Chime Round Up works by automatically rounding up your debit card purchases to the nearest dollar and transferring the difference into your Chime Savings account. This feature helps you save effortlessly and grow your savings over time.

Saving money can often feel challenging and overwhelming, but with Chime Round Up, the process becomes effortless and seamless. Chime Round Up is a feature offered by Chime banking, which allows you to save money every time you make a purchase with your Chime debit card.

By rounding up your transactions to the nearest dollar, the extra change is transferred directly into your Chime Savings account. This means that with every purchase, you are gradually accumulating savings without even having to think about it. Whether you’re buying a cup of coffee or shopping for groceries, Chime Round Up ensures that your spare change is put to good use, helping you reach your financial goals faster.

Chime Round Up: A Savings Strategy

The Chime Round Up feature is a unique savings strategy that can help you effortlessly save money. It works by rounding up your transactions to the nearest dollar and transferring the rounded-up amount into your savings account. This means that every time you make a purchase, the spare change is automatically saved for you.

With Chime Round Up, you can save money without even realizing it. It’s a simple and convenient way to build up your savings without having to manually transfer money or think about budgeting. By automatically saving your spare change, you can gradually grow your savings over time.

Here’s how it works: Let’s say you buy a cup of coffee for $2.50. With Chime Round Up, the transaction will be rounded up to $3, and the extra $0.50 will be transferred to your savings account. This might not seem like much, but over time, these small amounts can add up and contribute to your overall savings.

Discover the concept of Chime Round Up and start saving effortlessly today!

Credit: www.reuters.com

Setting Up Chime Round Up

Setting up Chime Round Up is a simple process that allows you to effortlessly save money. To get started, you need to link your Chime account to your checking account. This can be done by following a few easy steps:

- Open the Chime app on your mobile device or visit the Chime website on your computer.

- Go to the settings or account settings section of your Chime app or website.

- Look for the option to link an external account or add a new account.

- Enter your checking account details, including the account number and routing number.

- Confirm your information and authorize the linking process.

- Once your Chime account is successfully linked to your checking account, you can enable the Round Up feature.

Enabling Round Up allows Chime to round up your transactions to the nearest dollar and automatically transfer the difference to your Savings Account. This way, you can save money effortlessly without even thinking about it. Take advantage of Chime Round Up to boost your savings and reach your financial goals.

How Chime Round Up Works

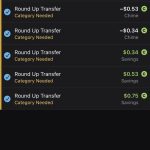

Chime Round Up is a feature offered by Chime, a popular mobile banking app that helps users save money effortlessly. With Chime Round Up, every transaction you make with your Chime debit card is rounded up to the nearest dollar, and the difference is automatically transferred to your Chime Savings Account.

The process is straightforward. For example, if you make a purchase for $4.50, Chime will automatically round up the transaction to $5 and transfer the additional $0.50 to your savings. These round-up amounts may seem small, but they can quickly add up over time, helping you accumulate savings without even realizing it.

To ensure transparency, Chime keeps track of your rounded-up amounts and savings in the Chime app. You can easily monitor how much you’ve saved through the Round Up feature, giving you a clear picture of your progress towards your financial goals.

Increasing Saving Potential

Chime Round Up is designed to help users increase their saving potential effortlessly. By choosing a higher round up amount, users have the opportunity to save more money with each transaction. Whether it’s rounding up to the nearest dollar or a higher amount, Chime allows users to customize their savings goals and preferences.

Additionally, Chime also provides the flexibility to exclude certain transactions from the Round Up feature. This ensures that users have control over which purchases are rounded up and which are not, allowing them to make strategic decisions based on their financial goals.

With Chime Round Up, users can save money without even thinking about it. It’s an innovative and convenient feature that helps users grow their savings effortlessly.

Reaping The Benefits

Chime Round Up is a feature offered by Chime, a popular online banking platform that helps individuals save money effortlessly. The process is simple and user-friendly. Whenever you make a purchase using your Chime debit card, the transaction is rounded up to the nearest dollar, and the difference is automatically transferred to your savings account. This innovative feature enables you to build a savings cushion effortlessly without even thinking about it. By rounding up your purchases, you are effectively utilizing the saved amount to build your financial future.

With Chime Round Up, you have the freedom to choose how that saved amount is utilized. You can either keep it in your savings account, where it earns interest, or transfer it to your spending account to use it for day-to-day expenses. This flexibility ensures that you have control over your finances and can allocate the saved amount according to your needs.

Automating Savings

Chime Round Up is a feature that enables you to automatically save money. Setting up automatic transfers to your savings account is a simple way to effortlessly grow your savings. With Chime, you have the option to allocate funds towards specific financial goals, making it easier to stay organized and focused on achieving your objectives.

By rounding up your everyday transactions to the nearest dollar and transferring the spare change into your savings account, Chime Round Up helps you save without even noticing. This innovative feature takes the guesswork out of saving and makes it a seamless process. Additionally, it allows you to monitor your progress towards your savings goals and take control of your financial future.

With the ability to set up automatic transfers and allocate funds towards your specific financial goals, Chime Round Up simplifies the savings process and empowers you to reach your objectives. Start automating your savings with Chime Round Up today and watch your savings grow effortlessly.

Budgeting And Round Up

Budgeting is an essential aspect of financial management, and incorporating the Chime Round Up feature into your budgeting strategy can be a game changer. This innovative feature allows you to round up your everyday purchases to the nearest dollar and save the spare change. It may seem like a small amount, but it can add up significantly over time. Adjusting your budget to accommodate Round Up savings is relatively simple. Start by analyzing your spending habits and identifying areas where you can cut back. Take a close look at your discretionary expenses and see if there are any non-essential items that you can eliminate or reduce. By reallocating some of these funds towards your savings goals, you can effectively incorporate Round Up into your budgeting strategy and watch your savings grow incrementally. It’s important to be consistent and diligent in redirecting your Round Up savings towards your financial goals to maximize the benefits of this feature.

Integrating Round Up With Investment Accounts

Chime Round Up seamlessly integrates with your investment accounts, allowing you to effortlessly save and invest your spare change. This innovative feature automates the process, making it easier than ever to grow your wealth.

Integrating Round Up with Investment AccountsInvesting the accumulated rounded-up amount

Chime offers a unique feature called Round Up, which allows you to automatically save and invest your spare change from everyday purchases. When you enable Round Up, Chime rounds up your transactions to the nearest dollar and transfers the rounded-up amount to your designated savings account. But what if you want to invest this accumulated amount?

Exploring Chime’s investment options

Chime provides a range of investment options to choose from. Once you have accumulated a substantial amount through Round Up, you can transfer it to Chime’s investment account. Chime offers a variety of investment vehicles, including individual stocks, exchange-traded funds (ETFs), and mutual funds. You have the flexibility to choose the investment options that align with your financial goals and risk tolerance.

Benefits of investing through Chime

Investing through Chime has several advantages. Firstly, Chime allows you to start investing with as little as $1, making it accessible to individuals with varying budgets. Secondly, Chime’s intuitive and user-friendly app makes it easy to track your investments and make informed decisions. Additionally, Chime offers fractional investing, which means you can buy a fraction of a share, enabling you to diversify your portfolio even with limited funds.

In conclusion

Integrating Round Up with Chime’s investment accounts is a seamless way to save and invest your spare change. By exploring Chime’s investment options, you can grow your accumulated amount and work towards achieving your financial goals. So, why not take advantage of Chime’s Round Up feature and start investing today?

Making Your Money Work For You

In Chime Round Up, you can make your money work for you by saving and investing your spare change. As you make purchases using your Chime debit card, the transaction amount is rounded up to the nearest dollar, and the extra amount is automatically transferred to your Chime savings account. This effortless saving technique helps you build a savings cushion without even thinking about it.

The potential growth of the invested round up amount can be significant over time. By regularly contributing to your Chime savings account through round-ups, you are continuously adding to your investment. As the invested amount grows, it has the potential to compound and earn returns.

The long-term benefits of investing your Chime Round Up savings include the potential to generate wealth and achieve financial goals. By consistently setting aside spare change, you are building a savings habit and harnessing the power of compounding interest. Over time, this can help you create a financial safety net, fund major purchases, or even save for retirement.

Investing your round-up savings through Chime Round Up is a simple and effective way to make your money work for you, potentially allowing you to achieve long-term financial success.

Common Questions About Chime Round Up

How does Chime Round Up differ from other saving methods?

Chime Round Up offers a convenient way to save money effortlessly. With each transaction you make using your Chime debit card, the Round Up feature automatically rounds up the purchase to the nearest dollar and transfers the spare change to your savings account. This innovative feature sets Chime apart from traditional savings methods, as it allows you to save without even thinking about it, making it easy to reach your financial goals.

Can the Round Up feature be disabled or adjusted?

Yes, you have full control over the Round Up feature in your Chime app settings. You can easily enable or disable it according to your preference. Furthermore, you can adjust the Round Up functionality to round up to the nearest dollar, ten dollars, or more, depending on your saving goals. Flexibility and control are key features of the Chime Round Up.

Is Chime Round Up available for joint accounts?

Yes, the Chime Round Up feature is available for both individual and joint accounts. Whether you have a personal account or share finances with someone else, you can enjoy the benefit of rounding up your purchases and saving money effortlessly with Chime.

Frequently Asked Questions For How Does Chime Round Up Work

How Does Chime Round Up Work?

Chime Round Up is a feature that automatically rounds up your purchases to the nearest dollar and transfers the spare change to your savings account. For example, if you make a purchase of $4. 50, Chime will round it up to $5 and transfer the extra 50 cents to your savings.

It’s an effortless way to save money without even thinking about it.

Is Chime Round Up Free?

Yes, Chime Round Up is completely free to use. There are no fees or charges associated with this feature. It’s just another way that Chime helps you save and manage your money without any extra cost.

Can I Opt-out Of Chime Round Up?

Yes, you can opt-out of Chime Round Up at any time. Simply go to the Chime app or website, navigate to the Round Up settings, and disable the feature. It’s a flexible option that allows you to control how you save your money with Chime.

Is Chime Round Up Secure?

Absolutely. Chime takes the security of your account and personal information seriously. Chime Round Up uses the same secure technology as all other transactions made through the Chime app. Your spare change is transferred securely and stored in your Chime savings account.

Conclusion

Chime Round Up offers a simple yet effective solution for saving money effortlessly. By rounding up your purchases to the nearest dollar, Chime allows you to effortlessly build your savings account. With its user-friendly interface and seamless integration with your everyday spending habits, Chime Round Up is a game-changer for those seeking a convenient way to save money.

Start using Chime Round Up today and watch your savings grow without even noticing it.