Chime is a trusted financial institution that offers innovative banking solutions with no hidden fees, making financial management simple and accessible for everyone. As a leading online bank, Chime provides a seamless mobile banking experience and a range of features that empower individuals to take control of their money.

With Chime, customers can manage their spending, automatically save, get paid early, and receive real-time transaction alerts, all in one convenient app. By leveraging advanced technology and a commitment to customer satisfaction, Chime has become a go-to choice for individuals seeking a modern and user-friendly banking experience.

1 Why Choose Chime As Your Financial Institution?

Chime is a leading financial institution that offers a range of benefits and features that set it apart from traditional banks. With Chime, users can enjoy a seamless and user-friendly banking experience that is designed to meet their financial needs.

One key advantage of Chime is its user-friendly mobile app, which allows customers to manage their accounts on the go. Whether it’s checking their balance, making payments, or transferring funds, Chime provides a convenient and easy-to-use platform.

In addition, Chime offers a range of features that make banking hassle-free. For instance, customers can receive instant notifications for every transaction, helping them stay on top of their financial activity. Furthermore, Chime provides an innovative automatic savings feature that rounds up purchases to the nearest dollar and deposits the difference into a savings account.

| Benefits of Chime | Features of Chime |

|---|---|

| Seamless and user-friendly banking experience | User-friendly mobile app |

| Instant transaction notifications | Automatic savings feature |

| Convenient account management on the go | Early direct deposit |

Overall, Chime offers a modern and innovative approach to banking, providing users with a range of benefits and features that make managing their finances easier and more convenient.

Credit: www.chime.com

A Digital Banking Solution That Puts You First

Chime is a digital banking solution that prioritizes the needs of its customers. With a fast and easy account set up process, you can start enjoying the benefits of their services in no time. Whether you’re at home or on the go, you have convenient access to your funds whenever and wherever you need them.

Chime’s mission is to empower customers and promote financial wellness. They understand the importance of putting individuals first and are committed to providing a seamless banking experience. Their user-friendly platform allows you to easily manage your financial transactions, track your spending, and save money.

With Chime, you can say goodbye to hidden fees and hello to a transparent and affordable banking solution. They offer a variety of features such as early direct deposit, automatic savings, and a debit card that works with mobile payment platforms.

Innovative Banking Services Tailored For You

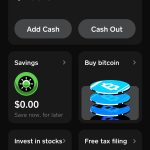

Chime offers a wide range of innovative banking services and products designed with your needs in mind. Whether you’re looking to spend or save, Chime has the tools to assist you in achieving your financial goals. With Chime’s spending tools, you can easily track your expenses and stay on top of your budget. Their savings tools enable you to save effortlessly, making it simple to build your savings and prepare for the future.

But what sets Chime apart from other financial institutions is its unique approach to eliminating hidden fees. Unlike traditional banks that charge fees for various services, Chime believes in transparency and does not charge unnecessary fees, such as overdraft fees or monthly maintenance fees. This means you get to keep more of your hard-earned money and have better control over your finances.

Experience the convenience and transparency of Chime’s banking services today and start taking control of your financial future.

2 Chime’s Mobile Banking Experience

Chime’s mobile banking experience is designed to provide a seamless and user-friendly platform for all your financial needs. With Chime’s mobile app, you can conveniently manage your money anytime and anywhere. The app offers a range of mobile banking features that set Chime apart from other financial institutions. From instant notifications for every transaction to automatic savings features that help you save effortlessly, Chime is committed to making your banking experience as efficient and enjoyable as possible. Features like early direct deposit and fee-free overdraft protection make Chime a popular choice among users seeking a flexible and convenient banking solution. Whether you need to send money instantly or track your spending, Chime’s mobile app has got you covered. Experience the power of mobile banking with Chime and take control of your finances today.

Banking Made Simple With Chime’s Mobile App

Banking Made Simple with Chime’s Mobile App provides a secure and seamless login and authentication process. The app’s intuitive navigation and user interface make banking effortless, allowing you to manage your finances with ease.

Chime’s mobile app offers essential features that make it convenient to handle your financial transactions. With the app, you can easily deposit checks, transfer funds, and pay bills. You can also set up automatic savings and receive real-time alerts for account activity.

The mobile app’s advanced security measures safeguard your information, ensuring that your transactions are protected. Chime’s technology provides bank-level security, protecting your sensitive data and preventing unauthorized access.

Banking with Chime’s mobile app offers you a seamless and convenient way to manage your finances, giving you peace of mind knowing that your money is secure and easily accessible.

Tools And Features To Enhance Your Financial Management

Enhance your financial management with Chime’s tools and features designed to improve your financial health. Chime provides budgeting tools that allow you to effortlessly track and control your expenses. With these tools, you can easily categorize your spending, set spending limits, and visualize your financial goals.

Chime also offers automatic savings features that help you grow your savings effortlessly. Set up recurring transfers to your savings account and watch your savings grow without even thinking about it. Additionally, Chime provides real-time transaction alerts and instant notifications, keeping you informed about every transaction that occurs in your account. This gives you peace of mind and helps you stay on top of your finances.

3 Chime’s Commitment To Security And Privacy

Chime prioritizes the security and privacy of its users’ financial information. With a deep commitment to protecting your funds, Chime has implemented robust security measures to ensure that your sensitive data is safeguarded at all times. By leveraging cutting-edge encryption technology, Chime ensures that your information is securely transmitted and stored, minimizing the risk of unauthorized access. The platform’s dedication to data protection is further exemplified through comprehensive privacy policies that outline how your information is collected, used, and shared. These stringent measures give you peace of mind, knowing that your financial details are well-protected within Chime’s secure environment.

State-of-the-art Security To Keep Your Money Safe

Chime prioritizes the security of your money by implementing various measures to prevent unauthorized access. One of the key features is the multi-factor authentication process, which adds an extra layer of security. With this feature, users have to verify their identity using multiple methods such as passwords, fingerprints, or facial recognition.

In addition to multi-factor authentication, Chime employs real-time transaction monitoring and fraud detection mechanisms. These systems constantly analyze account activities, looking for any suspicious transactions or patterns that could indicate fraudulent activity. By detecting and addressing potential threats in real-time, Chime ensures the safety of your money.

Furthermore, Chime provides a zero-liability policy for unauthorized transactions. In the unlikely event that your account is compromised, Chime will protect you from financial losses, making sure that you are not held responsible for any unauthorized transactions.

Transparency And Privacy In The Digital Banking Era

Privacy practices and protection of your personal information:

Chime, as a financial institution, places great importance on maintaining the privacy and security of your personal data. Chime understands the sensitivities associated with handling financial information in the digital banking era and has implemented robust measures to ensure the confidentiality and protection of your data.

Chime employs advanced encryption techniques to safeguard your personal information, ensuring that it remains secure and protected from unauthorized access or data breaches. Chime takes proactive steps to regularly assess and update its security protocols to mitigate any potential vulnerabilities.

Chime is committed to providing complete transparency regarding how it collects, uses, and shares your personal data. Through clear and concise privacy policies, Chime ensures that you have a clear understanding of how your information is being utilized. Additionally, Chime strives to build a trusting relationship with its customers by providing open channels of communication and promptly addressing any concerns regarding privacy or data security.

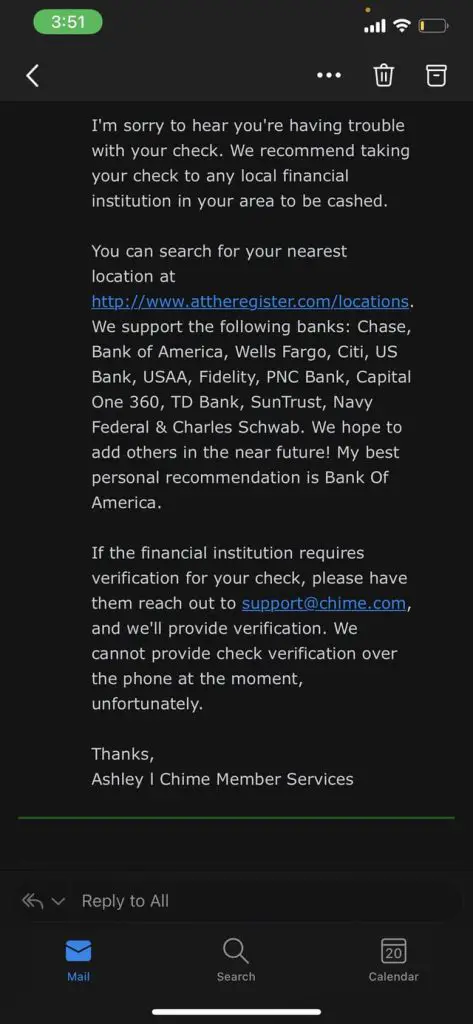

Frequently Asked Questions For Financial Institution For Chime

What Is Chime And How Does It Work?

Chime is a financial institution that offers online banking services. With Chime, you can manage your money, make purchases, and save with no hidden fees. It works by providing a mobile app that allows you to access your accounts, make transfers, and track your expenses anytime, anywhere.

What Are The Benefits Of Banking With Chime?

Banking with Chime comes with several benefits. Firstly, there are no overdraft fees, minimum balance requirements, or monthly maintenance fees. Additionally, Chime offers early direct deposit, allowing you to receive your paycheck up to two days in advance. Chime also has a robust savings account with a competitive interest rate.

Is Chime A Safe And Secure Financial Institution?

Chime takes the security of your money and personal information seriously. They use industry-standard encryption to protect your data and have multiple layers of security in place to prevent unauthorized access. Chime is also FDIC-insured up to $250,000, providing additional peace of mind.

Can I Use Chime For My Everyday Banking Needs?

Absolutely! Chime provides all the essential banking services you need for your everyday financial transactions. You can make purchases with your Chime Visa Debit Card, deposit checks using the mobile app, and even send money to friends and family members.

Chime also offers a feature called SpotMe, which allows you to overdraft your account up to a certain limit without any fees.

Conclusion

Chime is an innovative financial institution that offers user-friendly and hassle-free banking solutions. With its simple and intuitive mobile app, Chime provides convenient access to essential banking services, such as direct deposit, bill pay, and savings accounts. By prioritizing transparency and a customer-centric approach, Chime aims to revolutionize the traditional banking experience and empower individuals to take control of their financial well-being.

Experience better banking with Chime today.