Cash App banks with Lincoln Savings Bank, a reputable, federally-chartered bank in the United States. As an online banking service, Cash App utilizes Lincoln Savings Bank’s infrastructure to securely manage and facilitate financial transactions for its users.

Cash App, a popular peer-to-peer payment app, has gained significant traction in recent years due to its convenience and user-friendly interface. With the app, users can easily send, receive, and request money from friends, family, or businesses. However, some users may wonder where Cash App banks and how it ensures the safety of their funds.

We will explore the banking partnership of Cash App and shed light on the security measures in place to protect user transactions and data. By understanding the underlying banking infrastructure, users can gain confidence in utilizing Cash App as a reliable payment solution.

What Is Cash App?

Cash App is a mobile payment service that allows users to send and receive money quickly and easily. It is developed by Square Inc., a well-known financial services and digital payments company. With millions of users, Cash App has become popular for its convenience and user-friendly interface.

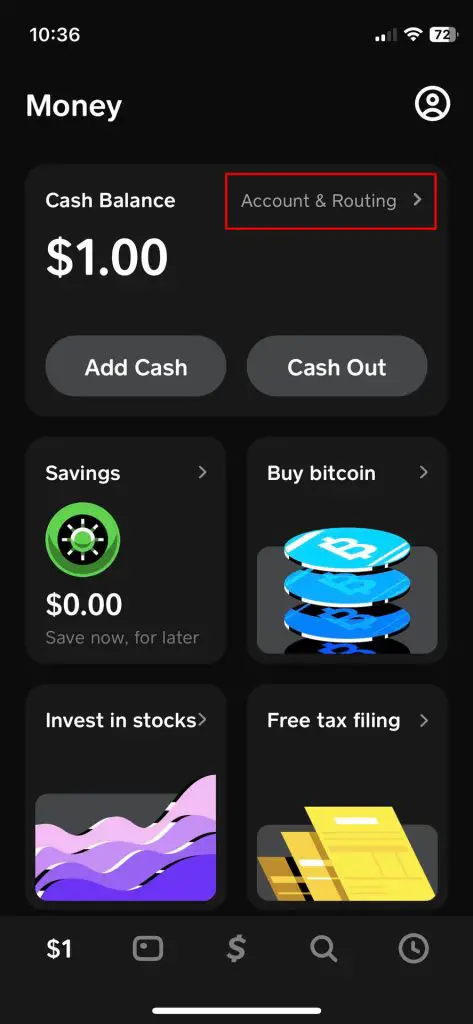

Cash App offers a range of features that make managing and transferring money simple. Users can link their bank accounts or debit cards to the app, enabling them to easily deposit and withdraw funds. Additionally, Cash App provides users with a unique account and routing number, allowing them to receive direct deposits (such as paychecks or tax refunds) straight into their Cash App balance.

Users can also use Cash App to make purchases at participating merchants using the Cash Card, a customizable debit card linked to their Cash App balance. With its innovative features and seamless integration with other financial services, Cash App has transformed the way people handle their personal finances.

Cash App’s Bank Partnership

What Does Cash App Bank With: Cash App has formed a partnership with Sutton Bank to provide banking services to its users. This partnership offers several advantages for users who want to utilize the banking features of Cash App.

1. Seamless integration: Cash App’s collaboration with Sutton Bank ensures a smooth banking experience within the app itself. Users can easily link their Cash App accounts with Sutton Bank and access various banking features without any hassle.

2. Direct deposits: Cash App users can receive their salaries, income, or any other direct deposits directly into their Cash App accounts, thanks to the partnership with Sutton Bank. This eliminates the need for traditional bank accounts and offers convenience.

3. Debit card: Cash App provides users with a Visa debit card, issued by Sutton Bank. This card allows users to make purchases online and in physical stores, withdraw cash, and perform other banking transactions.

4. FDIC insured: Sutton Bank, being a member of the Federal Deposit Insurance Corporation (FDIC), ensures that Cash App user’s funds are protected up to the maximum limit allowed by law.

5. Budgeting tools: Cash App, in partnership with Sutton Bank, offers various budgeting tools to help users manage their finances effectively. These tools assist in tracking spending, setting budgets, and gaining insights into personal financial habits.

6. Investment options: The collaboration with Sutton Bank also enables Cash App users to explore investment opportunities. Users can invest in stocks, buy and sell Bitcoin, and engage in other investment activities through the app.

7. Security measures: Cash App’s partnership with Sutton Bank ensures robust security measures to safeguard user information and transactions. Users can feel confident about the safety of their funds and personal data.

In summary, the partnership between Cash App and Sutton Bank offers numerous benefits to users, including seamless integration, direct deposits, a Visa debit card, FDIC insurance, budgeting tools, investment options, and enhanced security measures.

Cash App Bank Account Features

What Does Cash App Bank With. Cash App is a popular mobile payment service that allows users to send and receive money quickly and securely. But did you know that Cash App also offers a bank account feature? With a Cash App bank account, users can enjoy a range of benefits.

- Requirements: To open a Cash App bank account, you need to be at least 18 years old and have a valid social security number. You’ll also need to provide some basic personal information, such as your name, address, and date of birth.

- Benefits: Once you have a Cash App bank account, you can receive direct deposits, which means your paycheck can be deposited straight into your account. You can also use your Cash App bank account to pay bills, buy and sell Bitcoin, and even get a Cash App debit card to use for everyday purchases.

- Routing and Account Numbers: With a Cash App bank account, you’ll have your own unique routing and account numbers. This means you can easily set up direct deposits and make electronic transfers to and from your account.

Deposits And Withdrawals With Cash App

In order to deposit money into your Cash App account, you can follow a few simple steps. First, open the app on your device and navigate to the “My Cash” tab. Next, tap on the “Add Cash” option and enter the amount of money you want to deposit. You can choose between using your linked bank account or your Cash App balance to complete the transaction. If you decide to use your bank account, you will need to provide your account and routing numbers. Cash App also offers a convenient option to deposit cash into your account by visiting a participating retailer and adding funds through their cash deposit service.

When it comes to withdrawals, Cash App provides a few different options. You can transfer funds from your Cash App account to your linked bank account instantly, and the transaction usually takes one to three business days to complete. Another option is to use the Cash Card, which is a customizable Visa debit card linked to your Cash App balance. You can use the Cash Card to make purchases and withdraw cash from ATMs. Cash App also allows you to request a check to be mailed to your registered address, however, this option can take up to ten business days to receive.

Managing Your Cash App Bank Account

Managing your Cash App bank account is easy with the intuitive dashboard provided by the app. The Cash App bank account dashboard provides a comprehensive overview of your account, allowing you to easily track your transactions, check your balance, and review your banking activity.

It is important to note that Cash App prioritizes the security of your bank account. They employ various measures to ensure the safety of your information and transactions. This includes encryption technology to protect your data and multi-factor authentication to verify your identity. Additionally, Cash App may also monitor your account for any suspicious activity, providing an added layer of security.

As an avid Cash App user, you may have some frequently asked questions about managing your bank account. Rest assured, Cash App provides comprehensive support to address any concerns or inquiries you may have. They have a dedicated customer support team available to assist you with any difficulties or issues you encounter while managing your Cash App bank account.

Credit: m.youtube.com

Frequently Asked Questions Of What Does Cash App Bank With

What Bank Does Cash App Partner With?

Cash App partners with Lincoln Savings Bank, which provides FDIC insurance for the funds held in Cash App. This partnership ensures that your money is secure and protected.

Can I Use Cash App As My Primary Bank?

While Cash App offers some banking features, it is primarily a peer-to-peer payment app and not designed to replace a traditional bank account. However, you can use Cash App as a convenient and easy way to manage your day-to-day finances.

How Does Cash App Handle My Money?

When you receive money on Cash App, it is stored in a custodial account with Lincoln Savings Bank. This ensures that your funds are safe and available for you to use whenever you need them. Cash App also offers a Cash Card, which is linked to your Cash App balance and can be used for purchases and withdrawals.

Are My Funds Insured With Cash App?

Yes, the funds held in your Cash App account are FDIC insured through their partnership with Lincoln Savings Bank. This means that if anything were to happen to Cash App or the bank, your money would be protected up to the insurance limit.

Conclusion

Cash App is a popular mobile payment platform that offers banking services to its users. With features like direct deposit, debit card, and the ability to buy and sell stocks, Cash App provides convenience and accessibility to handle your financial needs.

By understanding what Cash App has to offer, you can make informed decisions about your banking and money management. Take advantage of the benefits Cash App provides and simplify your financial transactions.