Chime Financial Institution is the name of a popular and innovative digital banking platform that offers online banking services and features. Chime Financial Institution is a well-known and highly regarded digital banking platform that provides a range of online banking services.

With its user-friendly interface and innovative features, Chime has gained a reputation as a convenient and accessible option for individuals seeking a modern banking experience. Offering features such as no hidden fees, early direct deposit, and a unique savings account that helps users save money automatically, Chime has quickly become a popular choice among tech-savvy consumers.

In addition to its primary banking services, Chime also offers additional tools and incentives such as cash-back rewards and budgeting assistance, making it a comprehensive and forward-thinking financial platform.

What Is Chime?

Chime is a digital banking platform that aims to provide its users with a convenient and modern banking experience. Unlike traditional banks, Chime operates exclusively online, allowing users to access their accounts and perform banking tasks through the Chime mobile app or website.

| How Chime differs from traditional banks | Chime’s key features and benefits |

| Innovation: | Early access to direct deposits |

| Convenience: | Mobile banking app for easy access |

| Accessibility: | 24/7 customer support |

| Cost-saving: | No monthly fees or minimum balance requirements |

Chime stands out from traditional banks by leveraging technology to offer innovative features to its users. For instance, Chime users can get early access to their direct deposits, allowing them to receive their money faster. The Chime mobile banking app also provides convenience by enabling users to manage their finances on the go. Additionally, Chime’s customer support is available 24/7 to address any concerns or issues that may arise.

One of the major benefits of Chime is its cost-saving nature. Unlike many traditional banks, Chime does not charge monthly fees or require a minimum balance, making it an attractive option for individuals looking to avoid unnecessary expenses.

How Does Chime Work?

To open a Chime account, you can simply download the Chime mobile app or visit their website. Input your personal information, including your name, email address, and Social Security Number. Next, you will be asked to create a username and password for your account. Once you have completed these steps, Chime will perform a quick identity verification process, and upon successful verification, your account will be activated and ready to use.

Chime offers a user-friendly and intuitive mobile app as well as a functional website. The mobile app allows you to access your Chime account on the go, deposit checks using mobile check deposit, transfer funds, and pay bills. Through the website, you can manage your account, view transaction history, and customize your account settings. Both platforms provide a seamless banking experience with features designed to simplify your financial management.

Chime offers both a spending account and a savings account. The spending account functions like a traditional checking account, allowing you to deposit funds, make purchases with the Chime debit card, and access your money through ATMs. The savings account is an optional feature with no minimum balance requirement and no monthly fees. It offers an Annual Percentage Yield (APY) on your savings, helping you grow your money over time. Both accounts are easily managed through the Chime app or website.

| Fee | Description |

|---|---|

| No Monthly Fees | Chime does not charge any monthly fees for its accounts. |

| No Minimum Balance | There is no minimum balance requirement for Chime accounts. |

| No Overdraft Fees | Chime does not charge any overdraft fees for eligible customers. |

| ATM Withdrawals | Chime offers fee-free withdrawals at over 38,000 ATMs nationwide through the MoneyPass® and Visa Plus Alliance networks. |

| Out-of-Network ATM | For out-of-network ATM withdrawals, Chime may charge a $2.50 fee. |

Chime’s Unique Features

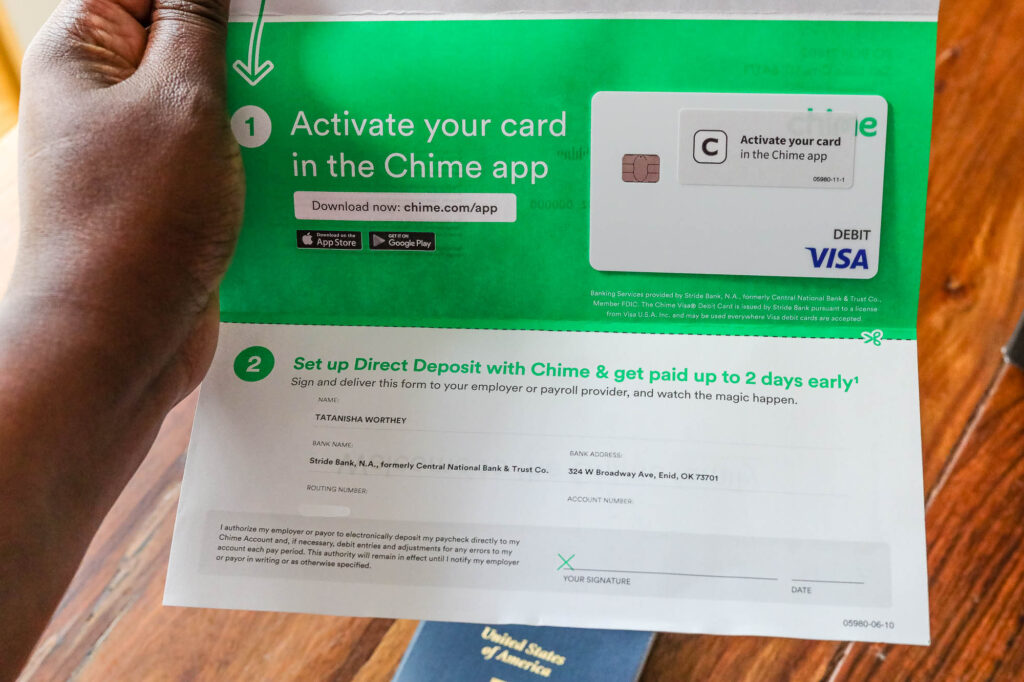

Chime is a financial institution that offers several unique features designed to make banking easier and more convenient. One of Chime’s standout features is its early direct deposit option, which allows users to receive their paycheck up to two days earlier than traditional banks. The ability to access funds before the official payday can be extremely beneficial for individuals who need to cover expenses or make payments in a timely manner.

In addition, Chime offers round-up savings, which is an automatic savings feature that helps users save money effortlessly. Every time a Chime user makes a purchase, Chime automatically rounds up the transaction amount to the nearest dollar and transfers the difference into a separate savings account. This feature allows users to save money without even realizing it, making it a great tool for building up a nest egg or reaching financial goals.

Another standout feature of Chime is its fee-free overdraft protection. Unlike many traditional banking institutions, Chime does not charge its users overdraft fees. Instead, if a user’s account balance is insufficient to cover a transaction, Chime simply declines the transaction, preventing the user from incurring any additional fees or charges. This can provide peace of mind for users who are worried about overdraft fees eating into their finances.

| Feature | Description |

|---|---|

| Early Direct Deposit | Users can receive their paycheck up to two days earlier than traditional banks. |

| Round-up savings | Automatically rounds up transaction amounts to the nearest dollar and transfers the difference into a separate savings account. |

| Fee-free overdraft protection | No overdraft fees; transactions are simply declined if the available balance is insufficient. |

Is Chime Safe And Secure?

Chime Financial Institution is committed to ensuring the safety and security of its users’ accounts. They have implemented various security measures and protocols to protect against fraudulent activities and unauthorized transactions.

| FDIC Insurance Coverage |

|---|

| Chime accounts are insured through their partner banks, which are members of the Federal Deposit Insurance Corporation (FDIC). This means that up to $250,000 of your deposits at Chime are protected by the FDIC in the event of a bank failure. |

| Protection Against Fraud and Unauthorized Transactions |

| Chime utilizes advanced security technology and encryption to safeguard user information and prevent fraudulent activities. They employ multi-factor authentication, which requires users to provide multiple pieces of information to verify their identities. |

| Privacy Policy and Data Protection |

| Chime is committed to protecting the privacy of its users’ personal information. They have a strict privacy policy in place that outlines how user data is collected, used, and shared. Chime also regularly updates their security measures to stay ahead of emerging threats. |

Chime Vs Traditional Banks

Chime, a financial institution that operates primarily online, offers several advantages over traditional banks. One of the key advantages is the lower fees that Chime charges compared to traditional banks. While traditional banks often charge various fees for services such as overdrafts, monthly maintenance, and foreign transactions, Chime strives to keep its fees minimal.

Another advantage of Chime is its accessibility and convenience compared to brick-and-mortar banks. With Chime, customers can access their accounts anytime and anywhere through the Chime mobile app. This means no need to visit a physical branch during limited hours or wait in long lines.

Moreover, Chime offers outstanding customer service and support. Chime’s customer service team is available via the mobile app, email, and phone to assist customers with their inquiries and concerns. This level of support sets Chime apart from traditional banks, where customer service can often be impersonal and time-consuming.

Chime’s Customer Experience

Chime Financial Institution Name is an innovative online banking platform that offers a seamless and user-friendly banking experience. Customers rave about the convenience and simplicity of the Chime mobile app and website. Navigating through the various features and functionalities is effortless, allowing users to easily manage their finances on the go.

One of the standout aspects of Chime’s customer support is their responsiveness. Users have reported quick and efficient assistance, with the support team being readily available to address any queries or issues. This prompt response time adds to the overall positive customer experience.

While Chime has garnered many positive user reviews, it’s important to consider potential drawbacks and limitations. Some users have mentioned occasional glitches or technical issues with the app, although these instances seem to be rare. Additionally, Chime does not have physical bank branches, which may limit some in-person banking services.

Overall, Chime’s customer experience and user reviews reflect a banking platform that prioritizes simplicity, efficiency, and prompt customer support. The ease of navigation, coupled with responsive assistance, make Chime a popular choice among customers looking for a modern banking experience.

Credit: www.awortheyread.com

Frequently Asked Questions Of What Is Chime Financial Institution Name

What Is Chime Financial Institution Name?

Chime Financial Institution is an online banking platform that offers no-fee accounts, early direct deposit, and built-in savings features. It allows users to manage their finances conveniently through its mobile app. Chime does not have physical branches but partners with several banks to provide FDIC-insured accounts.

How Do I Open A Chime Account?

To open a Chime account, simply download the Chime mobile app and sign up with your personal information. You will need to provide your name, address, social security number, and other identification details. The entire process takes only a few minutes, and there are no credit checks involved.

What Are The Benefits Of Using Chime?

Chime offers several benefits to its users. These include no overdraft fees, no monthly maintenance fees, early direct deposit, and automatic savings features. Chime also provides a Visa debit card, access to a network of fee-free ATMs, and real-time spending notifications to help you stay on top of your finances.

Can I Use Chime As My Primary Bank?

Yes, you can use Chime as your primary bank. Chime offers all the essential banking services you would expect from a traditional bank, including direct deposit, bill pay, and the ability to receive and send money. It also integrates with popular payment platforms like Venmo and Cash App.

Conclusion

Overall, Chime Financial Institution stands out as a modern and innovative banking solution for those seeking a hassle-free, convenient experience. With its mobile-first approach, user-friendly features, and no-hidden-fee policy, Chime caters to the needs of the tech-savvy generation. By providing access to early direct deposits, fee-free overdraft protection, and numerous money management tools, Chime is revolutionizing the way individuals manage their finances.

With Chime, banking has never been easier or more rewarding.