Chime’s bank name is The Bancorp Bank. Chime is an online banking platform that partners with The Bancorp Bank to provide services to its customers.

With Chime, customers can access mobile banking, direct deposit, and fee-free overdraft protection, among other benefits. This innovative and user-friendly platform aims to empower individuals in managing their finances effectively. By leveraging technology, Chime offers convenience and flexibility to its customers, allowing them to take control of their money anytime, anywhere.

With its partnership with The Bancorp Bank, Chime ensures that its customers have a secure and reliable banking experience. Overall, Chime is committed to simplifying banking and providing a seamless digital banking experience for its users.

Credit: www.awortheyread.com

What Is Chime’s Bank Name?

Chime is an online banking platform that provides users with a range of financial services. However, it is important to note that Chime is not a traditional bank itself. Instead, it partners with a number of banking institutions to provide its services.

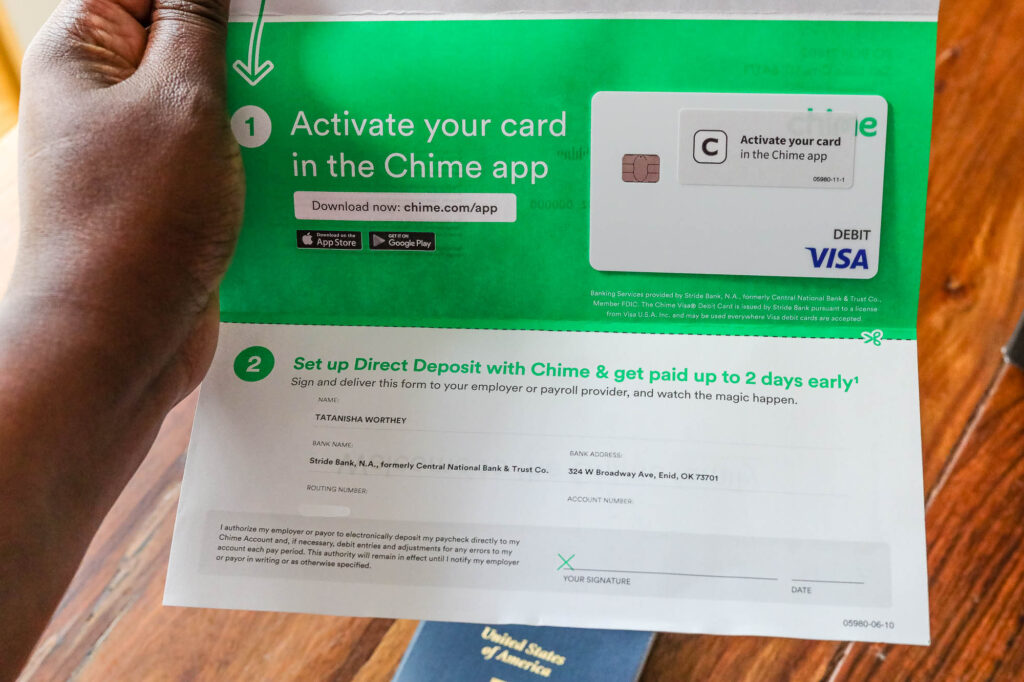

One of Chime’s primary banking partners is The Bancorp Bank, a member of the FDIC. This partnership allows Chime to offer its users features such as a Chime Visa® Debit Card, direct deposit, and fee-free access to over 38,000 ATMs nationwide.

By working with established banking institutions like The Bancorp Bank, Chime can provide its users with the convenience and security of a traditional bank account, but with the added benefits of a modern, digital banking experience.

The Chime Banking Experience

Chime is a popular mobile banking platform that offers a seamless banking experience to its users. With Chime, you can enjoy the convenience of managing your finances anytime, anywhere, straight from your mobile device.

One of the key benefits of Chime is its user-friendly interface and intuitive design, making it easy for anyone to navigate and access their banking information. Whether you’re checking your balance, depositing a check, or transferring funds, Chime simplifies the process, saving you time and effort.

Another notable feature of Chime is its fee-free approach. Unlike traditional banks, Chime does not charge any monthly fees, overdraft fees, or minimum balance requirements. This makes it an attractive option for individuals who want to avoid unnecessary fees and save money.

Furthermore, Chime offers early direct deposit, allowing you to receive your paycheck up to two days in advance. This feature can be particularly helpful for individuals who rely on their paycheck for day-to-day expenses.

In addition to the above, Chime also provides various tools to help you manage your money effectively. From setting up automatic savings to receiving real-time transaction alerts, Chime empowers you with the tools you need to stay on top of your finances.

Unveiling The Bank Name Of Chime

Chime, the popular mobile banking platform, has always been known for its seamless user experience and innovative features. However, one question that often arises is, “What is the bank name of Chime?” The answer to this mystery lies in the partnership between Chime and its banking provider.

Chime partners with multiple FDIC-insured banking institutions to provide its banking services. While Chime itself is not a bank, its banking services are offered through its partner banks. This unique collaboration allows Chime to offer a range of banking features, such as checking and savings accounts, without having to obtain its own banking license.

Due to regulatory requirements, Chime does not publicly disclose the names of its banking partners. This approach ensures that Chime can continue to provide a seamless banking experience while maintaining the highest standards of security and compliance.

In conclusion, while Chime is not a bank itself, it works closely with partner banks to offer its users a wide range of banking services. This collaborative approach allows Chime to focus on its strengths as a technology-driven platform, while leveraging the expertise and regulatory framework of its banking partners.

A Closer Look At Chime’s Partner Bank

Exploring the history and reputation of Chime’s banking institution:

Chime, a popular mobile banking platform, operates in partnership with The Bancorp Bank. Founded in 2000, The Bancorp Bank is an FDIC-insured institution that has established itself as a reliable player in the banking industry. With a strong emphasis on innovation, the bank has garnered a reputation for its user-friendly and technologically advanced banking solutions.

When it comes to services and products, The Bancorp Bank offers a comprehensive suite of financial tools to Chime users. These include free checking accounts, debit cards, direct deposit, and fee-free access to a large network of ATMs. With its focus on modern digital banking, The Bancorp Bank ensures that Chime users have a seamless experience when managing their finances.

Overall, Chime’s partnership with The Bancorp Bank ensures a secure and efficient banking experience for its customers. With a solid track record and a commitment to innovative solutions, Chime users can confidently leverage the services provided by The Bancorp Bank.

The Importance Of Partner Bank Selection

The selection of the partner bank plays a crucial role in the success of Chime. It is important for Chime to carefully choose a bank that aligns with its mission and provides benefits to its users. The partner bank’s policies directly impact Chime users, so it is essential to ensure that the bank’s policies are favorable and in line with Chime’s goals. The right partner bank can offer various advantages such as providing seamless integration of banking services, ensuring reliable and secure transaction processing, offering competitive interest rates and fees, and complying with regulatory requirements.

Moreover, the partner bank’s reputation and financial stability are also important factors to consider. Chime must establish a partnership with a bank that has a strong track record and good financial health to instill confidence in its users. By selecting the right banking partner, Chime can enhance its overall user experience and establish itself as a trustworthy and reliable online banking platform.

Chime’s Commitment To User Security And Privacy

Bank Name is not a term typically associated with Chime. Chime is an online banking platform that partners with The Bancorp Bank or Stride Bank, N.A., members FDIC, to provide banking services to its customers. Chime works hand in hand with its partner banks to ensure the highest level of user security and privacy.

Chime takes the protection of customer data very seriously. They have implemented strict security measures to safeguard personal and financial information. This includes encryption protocols, secure sockets layer (SSL) technology, and multi-factor authentication.

Chime and its partner banks adhere to strict privacy policies to ensure that customer data is not shared with third parties without proper consent. They are committed to transparency and have implemented robust measures to address concerns and misconceptions regarding data privacy.

Overall, Chime and its partner banks prioritize user security and privacy. They strive to provide a safe and secure banking experience for their customers.

Enhanced Financial Transparency Through Disclosure

Advocating for transparency within the banking industry includes encouraging Chime and other banks to disclose their partner bank’s name. Transparency is crucial in building trust and confidence among consumers. By voluntarily sharing this information, banks offer customers greater insight into their operations, fostering a stronger sense of transparency and accountability.

Sharing the partner bank’s name contributes to enhanced financial transparency in several ways. Firstly, customers can better understand which financial institution is backing their deposits, providing them with peace of mind when it comes to the security and stability of their funds. Secondly, knowing the partner bank facilitates the evaluation of the bank’s services and offerings, enabling customers to make informed decisions about where to entrust their money.

In conclusion, advocating for transparency within the banking industry, including the disclosure of partner bank names, offers numerous benefits to customers. By promoting open communication and providing customers with vital information, banks like Chime can foster trust, reliability, and a stronger connection with their clientele.

Public Perception And User Concerns

Chime, a popular online banking platform, has gained a positive public perception due to its user-friendly features and convenient services. Users have expressed concerns about the lack of physical branches and the bank’s customer support response time.

Analyzing Customer Attitudes Towards Chime’s Undisclosed Partner Bank

Chime, the popular online banking platform, has gained significant traction in recent years. However, some users have expressed concerns regarding the undisclosed partner bank behind Chime’s operations. Addressing these apprehensions is crucial for both current and potential Chime users.

Chime’s choice to not publicly disclose its banking partner has left customers curious and skeptical. However, it’s important to note that this is a common practice among many fintech and digital banking platforms.

To address these concerns, Chime can provide more transparency and reassurance to its users. Sharing information about its partner bank, without compromising security, can help build trust and alleviate customer apprehensions. This could include details about the partner bank’s reputation, regulatory compliance, and the level of deposit insurance coverage provided.

By openly communicating with its user base and addressing common queries, Chime can foster a more positive public perception. Reassuring users about the safety and reliability of their funds can help attract and retain customers in an increasingly competitive digital banking landscape.

The Future Of Chime’s Banking Partnership

Chime, a leading mobile banking platform, has been making waves in the financial industry. As it continues to innovate and expand its offerings, one of the most intriguing aspects is its banking partnership. Speculation is rife about the potential changes and developments in this relationship and how it will affect Chime’s future.

Chime is known for its customer-centric approach and has been consistently improving its strategies to enhance the customer experience. With a focus on providing innovative and convenient banking solutions, Chime’s evolving partnership in the banking institution realm is continuously evolving.

While the exact details of Chime’s banking relationship remain undisclosed, the company’s dedication to driving customer satisfaction remains at the forefront. By leveraging partnerships and exploring new avenues, Chime is poised to redefine the banking experience and set new standards in the industry.

Frequently Asked Questions On What Is The Bank Name Of Chime

What Is The Bank Name Of Chime?

Chime operates as an online-only bank, partnering with two FDIC-insured banks: Stride Bank and Bancorp Bank. This means that when you open an account with Chime, your funds are held and insured by one of these partner banks. As a customer, you can access your funds through Chime’s mobile app or website, just like with a traditional bank.

Conclusion

Overall, Chime has revolutionized banking by providing a user-friendly platform that makes managing finances a breeze. With their unique approach, Chime offers a comprehensive range of banking services without the hassle of traditional banks. By partnering with existing financial institutions, Chime ensures a secure and convenient banking experience for its customers.

So, whether it’s checking accounts, savings accounts, or even getting paid early, Chime has got you covered. Discover the future of banking with Chime today.