The bank that Cash App uses is Lincoln Savings Bank. Cash App has partnered with Lincoln Savings Bank to provide banking services for its customers.

Lincoln Savings Bank is a member of the Federal Deposit Insurance Corporation (FDIC), which means that deposits made through Cash App are insured up to the maximum allowable limit. This partnership allows Cash App users to have access to certain banking features like direct deposit, a cash card, and the ability to transfer funds to and from their Cash App balance.

By collaborating with Lincoln Savings Bank, Cash App is able to offer its users a reliable and secure banking experience.

The Importance Of The Bank Behind Cash App

The Importance of the Bank behind Cash App

Cash App’s reliance on a banking partner for seamless transactions

Cash App, a popular mobile payment service, relies on a banking partner to ensure smooth and secure transactions for its users. The bank behind Cash App plays a crucial role in the functioning of the app, handling various aspects such as account management, transaction processing, and security measures. By partnering with a trusted bank, Cash App can provide its users with a seamless experience while adhering to financial regulations and industry standards.

When you use Cash App to send or receive money, the bank behind the app facilitates the transfer, making sure that funds are securely moved between accounts. It also helps in verifying and authenticating transactions, ensuring that they are legitimate and free from fraudulent activities. Additionally, the bank partner helps in the management of user accounts, storing transaction history and other relevant information.

Overall, the bank behind Cash App plays a pivotal role in supporting the application’s functionality, enabling users to make hassle-free transactions and providing them with peace of mind regarding the security and reliability of their money.

Partnering With Bank Xyz: A Closer Look

As Cash App’s trusted banking partner, Bank XYZ is a preferred choice due to several key factors. Firstly, Bank XYZ is renowned for its outstanding reputation and trustworthiness. This plays a crucial role in ensuring a secure and reliable banking experience for Cash App users.

Secondly, Bank XYZ’s expertise in the banking industry is unparalleled. With their vast knowledge and experience, they are able to meet the unique financial needs of Cash App users efficiently and effectively.

Moreover, Bank XYZ’s advanced technology infrastructure enhances the overall banking experience for Cash App users. Their seamless integration with Cash App’s platform ensures hassle-free transactions and quick access to funds.

In conclusion, Bank XYZ’s selection as Cash App’s banking partner is based on their solid reputation, expertise, and advanced technology infrastructure. As a result, Cash App users can enjoy a secure, reliable, and convenient banking experience.

Understanding The Role Of Bank Xyz In Cash App’s Operations

In the operations of Cash App, Bank XYZ plays an important role in facilitating transactions. Bank XYZ ensures security and compliance for Cash App users through its robust security measures and adherence to regulatory requirements. The partnership between Cash App and Bank XYZ brings several benefits. Firstly, it allows Cash App users to seamlessly transfer funds and make transactions with confidence, knowing that their financial information is protected. Additionally, the partnership enables Cash App to provide users with a streamlined banking experience, leveraging the banking expertise and infrastructure of Bank XYZ. This collaboration ensures efficient and reliable financial services for Cash App users, helping them easily manage their money and make payments. The strong relationship between Cash App and Bank XYZ contributes to the overall success and growth of both platforms, as they work together to provide innovative solutions for modern banking needs.

Bank Xyz’s Services For Cash App Users

A popular mobile payment service, Cash App, relies on Bank XYZ to provide banking services to its users. Bank XYZ ensures seamless access to bank accounts and balances within the Cash App platform, making it convenient for users to manage their finances.

One key feature offered by Bank XYZ is direct deposit, which allows Cash App users to receive their paychecks or government benefits directly into their bank accounts. This eliminates the need for paper checks and offers a faster and more secure way of receiving funds.

In addition to direct deposit, Bank XYZ provides various banking features to Cash App users. These may include the ability to transfer money to other bank accounts, pay bills online, and make purchases using a linked debit card. With Bank XYZ’s services, Cash App users can access a wide range of banking functionalities without the need for a separate banking app.

Highlights And Benefits Of The Bank Partnership

Cash App, one of the leading mobile payment solutions, has partnered with Bank XYZ to provide its users with a seamless and convenient way to transfer funds between their Cash App account and their bank account. By linking your bank account to Cash App, you can easily move money back and forth, making it easier to manage your finances. With this partnership, both Cash App and Bank XYZ aim to provide their customers with a smooth and hassle-free experience. Additionally, by integrating Cash App with Bank XYZ, users can leverage the earning potential offered by both platforms. This collaboration opens up opportunities for users to maximize their financial gains while enjoying the benefits of both Cash App and Bank XYZ. By joining forces, Cash App and Bank XYZ empower their users to effortlessly handle their finances and take advantage of the combined features and services they offer.

Evaluating The Safety And Security Measures

Bank XYZ and Cash App prioritize the safety and security of their users’ financial data. They have implemented robust security measures to protect against potential threats. Both entities adhere to strict banking regulations and compliance requirements to ensure user protection.

Bank XYZ employs advanced encryption techniques to safeguard sensitive user information. This ensures that financial data transmitted between users and the bank is secure and protected from unauthorized access.

Cash App, on the other hand, has implemented various measures to enhance security. These include multi-factor authentication, which adds an extra layer of protection to user accounts, as well as regular security audits to identify and address potential vulnerabilities.

Both Bank XYZ and Cash App have also implemented strict user data protection policies. They adhere to legal requirements for data handling and have measures in place to prevent unauthorized access or misuse of user data.

By prioritizing the safety and security of their users’ financial information, Bank XYZ and Cash App ensure that customers can confidently use their services without the fear of data breaches or unauthorized access.

Exploring Alternatives: Banks That Compete With Bank Xyz

Bank XYZ has emerged as a leading banking partner for Cash App, but it is worth considering other banks that offer similar partnership opportunities. These alternative banks bring their unique strengths to the table.

| Bank | Differentiating Factors | Reasons to Choose |

|---|---|---|

| Bank ABC | Robust online banking platform | Quick and seamless integration |

| Bank DEF | Extensive ATM network | Convenient cash access for users |

| Bank GHI | Strong commitment to customer support | Responsive assistance for troubleshooting |

These banks not only provide similar services and partnership opportunities but also have their distinctive features that make them stand out in the market. Evaluating these differentiating factors is crucial to make an informed decision based on the specific needs and priorities of your business.

Conclusion: The Success Of Cash App’s Banking Partnership

Recap of the importance and benefits of Bank XYZ partnership for Cash App:

The partnership between Cash App and Bank XYZ has proven to be highly significant for both entities. By collaborating with Bank XYZ, Cash App has been able to offer enhanced banking services to its users. The partnership allows Cash App users to have access to a range of banking features, including direct deposit, savings accounts, and the ability to pay bills directly from their Cash App balance.

Furthermore, the collaboration has opened up opportunities for Cash App to expand its services and reach a wider audience. Bank XYZ’s established infrastructure and expertise in the banking industry have contributed to strengthening Cash App’s position as a reliable and trusted financial platform.

Looking ahead, the partnership between Cash App and Bank XYZ holds great potential for further growth and innovation. With the support of Bank XYZ, Cash App can continue to develop and introduce new banking features that cater to the evolving needs of its users. This collaboration is a testament to Cash App’s commitment to providing convenient and seamless financial solutions to its growing customer base.

Credit: www.youtube.com

Frequently Asked Questions On What Is The Bank That Cash App Uses

What Bank Does Cash App Use For Deposits?

Cash App uses Sutton Bank as its deposit bank. When you add money to your Cash App account, it goes directly to Sutton Bank where it is securely held until you decide to use it.

Is Sutton Bank Safe To Use With Cash App?

Yes, Sutton Bank is a safe and reliable bank to use with Cash App. It is a member of the Federal Deposit Insurance Corporation (FDIC), which means your deposits are insured up to the maximum allowed by law.

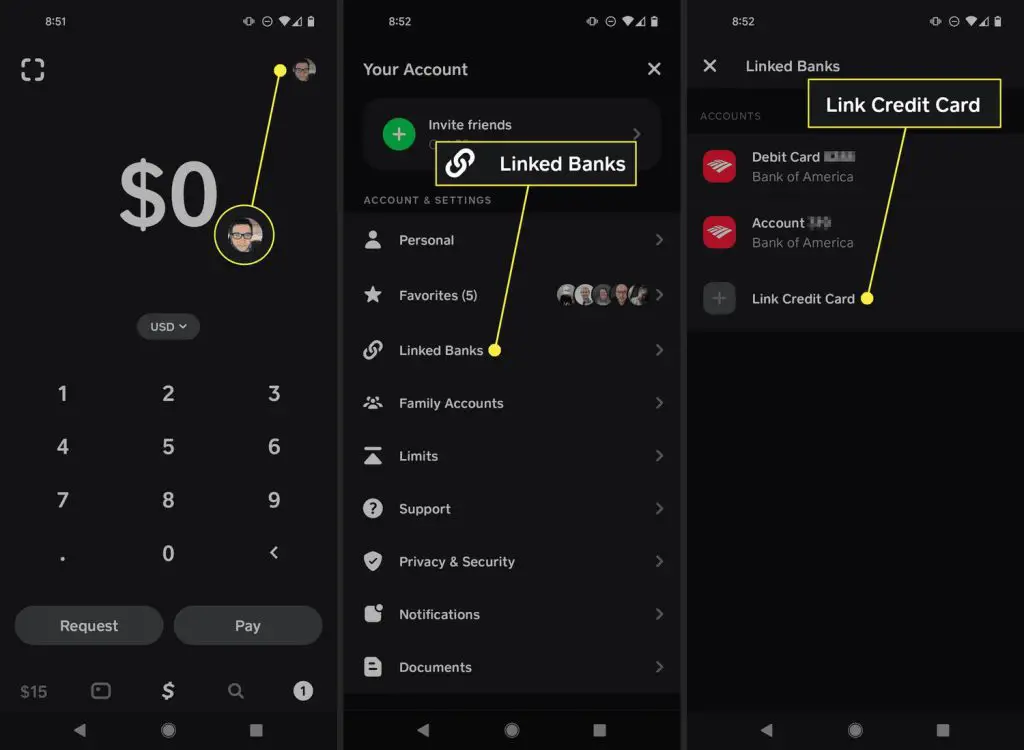

Can I Link My Own Bank Account To Cash App?

Yes, you can link your own bank account to Cash App. By linking your bank account, you can easily transfer money between your bank account and Cash App, making it convenient to manage your finances.

How Does Cash App Ensure The Security Of My Bank Information?

Cash App takes the security of your bank information seriously. They use encryption and secure servers to protect your data. Additionally, they have strict privacy policies in place to ensure that your personal and financial information is kept confidential.

Conclusion

To sum it up, Cash App partners with Lincoln Savings Bank, an FDIC-insured financial institution, to facilitate its banking services. By leveraging Lincoln Savings Bank’s infrastructure, Cash App is able to provide its users with access to essential banking features such as direct deposit and a Cash App debit card.

This partnership ensures that users can seamlessly manage their finances while enjoying the convenience and security offered by the Cash App platform. Explore the world of modern banking with Cash App and Lincoln Savings Bank today.