Chime Financial Institution is an online-based bank that offers fee-free banking services and a mobile app. It provides customers with access to a spending account, a savings account, the ability to send and receive money, and a Chime Visa Debit Card.

Introducing Chime Financial Institution: a modern, online bank that redefines the traditional banking experience. With its user-friendly mobile app and fee-free banking services, Chime offers a range of features designed to make managing your money easier than ever before. From the convenience of a spending account and a high-yield savings account to instant money transfers and a Chime Visa Debit Card, Chime provides a comprehensive suite of financial solutions.

Say goodbye to hidden fees and complex processes, and say hello to Chime Financial Institution, where banking becomes simple, accessible, and rewarding.

Credit: www.chime.com

Chime: The Next Generation Banking Solution

Chime Financial Institution brings a revolutionary mobile-first approach to banking that is transforming the way people manage their finances. With a seamless account setup process, customers can open an account in minutes, without any tedious paperwork or time-consuming visits to a physical branch.

The mobile-first approach means that Chime prioritizes the convenience and accessibility of banking through smartphones, enabling customers to perform various financial transactions at their fingertips. From checking balances and transferring funds to depositing checks and paying bills, Chime offers a hassle-free banking experience.

Chime’s simplified fee structure and user-friendly interface make it an attractive option for those seeking an alternative to traditional banking. By eliminating unnecessary fees commonly associated with traditional banks, Chime allows customers to make the most of their hard-earned money.

How Chime Works: A Closer Look At Chime’s Features

Chime Financial Institution offers a closer look into their features, providing a seamless and user-friendly banking experience. Explore how Chime works and its innovative functionalities to manage your finances effectively.

Chime Spending Account

Chime Financial Institution offers a unique Spending Account with no fees and no minimum balance requirement. It provides a convenient early direct deposit option that allows you to access your funds sooner. The account also comes with an automatic savings feature that helps you save money effortlessly. With the Chime Visa® Debit Card, you can enjoy fee-free transactions and receive real-time transaction notifications to stay up-to-date with your finances. In case your card is lost or stolen, instant card blocking option adds an extra layer of security.

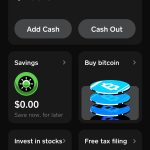

Chime’s Savings Account

Chime also offers a Savings Account with high-yield savings option to help your money grow. With every transaction made through your Spending Account, you can enjoy automatic savings. Furthermore, the round-up feature allows you to accelerate your savings by rounding up each purchase to the nearest dollar and depositing the change into your savings account.

The Benefits Of Using Chime Financial Institution

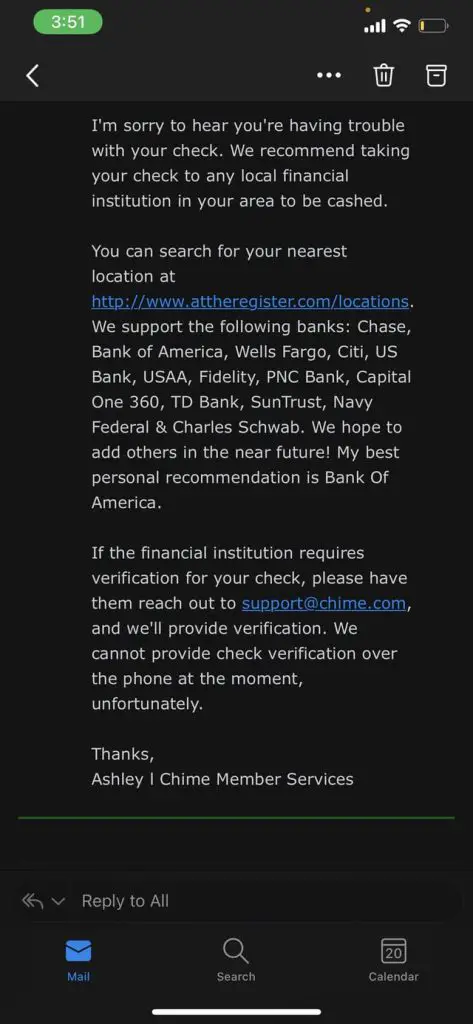

Chime Financial Institution is an online-based banking platform that offers numerous benefits to its users. Firstly, a major advantage is that Chime does not charge any hidden fees or have any surprise charges, making it transparent and convenient for users to manage their finances. Secondly, Chime implements enhanced security measures to protect sensitive customer information, providing users with peace of mind when conducting transactions online. Additionally, Chime allows for convenient access to funds through its mobile app, providing users with the flexibility to manage their money anytime and anywhere. Moreover, Chime offers innovative money management tools that help users track their spending, save money, and set financial goals. Lastly, Chime provides 24/7 customer support, ensuring that users can reach out for assistance whenever needed. Overall, Chime Financial Institution is a reliable and user-friendly online banking platform that offers a range of benefits to its users.

Chime’s Approach To Financial Wellness Education

The Chime Financial Institution has a unique approach to financial wellness education, providing valuable resources to its customers. Through its educational offerings, Chime aims to empower individuals to make informed financial decisions and improve their overall financial health. Chime provides a range of educational resources that cover various aspects of personal finance, such as budgeting, saving, and investing. These resources are designed to be easily accessible and user-friendly, allowing customers to navigate through the content at their own pace. Chime also offers financial coaching services, providing personalized guidance and support to individuals looking to improve their financial situation. By building a strong financial foundation, customers can gain greater control over their finances and work towards achieving their financial goals.

Chime Financial Institution Vs Traditional Banks: The Key Differences

Chime Financial Institution is a modern banking alternative that stands apart from traditional banks in several key ways. Branchless banking is one of the primary differences, as Chime operates entirely online without any physical branches. This allows for a more flexible and accessible banking experience for its customers. Simplified account management is another area where Chime excels. With their user-friendly interface and intuitive mobile app, customers can easily monitor their account activity, set up automatic savings contributions, and access a range of features designed to simplify their financial lives. Chime also differentiates itself through the use of advanced banking technology. Their platform incorporates cutting-edge security measures to protect customer data and transactions. Additionally, Chime offers features such as early direct deposit, round-up savings, and a fee-free overdraft model to provide users with a more modern and convenient banking experience. Lastly, Chime prioritizes providing an enhanced customer support experience. They offer a 24/7 customer support service that can be reached through their app or website. This ensures that any issues or concerns can be addressed promptly and efficiently. Overall, Chime Financial Institution offers a unique and innovative approach to banking that sets it apart from traditional banks. With its branchless model, simplified account management, advanced technology, and customer-centric approach, Chime provides a modern and convenient banking solution for today’s consumers.

Chime: Reviews And Customer Feedback

Customers who have used Chime financial institution have nothing but positive things to say about their experience. One satisfied customer mentioned the convenience and ease of use offered by Chime. The straightforward account setup process was seamless and hassle-free. Another customer praised Chime’s money management tools, emphasizing how they helped them stay on top of their finances effortlessly. The intuitive interface and comprehensive features allowed for effective budgeting and saving.

Testimonials on Chime’s convenience and ease of use

Many customers appreciate Chime’s user-friendly platform, as it simplifies banking tasks and provides an enjoyable experience. The mobile app offers a seamless interface, making it effortless to navigate through banking features, set up direct deposits, transfer funds, and manage finances on-the-go. Chime’s emphasis on a hassle-free experience is apparent from customers’ feedback, solidifying its reputation as a trustworthy financial institution.

Chime’s innovative money management tools have left a positive impact on users. The ability to categorize expenses, set savings goals, and receive real-time notifications on account activities has empowered customers to take control of their financial lives. Additionally, Chime’s automatic savings options enable users to effortlessly save money with every transaction, helping them reach their savings goals faster. This well-rounded approach to money management has garnered praise and loyalty from Chime’s customers.

Chime Financial Institution’s Impact On The Banking Industry

Disrupting traditional banking norms: Chime Financial Institution has emerged as a disruptive force in the banking industry, challenging the traditional norms of banking. With its innovative business model, Chime has revolutionized the way people think about banking, offering a range of digital-only services that cater to the needs of today’s tech-savvy consumers.

Growing popularity among millennials and Gen Z: One of the key factors driving Chime’s success is its growing popularity among millennials and Gen Z. These tech-native generations prefer seamless and convenient banking experiences, and Chime provides just that. Through its user-friendly mobile app and fee-free banking services, Chime has attracted a large customer base, positioning itself as a primary choice for younger consumers.

| Factors | Impact |

|---|---|

| Shaping the future of banking services: | Chime’s success has prompted traditional banks to rethink their strategies and adopt digital innovations to stay competitive. It has paved the way for a future in which banking services are predominantly digital, convenient, and accessible to all. |

Frequently Asked Questions For What Is Chime Financial Institution

What Is Chime Financial Institution?

Chime is an online banking platform that offers a full suite of banking services without any fees. With Chime, you can open a bank account, receive direct deposits, send money to friends and family, and manage your finances using their mobile app.

It’s a convenient and hassle-free way to handle your banking needs.

How Does Chime Work?

Chime operates entirely online, allowing you to access your funds and manage your account from anywhere. They provide you with a spending account and a Visa debit card, which you can use to make purchases and withdraw cash. Chime also offers an optional savings account to help you save money and reach your financial goals.

Is Chime Safe And Secure?

Yes, Chime takes the security of your personal and financial information seriously. They use advanced encryption technology to protect your data and offer 24/7 fraud monitoring. Additionally, Chime is FDIC-insured up to $250,000 per depositor, ensuring that your funds are protected.

Are There Any Fees Associated With Chime?

One of the main benefits of using Chime is that they do not charge any fees for their banking services. There are no monthly maintenance fees, overdraft fees, or minimum balance requirements. Chime also does not charge any fees for ATM withdrawals at over 38,000 MoneyPass® and Visa Plus Alliance ATMs.

Conclusion

Chime Financial Institution offers a user-friendly and innovative banking experience. With its mobile-first approach, Chime provides convenient and accessible services such as fee-free banking, early direct deposit, and automatic savings features. The institution’s commitment to transparency and simplicity sets it apart from traditional banking institutions.

Embracing the digital age, Chime provides a seamless banking experience for individuals looking for a modern and hassle-free way to manage their finances. Discover the benefits of Chime today and embark on a new era of banking.