The bank name for Chime is The Bancorp Bank. Chime is issued by The Bancorp Bank.

Chime is a popular online banking platform that provides users with a range of financial services. As an alternative to traditional brick-and-mortar banks, Chime allows users to manage their money easily and conveniently from their mobile devices. With Chime, users can open a bank account, receive a Chime Visa Debit Card, and enjoy features such as mobile check deposit, fee-free ATM withdrawals, and real-time transaction notifications.

Chime is known for its user-friendly interface and commitment to providing a seamless banking experience. In order to offer these services, Chime partners with The Bancorp Bank, an FDIC-insured institution that holds the funds deposited by Chime users. The partnership allows Chime to leverage the infrastructure and regulatory expertise of The Bancorp Bank, ensuring the safety and security of user funds.

What Is Chime Bank?

Chime Bank is a popular online banking platform that offers a range of financial services designed to make banking convenient and user-friendly. With Chime, you can manage your money on your own terms, avoiding the hassle of traditional brick-and-mortar banks.

Chime Bank makes it easy to stay on top of your finances with features like early direct deposit, automatic savings, and fee-free overdraft protection. You can access your account anytime, anywhere through their user-friendly mobile app or website.

With Chime Bank, you can say goodbye to hidden fees and enjoy modern banking convenience at your fingertips. Whether you’re depositing a check, paying a bill, or sending money to a friend, Chime Bank streamlines the process, making it simple and efficient.

How Does Chime Bank Work?

Chime Bank is known for its user-friendly mobile app, which offers a range of features and functionalities. The account setup process is seamless, allowing users to easily create their accounts and start banking right away. Chime operates under a unique banking model that is worth understanding. While Chime itself is not a bank, it partners with Bancorp Bank, a member of the FDIC, to hold and safeguard customer deposits. This partnership ensures that deposits made with Chime are FDIC-insured up to the standard maximum of $250,000 per depositor. One of the main highlights of Chime is its fee-free banking options. Chime does not charge any monthly service fees, overdraft fees, or minimum balance requirements, making it an attractive choice for those looking for a no-frills banking experience.

What Is The Official Bank Name For Chime?

The official bank name for Chime is The Bancorp Bank. Chime, a popular digital banking platform, operates in partnership with The Bancorp Bank to provide its banking services. The Bancorp Bank plays a crucial role in Chime’s services, serving as the provider of FDIC-insured accounts for Chime customers. With this partnership, Chime is able to offer its users a seamless banking experience while ensuring the safety and security of their funds.

FDIC insurance is an essential aspect of Chime’s banking services. It provides protection to Chime customers by insuring their deposits in the event of a bank failure. The Bancorp Bank’s FDIC-insured accounts give Chime users peace of mind, knowing that their funds are safeguarded up to the maximum limit allowed by the FDIC. Chime takes the safety of deposited funds seriously and works diligently to ensure the security of their customers’ money.

| Chime’s Official Bank | The Bancorp Bank |

|---|---|

| Partnership Role | Provider of FDIC-insured accounts |

| FDIC Insurance | Ensures safety of deposits |

| Security Measures | Chime prioritizes the safety of customer funds |

Chime Bank’s Alternative Approach To Traditional Banking

Chime Bank has revolutionized traditional banking with its alternative approach. Unlike traditional banks, Chime Bank operates without physical branches, redefining the banking experience for its customers. Embracing the digital banking revolution, Chime Bank provides numerous benefits and unprecedented convenience through its branchless banking model.

One of the key advantages of Chime Bank’s branchless approach is the ability to access banking services anytime and anywhere. With Chime Bank’s innovative mobile features, customers can perform a range of banking tasks through their mobile devices. This includes mobile check deposit functionality, allowing users to conveniently deposit checks by simply taking a photo of them.

In addition to mobile check deposit, Chime Bank also offers real-time transaction alerts and balance updates. This feature provides customers with instant notifications regarding their account activities, ensuring transparency and peace of mind.

Chime Bank’s commitment to digital banking has transformed the way people manage their finances. By embracing innovative mobile features and eliminating physical branches, Chime Bank prioritizes convenience and accessibility, making banking easier for its customers.

Chime Bank’s Commitment To Customer Satisfaction

Chime Bank is dedicated to ensuring customer satisfaction by providing exceptional customer support. With their commitment to service, Chime Bank offers 24/7 customer assistance, ensuring that customers can reach out for help at any time of the day. Their customer support team utilizes technology to efficiently address customer concerns and resolve any issues that may arise. The bank also prides itself on positive customer experiences and testimonials, which highlight the convenience and ease of their services. Personal stories from satisfied users further demonstrate the benefits of banking with Chime Bank. With a focus on customer satisfaction, Chime Bank strives to provide an outstanding banking experience for all of its customers.

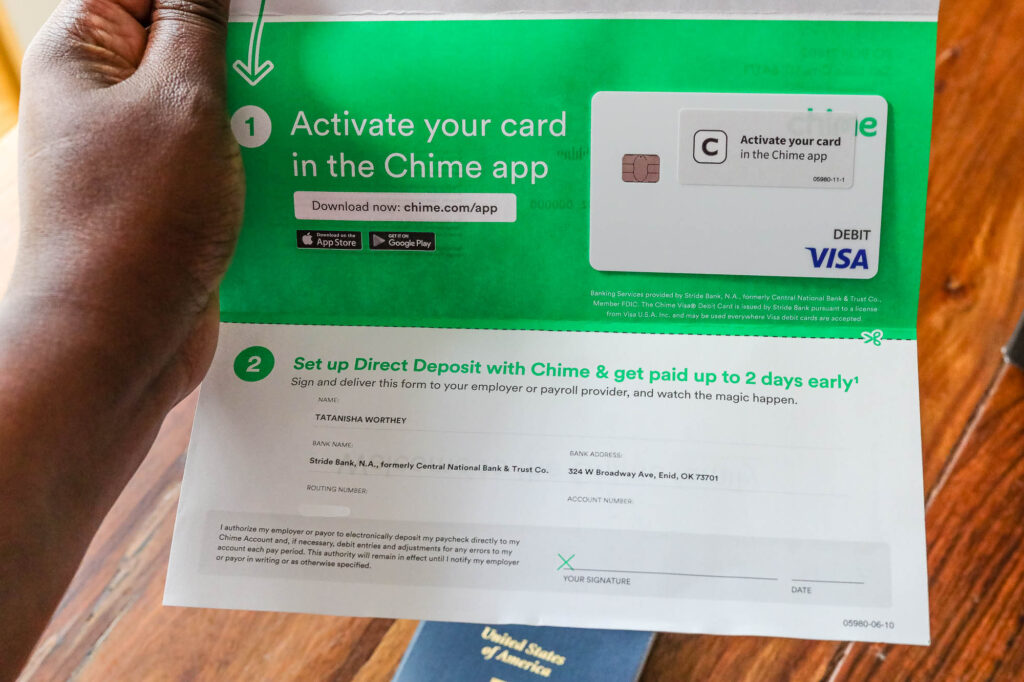

Credit: www.awortheyread.com

The Future Of Chime Bank And Online Banking

The future of Chime Bank and online banking looks promising as the institution continues to make improvements and expand its services. With a focus on customer satisfaction and convenience, Chime Bank is continuously introducing new features and enhancements to stay ahead in the banking industry.

Chime Bank’s upcoming features and enhancements aim to provide customers with a seamless banking experience. The institution is investing in cutting-edge technology and innovative products that cater to the evolving needs of its user base.

As online-only banks gain popularity, Chime Bank remains one of the leading options for consumers seeking digital banking solutions. Its user-friendly interface, fee-free services, and attractive rewards program make it an attractive choice for those looking for a hassle-free banking experience.

The trend towards digital banking is expected to continue growing, as customers embrace the convenience and accessibility offered by online services. Chime Bank is at the forefront of this movement, constantly adapting its offerings to meet the demands of the market.

In the competitive landscape of online banking, Chime Bank faces several competitors and alternatives. However, the institution’s commitment to customer-centric solutions and dedication to staying ahead in the industry position it as a leading player.

| Competitors | Alternatives |

|---|---|

| Varo Bank | Ally Bank |

| Simple | N26 |

| Aspiration | Sofi Money |

Frequently Asked Questions On What Is Bank Name For Chime

What Is The Bank Name For Chime?

Chime’s banking services are provided by The Bancorp Bank or Stride Bank, N. A. , Members FDIC.

Is Chime A Real Bank?

Yes, Chime is a real bank. It is an online-only bank that provides banking services through its mobile app and website. Chime’s services include checking and savings accounts, as well as a debit card.

How Do I Open A Chime Bank Account?

To open a Chime bank account, simply download the Chime mobile app or visit their website and follow the sign-up process. You will need to provide some personal information and verify your identity. Opening a Chime account is quick and easy!

Conclusion

Determining the bank name for Chime is essential for a smooth banking experience. By knowing the official bank associated with Chime, users can easily complete transactions, transfer funds, and access various banking services with confidence. Understanding the bank behind Chime reinforces the trust in its legitimacy and security.

So, make sure to stay informed about Chime’s bank name to enjoy hassle-free banking.