Cash App uses two FDIC-insured bank partners, Sutton Bank and Lincoln Savings Bank, to provide its financial services. Cash App, developed by Square Inc., is a popular peer-to-peer money transfer service that partners with two banks, Sutton Bank and Lincoln Savings Bank.

These bank partners play a crucial role in providing various banking services, including issuing prepaid debit cards and insuring Cash App balances. Cash App is not a bank itself but rather a financial platform that offers a faster and simpler way to bank, without excessive fees.

By partnering with reputable and FDIC-insured banks, Cash App ensures the security and reliability of its services. Whether it’s transferring money, making payments, or managing your finances, Cash App provides a convenient solution with the support of its bank partners.

Introduction To Cash App’s Banking Services

Cash App is a financial services platform, not a bank. It offers basic financial services through its bank partners, namely Sutton Bank and Lincoln Savings Bank. These bank partners are FDIC-insured, providing users with a secure and reliable platform to manage their money.

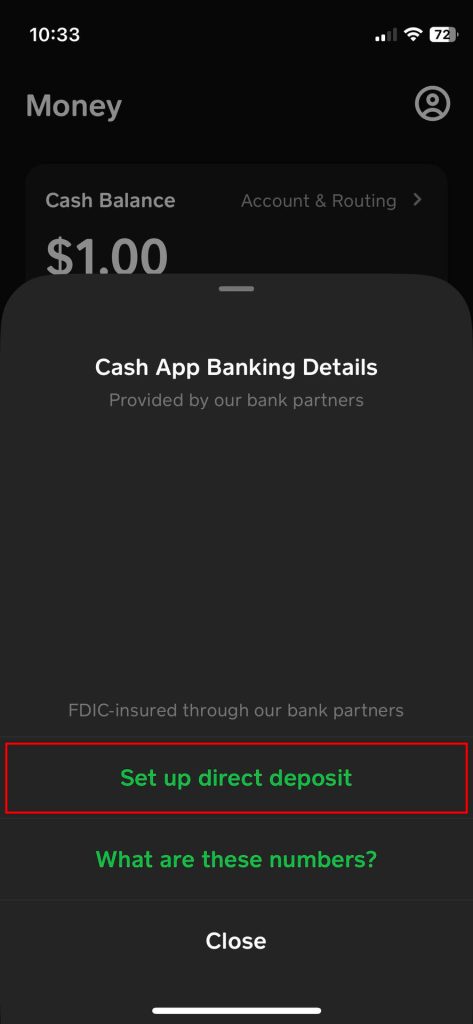

Through Cash App, users can access a range of banking services, including prepaid debit cards issued by Sutton Bank. With Cash App’s mobile banking, users can enjoy a faster and simpler way to bank, avoiding the excessive fees that traditional banks often charge.

While Cash App is not directly affiliated with Zelle, users can still transfer money between the two platforms. Although they are separate financial apps, users can utilize their bank accounts as a bridge to facilitate transfers between Cash App and Zelle.

Cash App’s commitment to partnering with reputable banks like Sutton Bank and Lincoln Savings Bank ensures that users can access a secure and reliable platform for their financial needs.

Sutton Bank: The First Cash App Bank Partner

Sutton Bank has become the first cash app bank partner, joining forces with Cash App to provide users with enhanced financial services. With this partnership, Cash App continues to expand its offerings, ensuring a seamless and convenient banking experience for its users.

Here is a paragraph with the information you provided: Cash App has partnered with Sutton Bank, one of its bank partners, to provide financial services to its users. As a result of this collaboration, Sutton Bank issues prepaid debit cards on behalf of Cash App. This partnership allows Cash App users to access banking services through a faster and simpler platform, with fewer fees. Additionally, Cash App’s bank partners, including Sutton Bank, play a crucial role in providing various services, such as insuring Cash App balances and facilitating crypto and investing options. Although Cash App is not a bank itself, it leverages the expertise and infrastructure of its bank partners to offer comprehensive financial solutions to its users. Overall, the partnership between Cash App and Sutton Bank enables individuals to conveniently manage their money and transactions through a secure and reliable platform.Lincoln Savings Bank: The Second Cash App Bank Partner

Lincoln Savings Bank is the second partner of Cash App, providing financial services alongside Sutton Bank. Together, these banks offer a seamless banking experience through Cash App’s platform.

Cash App has partnered with Lincoln Savings Bank to provide its financial services. Lincoln Savings Bank, along with Sutton Bank, is a FDIC-insured bank partner of Cash App. As a partner, Lincoln Savings Bank offers banking services that include prepaid debit cards issued by Sutton Bank. Cash App users can benefit from faster and simpler banking without the burden of excessive fees. The collaboration between Cash App and Lincoln Savings Bank allows Cash App to offer basic financial services to its customers. In addition, Cash App also offers crypto and investing services through its banking partners. The partnership with Lincoln Savings Bank plays a crucial role in providing various financial features to Cash App users. To link a bank account to Cash App, users can tap the Profile Icon on their app and follow the necessary steps.How Cash App’s Bank Partners Enhance User Experience

Cash App enhances user experience by partnering with two FDIC-insured banks, Sutton Bank and Lincoln Savings Bank, to provide a range of financial services. With these partnerships, Cash App offers prepaid debit cards and a faster, simpler way to bank, ensuring secure and convenient transactions for its users.

Banking services offered by Cash App’s bank partners:

|

Benefits of using Cash App’s bank partner’s services:

|

Comparison of Cash App’s bank partners’ offerings:

|

Cash App’s Bank Partners And Financial Inclusion

Cash App uses two FDIC-insured bank partners, Sutton Bank and Lincoln Savings Bank, to provide its financial services. Sutton Bank administers the prepaid debit cards issued by Cash App, offering faster and simpler banking without excessive fees. Lincoln Savings Bank also plays a crucial role in promoting financial inclusion through its partnership with Cash App. This partnership has a significant impact on underserved communities, ensuring access to basic financial services and empowering individuals to manage their money effectively.

| Bank Partner | Services Provided |

|---|---|

| Sutton Bank | Prepaid debit cards |

| Lincoln Savings Bank | Promoting financial inclusion |

Future Plans And Expansions With Bank Partners

Cash App partners with two FDIC-insured banks, Sutton Bank and Lincoln Savings Bank, to provide financial services to its users. With the help of these bank partners, Cash App offers prepaid debit cards and simplified banking services, making it a convenient platform for managing money.

Cash App has established strong partnerships with two FDIC-insured bank partners: Sutton Bank and Lincoln Savings Bank. These partnerships allow Cash App to provide a range of financial services to its users, including prepaid debit cards issued by Sutton Bank. By collaborating with reputable banks, Cash App ensures that its users have access to secure and reliable banking services.

In line with its vision for collaboration with bank partners, Cash App is constantly exploring potential for new partnerships and expansions. This ensures that Cash App can continue to provide its users with innovative and efficient financial solutions. By partnering with different banks, Cash App aims to enhance its services, offering more diverse options and features to its growing user base. These partnerships also enable Cash App to offer additional services, such as crypto and investing capabilities.

Potential Benefits of Cash App’s Bank Partnerships:

| Benefits | Sutton Bank | Lincoln Savings Bank |

|---|---|---|

| Secure Banking Services | ✔️ | ✔️ |

| Prepaid Debit Cards | ✔️ | ❌ |

| Crypto and Investing | ✔️ | ✔️ |

| Expansion Opportunities | ✔️ | ✔️ |

Conclusion: Cash App’s Bank Partner Revolutionizing Financial Services

Cash App utilizes the services of two FDIC-insured bank partners, Sutton Bank and Lincoln Savings Bank, to provide its financial services. These partnerships allow Cash App to offer basic banking services, such as prepaid debit cards and faster, simpler banking, without excessive fees. Additionally, Cash App’s bank partners play a crucial role in providing various financial services and insuring Cash App balances.

Furthermore, it is important to note that Cash App is a financial services platform, not a bank itself. The banking services are provided by Cash App’s bank partner(s), with Sutton Bank issuing Cash App’s Cash Card and Wells Fargo insuring Cash App balances up to a certain amount.

In conclusion, the partnership between Cash App and its bank partners, such as Sutton Bank and Lincoln Savings Bank, has revolutionized the financial services industry and provided users with a convenient and secure way to manage their money.

Credit: www.12newsnow.com

Frequently Asked Questions On Cash App Bank Partner

What Bank Is Cash App Affiliated With?

Cash App is affiliated with two FDIC-insured bank partners: Sutton Bank and Lincoln Savings Bank.

Is Cash App A Sutton Bank?

No, Cash App is not a Sutton Bank. Cash App is a financial services platform that partners with Sutton Bank and Lincoln Savings Bank for its banking services. Prepaid debit cards issued by Sutton Bank.

Does Cash App Partner With Zelle?

No, Cash App does not partner with Zelle. They are two different financial platforms and cannot directly interact with each other. However, you can use your bank account as a bridge to transfer money between these two apps.

Can Cash App Be Linked To A Bank Account?

Yes, Cash App can be linked to a bank account. To add a bank account to your Cash App, follow these steps: Tap the Profile Icon on your Cash App home screen. Select Linked Banks. Tap Link Bank. Follow the prompts.

Conclusion

Cash App, the peer-to-peer money transfer service, partners with two FDIC-insured bank partners, Sutton Bank and Lincoln Savings Bank, to provide its financial services. These partnerships ensure that Cash App users can access basic banking services, such as prepaid debit cards and direct deposit.

By working with reputable banks, Cash App offers its users a faster and simpler way to manage their money, without the hassle of excessive fees. With Cash App and its reliable bank partners, users can confidently handle their finances with ease.