Chime Account is a digital banking platform that offers fee-free checking and savings accounts. Chime Account is a popular digital banking platform that provides users with fee-free checking and savings accounts.

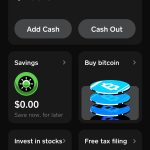

With its easy-to-use mobile app, Chime allows customers to manage their finances on the go. In addition to the convenience of mobile banking, Chime offers a range of features, including direct deposit, automatic savings tools, and early payday access. As a result, Chime has gained popularity among consumers looking for a hassle-free and affordable banking experience.

With its no-fee approach and user-friendly interface, Chime Account has become a top choice for individuals seeking a convenient and cost-effective way to handle their financial needs.

Credit: www.withyotta.com

Benefits Of Using Chime Account

Chime Account offers a range of benefits for its users. One of the major advantages is the absence of any hidden fees; users are not charged for maintenance, overdraft, or minimum balance requirements. Additionally, Chime Account provides early access to direct deposit funds, allowing users to access their paychecks up to two days earlier than traditional banks.

Furthermore, Chime Account offers automatic savings options to help users grow their savings effortlessly. With this feature, users can automatically set aside money into their savings account with every transaction or receive a percentage of their paycheck directly into savings. This makes it easier for individuals to build a savings habit and achieve their financial goals.

Chime Account Features

A Chime Account is a fee-free online banking service that offers a variety of features to its users. With a Chime Account, you can access your money through their mobile banking app, which provides real-time notifications for transactions and account activity. This allows you to stay updated on your finances and track your spending easily. In addition, Chime Account provides a Chime Visa Debit Card that you can use for everyday purchases.

How To Sign Up For Chime Account

To sign up for a Chime account, you will need to download the Chime app from the App Store or Google Play Store. Once you have downloaded the app, follow the instructions to create your account.

During the sign-up process, you will be asked to provide personal information, such as your full name, date of birth, and social security number. This information is necessary for Chime to verify your identity and ensure the security of your account.

After entering your personal information, you will need to verify your identity. Chime may ask you to provide additional documentation, such as a photo ID or a utility bill, to confirm your identity.

Once your identity is verified, you can start using your Chime account. The app offers a range of features, including the ability to access your account balance, make mobile deposits, send money to friends, and manage your finances.

Chime Account Limits

Chime Account offers certain limits on daily withdrawals, spending, deposits, and transfers. These limits are in place to ensure the security and convenience of your financial transactions. Here are the specific limits:

| Limits | Daily Withdrawal Limit | Daily Spending Limit | Depositing Limit | Transferring Limit |

|---|---|---|---|---|

| Amount | $500 | $2,500 | $1,000 | $5,000 |

Please note that these limits are subject to change and are dependent on various factors, including your account standing and activity. Chime Account strives to provide a seamless banking experience while ensuring the safety and security of your funds. If you require higher limits, you may contact Chime support for further assistance.

Chime Account Security

Chime Account provides advanced security features to protect your financial information. The account is backed by the Federal Deposit Insurance Corporation (FDIC), which offers insurance coverage up to $250,000 per account holder. This means that even in the unlikely event of a bank failure, your funds are protected.

Chime Account also includes two-factor authentication for added security. This involves an additional layer of verification, such as a unique code sent to your phone, to ensure that only authorized individuals can access your account.

Real-time transaction alerts are another valuable feature offered by Chime Account. You’ll receive instant notifications on your phone or via email for every transaction, which allows you to quickly identify any suspicious activity and take immediate action if necessary.

Chime Account Customer Support

In need of support for your Chime account? Good news – Chime offers 24/7 customer support to assist you with any questions or concerns you may have. Whether you’re facing a technical issue, have inquiries about your account, or just need some guidance, Chime is here to help. They provide an extensive range of Help Center resources that cover a wide variety of topics, allowing you to find answers to common questions and troubleshoot common problems on your own. If you prefer to speak with a representative directly, Chime also offers options for contacting customer service. Reach out via phone, email, or through their website to get the support you need. Rest assured that Chime is dedicated to ensuring the satisfaction of their users and providing excellent customer service.

Chime Account Comparisons

Chime Account is an online banking service that offers various advantages when compared to traditional banks and other online banks. One of its key benefits is the absence of any fees, including minimum balance requirements, overdraft fees, and monthly maintenance fees. This sets it apart from many traditional banks that often impose these charges. Chime Account also provides early access to paychecks, allowing users to receive their salaries up to two days earlier than with traditional banks. This can be particularly useful for individuals who live paycheck to paycheck and need immediate access to their funds.

In terms of convenience and accessibility, Chime Account offers a user-friendly mobile app that enables customers to easily manage their finances anywhere, anytime. Additionally, Chime Account provides a feature called “Save When I Get Paid,” which automatically sets aside a percentage of each paycheck into a savings account. This helps users effortlessly build their savings over time.

Compared to other online banks, Chime Account stands out with its extensive fee-free ATM network. Users can access over 38,000 fee-free MoneyPass and Visa Plus Alliance ATMs nationwide, providing greater accessibility and convenience compared to other online banks with limited ATM partnerships.

Chime Account Tips And Tricks

Chime Account offers a host of features that can make managing your finances easier and more convenient. One of the most useful tips is to set up direct deposit for faster access to funds. By linking your employer to your Chime Account, you can receive your paycheck directly, eliminating the need for paper checks or cashing at a bank. This not only saves time but also ensures you get immediate access to your money.

Another great trick is to utilize Chime Account’s automatic savings features. With the Save When I Get Paid feature, a portion of your paycheck can be automatically transferred to your Chime Savings Account, helping you build savings effortlessly. Additionally, the Round-Ups feature allows you to save money by rounding up every transaction to the nearest dollar and depositing the difference into your savings account.

Managing your budget becomes a breeze with the Chime app. The app provides real-time notifications for all your transactions, keeping you informed about your spending habits. You can also set spending limits, track your expenses, and create customized budgets to stay on top of your financial goals. Chime’s app is intuitive and user-friendly, making it easy to manage your money on the go.

In conclusion, Chime Account offers a range of valuable tips and tricks to help you maximize the benefits of your banking experience. Setting up direct deposit, utilizing automatic savings features, and managing your budget using the Chime app can all contribute to a more seamless and efficient financial journey.

Chime Account Reviews

Chime Account has garnered positive customer experiences due to its user-friendly interface, convenient features, and excellent customer service. Users appreciate the ease of setting up an account, with no hidden fees or stringent requirements. The ability to receive early direct deposits, round-up savings, and access to a robust mobile app are highly valued benefits of Chime Account.

However, it’s essential to consider potential drawbacks before opening a Chime Account. Some users have reported occasional technical glitches, such as delayed notifications or temporary account freezes. While these issues are not widespread, they can be frustrating for some individuals. Additionally, Chime does not offer physical branches, which may not suit those who prefer in-person banking services.

Chime Account Faqs

Who can open a Chime Account? The Chime Account is available to anyone who is 18 years or older, has a valid Social Security Number, and lives in the United States.

What fees are associated with Chime Account? There are no monthly maintenance fees, overdraft fees, or minimum balance requirements with a Chime Account. However, there may be fees for certain optional services such as expedited card replacement or out-of-network ATM withdrawals.

Can I use Chime Account for business banking? Chime Accounts are designed for personal use and are not intended for business banking. While you can use the Chime Account for personal expenses and to manage your finances, it is recommended to explore business banking options for your business needs.

Frequently Asked Questions Of What Is Chime Account

What Is A Chime Account?

A Chime Account is a mobile banking app that offers an online bank account with no fees, overdrafts, or monthly maintenance charges. It provides features like free debit card, early direct deposit, and automatic savings options.

How Do I Open A Chime Account?

To open a Chime Account, simply download the Chime app, enter your personal information, and verify your identity. Once verified, you can fund your account by linking it to an existing bank account or by setting up a direct deposit.

What Are The Benefits Of Using A Chime Account?

Using a Chime Account offers many benefits such as no monthly fees, no minimum balance requirements, and access to a large network of fee-free ATMs. Additionally, Chime provides real-time transaction alerts, early direct deposit, and the ability to round up purchases and save the difference.

How Secure Is My Chime Account?

Chime takes security seriously and ensures your personal information is protected. They use secure encryption methods to safeguard your data and offer two-factor authentication for added security. Chime also provides instant alerts for any suspicious activity that may occur on your account.

Conclusion

To wrap it up, Chime Account is a modern and convenient banking solution designed to simplify your financial life. With its seamless mobile app, fee-free banking, and innovative features like early paycheck access, Chime Account offers a fresh alternative to traditional banks.

It’s time to say goodbye to hidden fees and cumbersome processes – Chime Account is here to revolutionize your banking experience. Take the leap and join the millions of satisfied users who have embraced Chime Account as their go-to financial companion.