Cash App, you can easily transfer funds between the two platforms, allowing for quick and convenient access to your money. Plus, connecting your Cash App to your own bank provides added security, as you can monitor your transactions within a familiar banking platform.

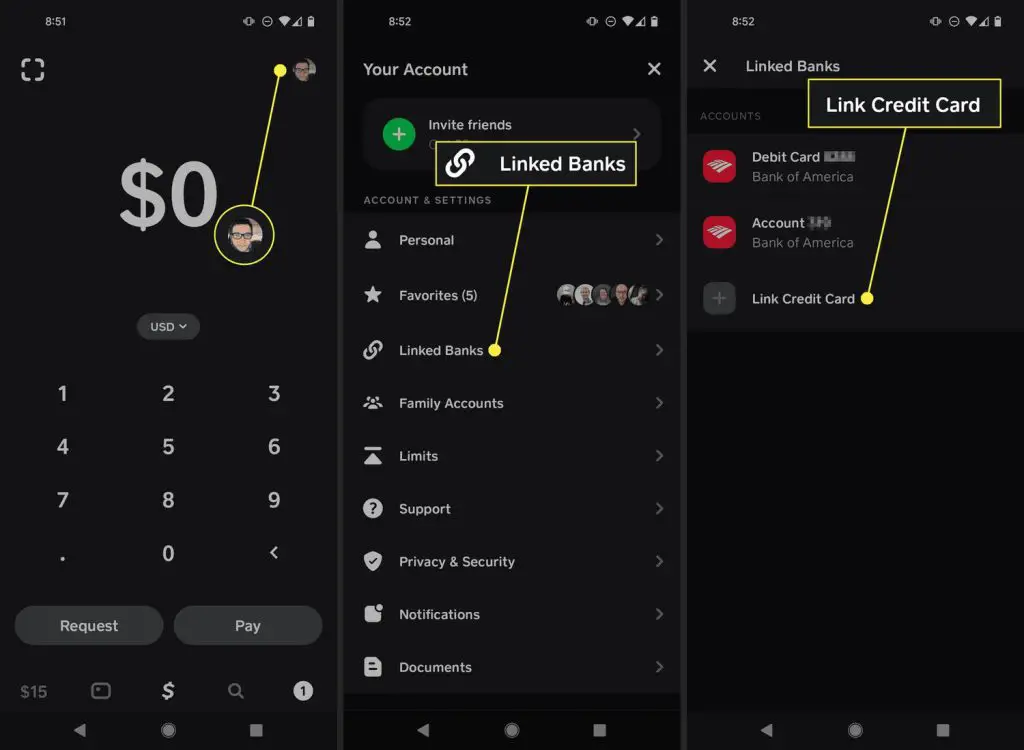

To switch banks on Cash App, ensure that you have the necessary login credentials for your preferred bank account. Once you have this information, simply follow the steps provided by Cash App to link your new bank account. This process typically involves verifying your account through a series of security measures. Once successfully linked, you can easily manage your finances and make quick transfers between Cash App and your preferred bank.

Make the most of your Cash App experience by connecting it to your own bank account. Enjoy the convenience, security, and ease of managing your finances all in one place.

Innovations In Cash App Banking

The Cash App is connected to several banks, allowing its users to easily manage their finances directly from the app. Through strategic partnerships with multiple financial institutions, Cash App has been able to offer innovative banking services to its users. This partnership ensures that users can link their Cash App accounts to their existing bank accounts and seamlessly transfer funds between the two platforms. This advancement in Cash App’s banking system has revolutionized the way users handle their finances, offering a convenient and user-friendly solution. With these advancements, Cash App has become a popular choice for individuals seeking a modern and efficient way to manage their money.

Expanding Banking Options For Cash App Users

Cash App, the popular mobile payment service, is continuously looking to enhance its users’ banking options. With a focus on establishing new partnerships, Cash App aims to integrate with additional banks, offering increased benefits to its users. The potential integration with more banks opens doors to a wider range of financial services and features on the Cash App platform.

This banking expansion not only allows users to manage their finances conveniently but also provides them with a variety of options, such as direct deposits, savings accounts, and investment opportunities. By leveraging these new partnerships, Cash App is positioning itself as an all-in-one solution for both payment and banking needs.

By forging strategic alliances and expanding its network of affiliated banks, Cash App strives to bring more value to its users and provide them with a seamless and comprehensive banking experience. The future looks bright for Cash App as it continues to revolutionize the way people handle their finances.

Frequently Asked Questions On What Bank Is Cash App Connected To

What Bank Is Cash App Connected To?

Cash App is connected to Lincoln Savings Bank, which is an FDIC-insured bank located in Cedar Falls, Iowa. Lincoln Savings Bank holds all user funds for Cash App, ensuring their security and complying with all regulatory requirements. Rest assured that your money is safe and backed by a reputable banking institution.

Conclusion

To sum up, Cash App is connected to a banking partner that enables users to link their bank accounts for seamless transactions. By partnering with a reliable banking institution, Cash App ensures secure and efficient money transfers. This partnership also allows users to enjoy additional features such as direct deposit and cashing out funds.

So, whether you’re sending money to friends or making online purchases, Cash App’s connectivity to a trusted bank ensures a smooth and hassle-free experience.