Cash App is not affiliated with any bank; it is a mobile payment service developed by Square, Inc. Cash App, developed by Square, Inc., is a popular mobile payment service that is not associated with any specific bank. With its easy-to-use interface and various features, Cash App allows users to send and receive money, make purchases, and invest in stocks and Bitcoin.

It has gained significant popularity due to its convenience and user-friendly design. However, it is important to note that while Cash App offers a “Cash App Card” that operates like a debit card, it is not linked to any traditional bank account.

Instead, users can add funds to their Cash App balance directly from their linked bank account or through other available options.

The History Of Cash App

The History of Cash App dates back to its development by Square Inc. Cash App is a mobile payment service that allows users to send and receive money. It was first introduced by Square Inc. in 2013 as a person-to-person payment solution. Over the years, Cash App has evolved to offer additional banking services, including a Cash Card that allows users to make purchases using their Cash App balance.

As Cash App gained popularity, Square Inc. recognized the need to expand its features and functionality to provide users with a more comprehensive banking experience. In 2018, Cash App introduced the ability to buy and sell Bitcoin, giving users the opportunity to invest in cryptocurrency directly from the app.

With the development of Cash App, Square Inc. aimed to provide a simple and convenient solution for individuals to manage their finances. By offering a range of banking services, Cash App has become a popular choice for those seeking a modern and digital banking experience.

Cash App And Traditional Banks

With the rise of digital payment platforms, traditional banks are facing competition from fintech companies like Cash App. Cash App, developed by Square, offers a convenient and user-friendly way to send, receive, and manage money. How does Cash App differ from traditional banks? Let’s explore the benefits of choosing Cash App over traditional banking institutions.

1. Ease of Use

Cash App provides a simple and intuitive interface, making it easy for users to navigate and perform transactions. From sending money to paying bills, the app streamlines financial processes, saving users time and effort.

2. Speedy Transactions

With Cash App, transferring money is quick and efficient. Unlike traditional banks that may take hours or even days to process transactions, Cash App enables instant peer-to-peer transfers, allowing users to access their funds immediately.

3. Cost-Effective

Compared to traditional banks, Cash App offers competitive fees and low-cost services. Users can avoid excessive charges for services like wire transfers or overdraft fees, ultimately saving money.

4. Mobile and Digital Integration

Cash App is designed for mobile devices, ensuring compatibility with smartphones and tablets. With the app, users can conveniently manage their finances on the go. It also integrates digital payment options, such as Bitcoin, providing users with additional flexibility.

5. Enhanced Security

Cash App prioritizes the security of user data and transactions. It employs encryption technology to protect sensitive information, reducing the risk of fraud or identity theft.

By considering these factors, individuals can evaluate whether Cash App aligns with their financial goals and preferences, making it a viable alternative to traditional banks.

Partner Banks Of Cash App

Partner banks play a crucial role in enabling cash transactions through the Cash App. These banks work together with Cash App to ensure smooth and secure transfer of funds. Users can connect their Cash App accounts with their bank accounts and use them seamlessly for various banking needs.

Here is a list of banks that work with Cash App:

| Bank of America | Chase | Wells Fargo |

| TD Bank | PNC Bank | US Bank |

| SunTrust | Citibank | Capital One |

These partner banks provide various services such as depositing, withdrawing, and transferring money with ease. Additionally, Cash App users can link their debit or credit cards to make seamless transactions. It is important to note that each bank may have its own policies and fees associated with using the Cash App.

In conclusion, if you are a Cash App user, having an account with one of these partner banks can enhance your banking experience and facilitate hassle-free transactions.

Popular Banks For Cash App Users

Cash App, a popular mobile payment service, is used by millions of people for its convenience and ease of use. If you are wondering which banks are compatible with Cash App, here are some options to consider:

| Bank Name | Features and Benefits |

| Bank A |

– Quick and secure linkage to your Cash App account – Easy access to funds and transactions – Seamless integration for hassle-free transfers |

| Bank B |

– Instant notifications for all Cash App transactions – Convenient management of funds through the bank’s mobile app – Enhanced security features for peace of mind |

| Bank C |

– Simple and straightforward connection to your Cash App – Real-time balance updates and transaction history – Quick and easy account verification for a seamless experience |

These banks are among the most preferred by Cash App users due to their compatibility and user-friendly features. Whether you are an existing customer or looking to open a new account, using Cash App with these popular banks can provide you with a seamless and efficient payment experience.

Opening A Bank Account With Cash App

Opening a bank account with Cash App is a convenient and straightforward process. To begin, you will need to gather the necessary documents and requirements. These include a valid government-issued ID such as a driver’s license or passport, as well as your social security number. It’s important to have these documents ready before you start the account opening process.

Once you have gathered the required documents, you can then follow the step-by-step guide provided by Cash App to open your bank account. The process typically involves downloading the app, creating an account, and providing the necessary personal information. Cash App may also require verification of your identity and address before approving your account.

Opening a bank account with Cash App offers many benefits and ease of use. With just a few simple steps and the required documents, you can have your account up and running in no time.

Credit: money.com

Linking Current Bank Accounts To Cash App

If you want to link your current bank accounts to Cash App, you can easily do so by following a few simple steps. First, open the Cash App on your mobile device and tap on the profile icon in the top left corner. Then, scroll down and select “Linked Banks” under the “Fund” section. Next, choose your bank from the list of available options or search for it manually. Once you’ve selected your bank, you’ll be prompted to enter your online banking login credentials. After successfully logging into your bank account, you can authorize the connection with Cash App. By linking your bank accounts to Cash App, you can easily transfer money between your bank and Cash App, making it convenient for managing your finances. Additionally, connecting your bank accounts provides a secure and reliable way to fund your Cash App account and use its various features.

Transferring Funds From Cash App To Bank Accounts

Transferring funds from Cash App to your bank account is a quick and convenient process. To initiate the transfer, follow these steps:

- Open the Cash App on your mobile device and locate the balance tab on the home screen.

- Tap the “Cash Out” option and enter the amount you want to transfer.

- Select your bank from the list provided or manually enter your bank account details.

- Review the details and confirm the transfer.

Once the transfer is initiated, it usually takes 1-3 business days for the funds to reach your bank account. Keep in mind that Cash App may charge a nominal fee for instant transfers, and the availability of this option varies depending on your account history and the specific bank involved.

| Transfer Type | Processing Time | Fees |

|---|---|---|

| Standard Transfer | 1-3 business days | No fee |

| Instant Transfer | Instantly | 1.5% fee |

Ensure that you have sufficient balances in your Cash App account to cover the transfer amount, including any applicable fees. It’s also advisable to double-check the accuracy of the bank account details entered to avoid any delays or issues. Take advantage of the convenience of the Cash App to easily transfer funds to your bank account whenever needed.

Cash App Virtual Banking Services

With the rise of online banking, the Cash App has emerged as a popular virtual banking service. This innovative platform offers a range of features that make managing your finances easier and more convenient.

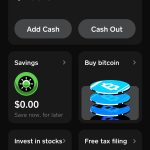

Cash App provides users with a variety of virtual banking features that simplify everyday financial transactions. Users can send and receive money instantly, pay bills, and even invest in stocks directly from their Cash App account. Additionally, Cash App offers a debit card that allows users to make purchases at any retailer that accepts Visa.

Benefits and Limitations of Cash App Virtual Banking

One of the key benefits of using Cash App is its user-friendly interface, which makes it easy for even those new to virtual banking to navigate. It also offers quick and seamless transactions and provides users with the ability to earn rewards for using the app.

However, it’s important to note that Cash App is not a traditional bank and does not provide the same level of security and protection as a traditional bank account. Additionally, there are certain limitations to consider, such as transaction limits and potential fees for certain services.

Cash App’s Future In Banking

Developed by Square Inc., Cash App has gained immense popularity as a peer-to-peer payment app. While its primary focus has been on providing easy and convenient money transfer services, its potential impact on the banking industry is worth exploring.

Cash App’s future development is being closely watched by many experts in the finance sector. The app’s user-friendly interface and seamless functionality have attracted a significant user base, indicating its potential to revolutionize traditional banking systems.

The predictions for Cash App’s future suggest a gradual shift towards offering more comprehensive banking services. This could include expanded investment options, credit services, and even the possibility of becoming a full-fledged digital bank.

With its growing customer base and increasing market share, Cash App has the potential to disrupt the banking industry by offering efficient and user-centric financial services. Its impact on traditional banking can be significant and may lead to a shift in consumer behavior towards digital banking solutions.

Exclusive Cash App Banking Features

One of the most appealing aspects of Cash App is its seamless integration of banking services. Unlike traditional banks, Cash App offers several unique features that enhance the user experience.

Firstly, users can easily link their bank accounts to Cash App, allowing them to transfer funds effortlessly between the two platforms. This feature eliminates the need for separate banking apps and simplifies the management of finances.

Secondly, Cash App provides users with a free Visa debit card, which can be used for everyday purchases and withdrawals at ATMs. This added convenience allows users to access their funds instantly, whether they are shopping, dining out, or traveling.

Additionally, Cash App offers a range of personalized banking services, including the ability to set up direct deposits and receive paychecks early. This feature is particularly useful for those who need quick access to funds, such as freelancers or gig workers.

Overall, Cash App’s banking services are designed to make financial transactions seamless and user-friendly. With its unique features and convenient functionality, Cash App is revolutionizing the way users manage their finances.

Security Measures In Cash App Banking

One of the primary concerns of users when it comes to banking with Cash App is the security of their information. Fortunately, Cash App has implemented several security measures to protect user data and prevent unauthorized access.

Fraud prevention is a top priority for Cash App. They employ state-of-the-art technology and encryption techniques to ensure that all data transmitted on their platform is secure. Additionally, they have implemented measures such as two-factor authentication and email verification to further enhance security.

Cash App also takes strong measures to protect user information from unauthorized access. They regularly monitor their systems for any suspicious activity and have implemented firewalls and intrusion detection systems to prevent unauthorized access to user data. Furthermore, Cash App follows industry best practices in data security and compliance with regulatory requirements.

By taking these security measures, Cash App ensures that user data is safeguarded against fraud and unauthorized access, providing users with peace of mind when using their banking services.

Frequently Asked Questions For What Bank Uses Cash App

What Is Cash App And How Does It Work?

Cash App is a popular mobile payment service that allows users to send and receive money easily. It works by linking your bank account or debit card to the app, allowing you to transfer funds between friends or make payments at participating merchants.

Can I Link My Bank Account To Cash App?

Yes, you can link your bank account to Cash App. By doing so, you can easily transfer funds between your bank account and Cash App, making it convenient for sending or receiving money.

Which Banks Are Compatible With Cash App?

Cash App is compatible with a wide range of banks, including popular ones like Chase, Wells Fargo, Bank of America, and Citibank. However, it is recommended to check with your specific bank to ensure compatibility before linking your account.

Is Cash App Safe To Use For Banking Transactions?

Cash App takes security seriously and uses encryption and other security measures to protect your personal information. However, it is always important to take precautions and avoid sharing sensitive information with unknown or untrusted individuals.

Conclusion

To sum up, Cash App allows users to engage in banking activities such as transferring money, receiving salaries, and even investing in Bitcoin. However, it’s important to note that Cash App is not a traditional bank. It works in collaboration with Sutton Bank to provide its users with banking services.

So, if you’re looking for a convenient and user-friendly app that enables financial transactions, Cash App is definitely worth considering.