Chime Bank partners with The Bancorp Bank or Stride Bank for its banking services. (19 words) Chime Bank, a popular digital banking platform, has gained significant attention among consumers.

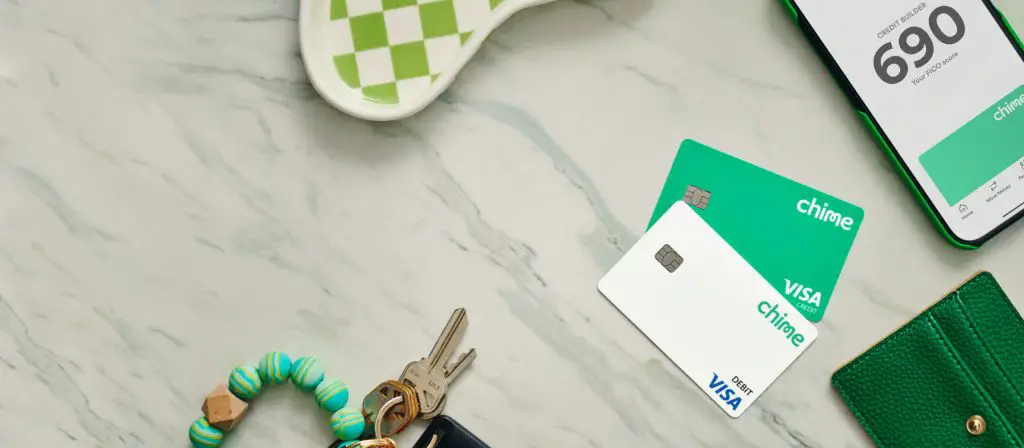

With its innovative features and no-hidden fee policy, it has emerged as a favored choice for many individuals. But have you ever wondered which bank powers Chime Bank’s services? We will unveil the answer to the question “What bank does Chime Bank with?

” Knowing the answer will provide you with a better understanding of the banking infrastructure behind this modern financial institution. So, let’s dive in and explore the partnership that supports the seamless functioning of Chime Bank.

A Look Into Chime Bank’s Bank Association

Chime Bank, an online-based banking service, is associated with The Bancorp Bank and Stride Bank, N.A. These partnerships allow Chime Bank to provide its customers with a variety of benefits. Having a bank partner allows Chime Bank customers to enjoy the security and reliability that comes with being a member of a well-established banking institution. The association with trusted banks ensures that Chime Bank customers’ funds are FDIC-insured up to the maximum limit and protected against unauthorized transactions. Additionally, Chime Bank customers can access the nationwide network of ATMs provided by the bank partners, making it easier to withdraw cash and manage their finances. This partnership also enables Chime Bank to offer features like early direct deposit, where customers can receive their paychecks up to two days in advance. Overall, Chime Bank’s bank partner relationships provide its customers with peace of mind, convenient access to funds, and enhanced financial services.

Bancorp Bank is an FDIC member institution that operates as a subsidiary of Bancorp, Inc. With its partnership with Chime Bank, Bancorp Bank enables Chime to offer various banking features, such as checking and savings accounts, mobile deposit, and debit card services. This collaboration has allowed Chime Bank to provide its users with a seamless banking experience through its mobile app.

The partnership between Chime Bank and Bancorp Bank highlights the importance of strategic alliances in the ever-evolving financial technology industry. By working together, these two institutions have been able to provide innovative banking solutions that cater to the needs of the modern consumer.

Evaluating The Services Provided By Chime Bank’s Partner

Chime Bank has gained considerable popularity for its innovative approach to banking, including its partnership with a major financial institution. This partnership allows Chime Bank to provide a wide range of products and services to its customers.

By analyzing the offerings of Chime Bank’s partner, it becomes evident that they have placed a strong emphasis on addressing the needs of modern banking customers. They offer a variety of checking and savings accounts, as well as features such as early direct deposit, fee-free overdraft protection, and instant money transfers.

When comparing these features to those offered by other financial institutions, it is clear that Chime Bank’s partner is at the forefront of providing convenient and customer-friendly solutions. The seamless integration of technology in their banking services ensures that customers can easily manage their accounts using their smartphones or online platforms.

In conclusion, Chime Bank’s partnership plays a vital role in expanding the range of products and services available to their customers. Their commitment to innovation and customer satisfaction reinforces their position as a leading player in the digital banking industry.

Uncovering The Seamless Integration Between Chime Bank And Its Partner

The seamless integration between Chime Bank and its partner is a game-changer in the banking industry. The technological partnership between Chime Bank and its partner has created a frictionless experience for customers. By harnessing the power of advanced technology, Chime Bank has revolutionized the way banking is done.

Exploring the technological integration between Chime Bank and its partner reveals that the two entities have worked together to develop a robust and secure platform. Through this collaboration, Chime Bank has been able to offer its customers a wide range of innovative features and services.

Clients of Chime Bank and its partner benefit from a user-friendly interface that simplifies their banking experience. The integration has enabled customers to easily manage their accounts, make payments, and track their finances all in one place.

The customer experience within the Chime Bank and partner framework is further enhanced by the seamless transfer of funds between accounts and the ability to receive instant notifications for transactions. This level of convenience and transparency has made banking with Chime Bank a top choice for many customers.

In conclusion, the integration between Chime Bank and its partner has transformed the way banking services are delivered. Through advanced technology and collaborative efforts, both entities have created an exceptional banking experience for their customers.

The Future Of Chime Bank’s Partnership With Its Bank

The future of Chime Bank’s partnership with its bank:

Speculations on the potential expansion of Chime Bank’s bank partnership suggest exciting possibilities for the future. Chime Bank has already made a significant impact in the financial industry with its innovative digital banking services. By partnering with traditional banks, Chime Bank has been able to provide seamless transactions and enhanced banking experiences for its customers.

Looking forward, predictions for the evolution of Chime Bank’s financial services indicate a continued commitment to partnering with reliable banks to offer even more features and services. This collaboration will likely result in improved savings accounts, investment options, and lending opportunities.

| Predictions for the evolution of Chime Bank’s financial services: |

| 1. Expanded savings account options with competitive interest rates. |

| 2. Introduction of investment platforms to help customers grow their wealth. |

| 3. Enhanced lending services such as personal loans and mortgages. |

| 4. Integration of additional financial tools, like budgeting and expense tracking. |

With Chime Bank’s commitment to innovation and the continuous growth of digital banking, it is evident that exciting advancements lie ahead in its bank partnership. While the specifics of these expansions are yet to be revealed, customers can anticipate a seamless and comprehensive banking experience from Chime Bank.

Frequently Asked Questions For What Bank Does Chime Bank With

What Bank Does Chime Bank With?

Chime Bank partners with The Bancorp Bank and Stride Bank for its banking services. These partnerships allow Chime Bank to provide its customers with FDIC-insured accounts and a wide range of banking features and services.

Is Chime Bank Affiliated With Any Major Banks?

No, Chime Bank is not affiliated with any major banks. It partners with The Bancorp Bank and Stride Bank to provide its banking services, but it operates as an independent online banking platform.

Can I Transfer Money From Chime Bank To Other Banks?

Yes, you can transfer money from your Chime Bank account to other banks. Chime Bank allows you to link external bank accounts and transfer funds through the Chime mobile app or website. Keep in mind that there may be certain limitations or fees associated with external transfers.

How Does Chime Bank Protect My Money?

Chime Bank takes several measures to protect your money. They use advanced encryption technology to secure your personal and financial information. Additionally, Chime Bank is FDIC-insured through its partner banks, which means your deposits are protected up to $250,000 in case of bank failure.

Conclusion

To sum up, Chime Bank is not associated with any specific traditional bank. Instead, it functions as an independent online bank, providing its services and features without relying on a brick-and-mortar institution. This unique approach allows Chime Bank to offer a streamlined and digital banking experience to its users.

By leveraging technology and user-friendly features, Chime Bank stands out from traditional counterparts, providing a convenient and efficient way to manage personal finances.