Chime Bank is the name of the bank. Chime Bank is a popular online bank that offers fee-free banking services and aims to help its customers achieve financial stability and control.

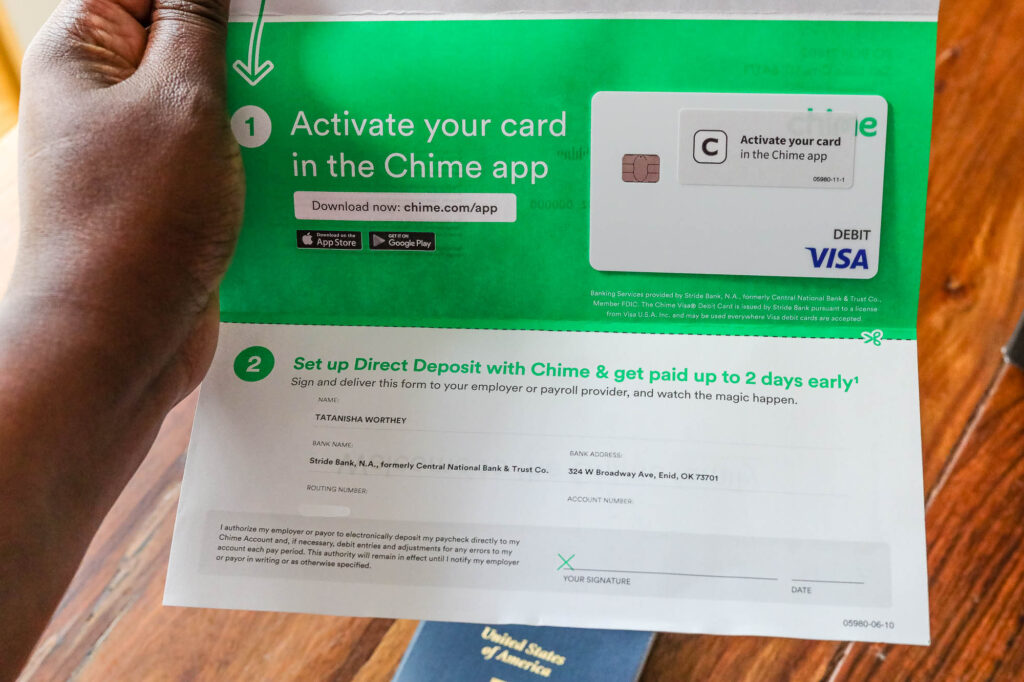

With its user-friendly mobile app and innovative features like early direct deposit and automatic savings tools, Chime Bank has gained traction as a digital banking solution trusted by millions of users. The bank provides a range of services, including checking and savings accounts, as well as a Chime Visa Debit Card that can be used worldwide.

Chime Bank sets itself apart by focusing on accessibility, transparency, and keeping its customers’ best interests at heart. Whether you’re looking to simplify your financial management or explore modern banking options, Chime Bank could be the solution for you.

Overview Of Chime Bank

Chime Bank is an innovative digital banking solution that offers a range of features and benefits to its customers. With Chime Bank, you can enjoy convenient banking services without the hassle of traditional brick-and-mortar branches.

Chime Bank stands out from traditional banks with its user-friendly mobile app and website interface, providing a seamless banking experience. Through Chime Bank, you can easily manage your finances, deposit checks, transfer funds, and pay bills anytime, anywhere.

One of the key advantages of Chime Bank is its early direct deposit feature, enabling you to receive your paycheck up to two days earlier than traditional banks. Additionally, Chime Bank offers a fee-free banking experience with no monthly maintenance fees, overdraft fees, or minimum balance requirements.

With Chime Bank’s savings account, you can set up automated savings tools, allowing you to effortlessly save money and reach your financial goals faster. Chime Bank also provides a debit card and spotme feature, granting you fee-free overdraft protection up to a certain limit.

| Features and Benefits of Chime Bank: |

|---|

| 1. User-friendly mobile app and website interface |

| 2. Early direct deposit feature |

| 3. Fee-free banking experience |

| 4. No monthly maintenance fees, overdraft fees, or minimum balance requirements |

| 5. Automated savings tools |

| 6. Debit card and fee-free overdraft protection with spotme feature |

The Origin And Evolution Of Chime Bank

Chime Bank, a leading digital banking platform, has revolutionized the financial industry with its innovative approach. Starting from humble origins, Chime has evolved into a trusted name, providing customers with seamless and user-friendly banking services.

The Origin and Evolution of Chime Bank

Chime Bank, a popular name in the banking industry, has a unique origin story that has contributed to its rapid growth and success. Founded in 2013 by Chris Britt and Ryan King, Chime Bank emerged with a mission to provide a user-friendly and mobile-focused banking experience. With the goal of empowering individuals, particularly millennials, to take control of their finances, Chime Bank set out to revolutionize traditional banking practices.

Today, Chime Bank boasts a customer base of millions, undoubtedly highlighting its success in the industry. Through innovative features like early direct deposit, fee-free banking, and automatic savings programs, Chime Bank has managed to attract and retain a loyal customer base.

Over the years, Chime Bank has continued to expand its services and offerings. It has introduced features like cash back rewards, mobile check deposits, and fee-free overdraft protection, further solidifying its position as a leading online banking platform. Chime Bank’s continuous growth and expansion have positioned it as one of the top players in the industry, challenging traditional banking norms and setting new standards for user-centric banking.

Chime Bank’s Unique Name And Branding

Unpacking the meaning behind the name “Chime Bank”

Chime Bank has made a significant impact in the banking industry, partly due to its catchy and distinctive name. The word “chime” invokes a sense of harmony, signaling a pleasant and refreshing experience. Its simplicity and conciseness add to its branding strength, making it memorable and easily recognizable. The name also cleverly aligns with Chime Bank’s core values, as it represents the concept of change and progress.

By analyzing the significance of Chime Bank’s branding, we can understand the strategic intent behind their name choice. The use of the word “chime” not only conveys a positive and welcoming atmosphere, but it also reflects the bank’s commitment to revolutionizing traditional banking methods. Chime Bank aims to bring about a refreshing and innovative approach to banking, resonating with customers seeking a modern banking experience.

How Chime Bank Differentiates Itself

Chime Bank sets itself apart by offering innovative features like early access to direct deposits, no hidden fees, and a user-friendly mobile app. Their commitment to providing a seamless banking experience makes them a top choice for customers seeking a reliable and convenient banking solution.

Chime Bank’s Distinctive Approach To Banking Services

Chime Bank stands out from traditional banks through its unique features and customer-centric approach. The bank’s commitment to providing a seamless and user-friendly banking experience has made it a preferred choice among customers. Here are some key features that set Chime Bank apart:

| Key Features |

|---|

| No hidden fees: Chime Bank prides itself on being transparent and does not charge any hidden fees for essential banking services such as maintenance, minimum balance, or overdraft. |

| Early direct deposit: With Chime Bank, users can get their paychecks up to two days early, ensuring quick access to funds. |

| Automatic savings: Chime Bank’s automatic savings feature allows users to save money effortlessly by rounding up every transaction to the nearest dollar and automatically depositing the difference into a savings account. |

| Fee-free overdraft protection: Chime Bank offers fee-free overdraft protection up to a certain limit, providing peace of mind without imposing additional charges. |

Chime Bank’s commitment to innovation and customer satisfaction has made it stand out in the banking industry. Its focus on eliminating unnecessary fees and providing convenient features has resonated with customers seeking a modern and hassle-free banking experience.

Chime Bank’s Technology And Security Measures

Chime Bank is known for its exceptional technology and stringent security measures. The bank utilizes cutting-edge technology to provide its customers with a seamless and secure banking experience.

When it comes to technology, Chime Bank leverages modern solutions to offer a user-friendly interface and efficient services. Its mobile banking app is designed to be intuitive and easy to navigate, allowing customers to conveniently manage their finances on the go.

Chime Bank also keeps security at the forefront of its operations. The bank implements robust security measures to protect customer data and prevent unauthorized access. With encrypted data transmission, secure authentication protocols, and continuous monitoring, Chime Bank ensures the highest level of security for its customers’ sensitive information.

In addition to the technological advancements, Chime Bank also places great emphasis on educating its customers about online security. Through their blog and educational resources, they provide valuable information and tips to help customers safeguard their accounts.

Overall, Chime Bank’s commitment to technology and security enables its customers to have a secure and convenient banking experience.

Customer Experience With Chime Bank

Chime Bank has gained popularity amongst users for its user-friendly interface and seamless banking experience. Customers have expressed their satisfaction with the convenience and efficiency the bank offers. The simple and intuitive design of the app and website allows users to navigate effortlessly, making transactions and managing finances a breeze.

The streamlined account setup process has also been highly praised, with customers appreciating the seamless integration with other financial apps and services. Users can easily link their accounts and transfer funds, while also taking advantage of features such as automatic savings and budgeting tools.

Testimonials and feedback from Chime Bank customers resonate with the overall positive experience. From quick customer support responses to the high level of security and transparency, Chime Bank has successfully created a banking platform that has won the trust of its users.

Chime Bank’s Impact On The Banking Industry

Chime Bank has emerged as a disruptive force in the banking industry, challenging the traditional model and leaving a lasting impact on other financial institutions. With its innovative approach, Chime has successfully captured the attention of consumers by offering a user-friendly mobile banking experience combined with a fee-free and transparent system.

Chime Bank’s success has prompted other banks to take notice and adapt their strategies accordingly. The ripple effect can be seen in the industry-wide shift towards digital banking solutions and the elimination of various fees that were once embedded in the traditional banking model. This has not only benefited consumers but has also forced banks to reconsider their business models and focus more on customer-centric offerings.

By prioritizing the needs of its customers and embracing technological advancements, Chime Bank has proven to be a game-changer in the banking industry. Its impact has paved the way for a more accessible and customer-friendly banking landscape, which is likely to continue evolving as more institutions strive to replicate Chime’s success.

Chime Bank’s Future Outlook

Chime Bank, a popular digital banking platform, has been making waves in the financial industry. Its future outlook appears promising, with potential for significant growth and innovation. As the banking landscape evolves, Chime Bank continues to adapt and position itself as a leader in the digital banking space.

An area of focus for Chime Bank is its upcoming developments and innovations. Speculations surround the introduction of new features and services that aim to enhance the user experience. With a customer-centric approach, Chime Bank is expected to prioritize convenience and accessibility. These factors, combined with its user-friendly interface and fee-free banking model, will likely contribute to its future success.

Furthermore, Chime Bank’s commitment to financial education and empowerment sets it apart from traditional banks. By providing tools and resources to help users achieve their financial goals, Chime Bank cultivates a sense of trust and loyalty. This dedication is expected to further boost its growth and solidify its position as a top digital banking option.

In summary, Chime Bank’s future outlook is promising, with the potential for continued growth and innovation. Its focus on user experience, convenience, and financial empowerment sets it apart in the banking industry.

Chime Bank’s Expansion And Partnerships

Chime Bank, the popular mobile banking platform, is making waves with its expansion plans and strategic collaborations within the industry. The bank’s recent partnerships have positioned it as a leading player in the digital banking space, offering innovative solutions and enhanced financial services to its customers.

Chime Bank’s expansion initiatives reflect the growing demand for convenient, accessible and user-friendly banking experiences. By expanding its reach and presence, Chime Bank aims to provide its customers with seamless banking services, including no-fee checking accounts, savings accounts, and innovative features like early direct deposit and automatic savings tools.

Furthermore, Chime Bank’s collaborations with key players in the industry enable it to leverage the strengths and expertise of its partners, enhancing its product offerings and driving customer satisfaction. These strategic partnerships also pave the way for Chime Bank to stay at the forefront of technological advancements, ensuring that its customers have access to the latest digital banking solutions.

Overall, Chime Bank’s expansion plans and partnerships demonstrate its commitment to revolutionizing the banking sector by offering innovative and user-centric financial products. By staying ahead of the competition and continuously enhancing its offerings, Chime Bank is solidifying its position as a disruptor in the industry.

Chime Bank’s Awards And Recognitions

Chime Bank has been honored with several awards and recognitions in the banking industry. These accolades are a testament to the bank’s commitment to providing innovative and user-friendly banking solutions.

One of the notable awards received by Chime Bank is the “Best Digital Bank” recognition, showcasing its excellence in digital banking services. This award highlights Chime Bank’s ability to deliver seamless and convenient banking experiences to its customers through its mobile app and online platform.

Chime Bank has also been recognized for its customer-centric approach. It has been awarded the “Customer Satisfaction Excellence Award” for its commitment to providing exceptional customer service and meeting the needs of its customers.

In addition to these awards, Chime Bank has also received industry recognition for its financial wellness initiatives. The bank has been praised for its efforts in helping customers manage their finances effectively and achieve financial stability.

These awards and recognitions serve as a testament to Chime Bank’s dedication to innovation, customer satisfaction, and financial wellness. They establish Chime Bank as a leader in the digital banking space and validate its mission of providing accessible and empowering financial services to its customers.

Credit: www.awortheyread.com

Frequently Asked Questions Of What Is The Chime Bank Name

What Is Chime Bank And How Does It Work?

Chime Bank is an online bank that offers fee-free banking services and financial products. It works by providing customers with a mobile banking app and a Visa debit card, allowing easy access to their accounts anytime, anywhere. With Chime, you can manage your money, save automatically, and make purchases with peace of mind.

Is Chime Bank Safe And Secure?

Yes, Chime Bank takes the security of your personal and financial information seriously. They employ industry-standard security measures, including encryption and multi-factor authentication, to protect your data. Additionally, Chime Bank is FDIC insured, meaning your deposits are insured up to $250,000 per depositor, giving you added peace of mind.

What Are The Benefits Of Using Chime Bank?

There are several benefits to using Chime Bank. First, there are no monthly fees, overdraft fees, or minimum balance requirements. Second, Chime offers early direct deposit, allowing you to get paid up to two days early. Third, it has a built-in saving feature that rounds up your transactions to the nearest dollar and saves the difference.

Finally, Chime Bank provides instant transaction alerts and real-time balances, giving you full control over your finances.

Can You Deposit Cash Into A Chime Bank Account?

Yes, you can deposit cash into your Chime Bank account. Simply visit any of the 90,000+ retail locations that participate in the Green Dot network, including Walmart, Walgreens, and CVS. Bring your Chime debit card and cash, and follow the instructions at the register.

Note that there may be a fee associated with this service, depending on the location.

Conclusion

Chime Bank offers a convenient and user-friendly banking experience, making it a popular choice among customers today. With its innovative features and seamless mobile app, Chime Bank stands out in the crowded banking industry. Whether you’re looking to avoid fees or enjoy early paycheck access, Chime Bank has got you covered.

Experience hassle-free banking with Chime Bank and take control of your finances today!