Chime banking works as an online bank that offers fee-free checking and savings accounts to users. Chime banking is an online bank that provides users with fee-free checking and savings accounts.

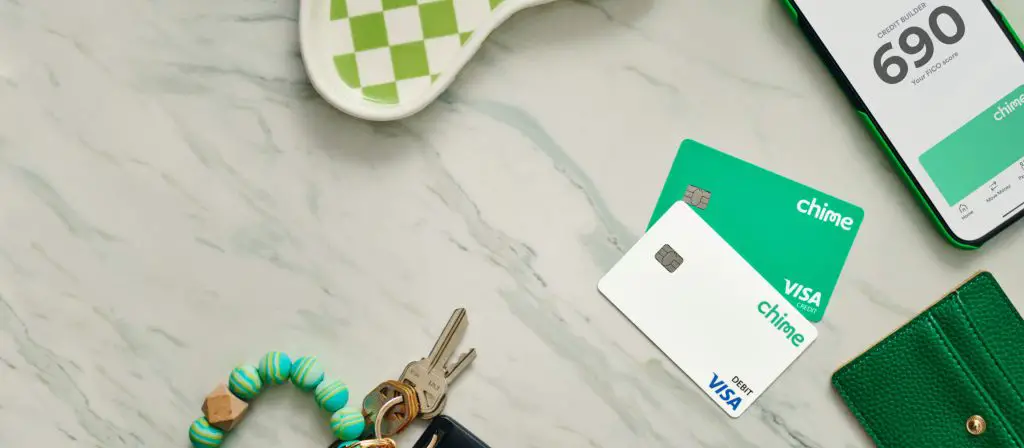

With Chime, customers can access their money through a mobile app, make purchases using the Chime Visa debit card, set up direct deposit, and transfer money to friends and family. Additionally, Chime offers early direct deposit, where users can receive their paycheck up to two days earlier than traditional banks.

Chime also provides automatic savings features, such as rounding up purchases and depositing the difference into a savings account. Another benefit of Chime is its lack of overdraft fees and minimum balance requirements. Overall, Chime banking offers a convenient and affordable banking experience for users through its online platform.

What Is Chime Banking?

Chime Banking is an innovative online banking platform that offers convenient and hassle-free banking services to its users. It operates entirely online, making it accessible at any time and from anywhere with an internet connection. Chime provides a range of financial products and services accompanied by a user-friendly mobile app.

Chime Banking stands out for its commitment to transparency and customer-centricity. The platform aims to simplify and improve the traditional banking experience, providing its users with tools to manage their finances effectively. Some of the key features of Chime Banking include:

- Fee-free banking

- Early direct deposit

- Automatic savings

- Spending and saving insights

- Mobile check deposit

- Instant notifications

- Fraud protection and security

Chime Banking operates as a partner with various financial institutions to provide banking services to its users. By leveraging technology and innovation, Chime has created a modern banking experience that prioritizes accessibility, convenience, and savings.

Setting Up Your Chime Bank Account

Creating a Chime Bank account is quick and easy. Simply visit the Chime website or download the Chime mobile app from the App Store or Google Play. Sign up with your personal information, including your full name, email address, and password. You’ll also need to provide your phone number, Social Security number, and date of birth for identity verification purposes.

Once you’ve entered your personal details, Chime will perform a soft credit check to verify your identity. This process won’t impact your credit score. You may be asked to provide additional information, such as a photo of your identification document or a selfie for facial recognition technology.

After your identity has been successfully verified, you’ll be able to fully access your Chime Bank account. This includes features such as a spending account, savings account, and optional debit card. Chime also offers additional benefits like early direct deposit, fee-free overdraft protection, and automatic savings.

With Chime, managing your finances has never been more convenient and secure. Sign up today and experience the benefits of modern banking.

Understanding Chime Bank’s Mobile App

Chime Banking is revolutionizing the way people manage their finances with its user-friendly mobile app.

Navigating the Chime Bank Mobile App is a breeze, making it easy for users to access their accounts and perform various banking tasks.

| Features | Tools |

|---|---|

| Real-time balance updates | Deposit alerts |

| Instant transaction notifications | Card management |

| Mobile check deposits | Bill pay |

| Fee-free overdraft protection | Savings goals |

| Spending insights | Automatic savings |

The Chime Bank Mobile App provides real-time balance updates and instant transaction notifications to keep users informed about their finances. Additionally, users can conveniently deposit checks using their mobile devices.

With the app’s card management feature, users can easily freeze or unfreeze their cards, report lost or stolen cards, and set spending limits.

Chime Bank’s bill pay feature allows users to schedule and manage their payments, ensuring bills are paid on time. The app also offers fee-free overdraft protection to help users avoid unnecessary charges.

Users can set savings goals and track their progress using the Chime Bank Mobile App. The app provides spending insights to help users understand their spending habits and make informed financial decisions.

With automatic savings, users can effortlessly save money by setting up recurring transfers from their Chime Spending Account to their Chime Savings Account.

Managing Your Chime Bank Account

Chime Banking simplifies managing your bank account with its user-friendly features. With Chime, depositing and withdrawing money is hassle-free. You can deposit money into your Chime account through direct deposit or by transferring funds from another bank account. Chime also offers the option to withdraw money at thousands of fee-free ATMs nationwide.

Transferring funds is convenient and can be done instantly through the Chime mobile app. You can send money to friends and family using their email or mobile number, even if they don’t have a Chime account. Chime’s Spending Account allows you to make purchases using your Chime Visa Debit Card while their Savings Account lets you save money effortlessly with automatic transfers.

| Depositing and Withdrawing Money |

| – Direct deposit and fund transfers |

| – Fee-free withdrawals at thousands of ATMs |

| Transferring Funds |

| – Instant transfers through Chime mobile app |

| – Send money to friends and family |

Chime Banking offers a seamless banking experience, making it easy for you to manage your finances efficiently.

Chime Bank’s Fee Structure

Chime Bank offers a no fee policy, which means that they strive to minimize the fees and charges associated with their banking services. This approach sets them apart from traditional banks that often impose a variety of fees on their customers. With Chime, you won’t have to worry about monthly maintenance fees, minimum balance requirements, or overdraft fees. These fees are particularly frustrating for customers who are trying to save money and avoid unnecessary charges. Chime aims to make banking more accessible and affordable by eliminating these fees altogether.

Chime’s Security Measures

When it comes to Chime Banking, security measures are of utmost importance. Chime ensures the protection of your bank account through various ways.

One fraud protection feature offered by Chime is the ability to disable or enable transactions on your account instantly through the Chime mobile app. If you suspect any unauthorized activity, you can simply turn off your Chime card to prevent any further charges. Chime also provides real-time alerts for any transactions made with your account, so you can quickly identify and report any suspicious activity.

Additionally, Chime implements strong security protocols to safeguard your information. Chime uses encryption to protect your personal data, and their systems are regularly monitored and audited to ensure security. Moreover, Chime collaborates with leading payment processors to ensure the safety of your transactions.

In conclusion, Chime employs robust security measures such as instant transaction controls, real-time alerts, encryption, and collaboration with payment processors. With Chime, you can have peace of mind knowing that your bank account is protected.

Chime Bank’s Additional Features And Benefits

Chime Bank offers a range of additional features and benefits that make it stand out from other banking options. One notable feature is Chime’s Automatic Savings Program. This program allows users to effortlessly save money by automatically depositing a percentage of their paycheck into their savings account. By setting up this feature, users can prioritize their savings goals and grow their savings without even thinking about it. Another noteworthy feature is Chime’s Early Direct Deposit. With this feature, users receive their paycheck up to two days earlier than traditional banks. This can be especially beneficial for those who need immediate access to their funds and want to avoid waiting for payday. Overall, Chime Bank’s additional features and benefits make it a convenient and user-friendly option for individuals looking to manage their finances effectively.

Credit: usa.visa.com

Frequently Asked Questions Of How Does Chime Banking Work

How Does Chime Banking Work?

Chime banking is an online bank that provides full-service banking services through a mobile app. Users can open an account, deposit funds, and access features like spending alerts, automatic savings, and early direct deposit. Chime does not charge overdraft fees or monthly maintenance fees, making it a convenient and affordable option for banking.

Is Chime Banking Safe?

Yes, Chime banking is safe. It encrypts all data and transactions to protect users’ personal and financial information. Chime also offers two-factor authentication and fingerprint login for added security. Additionally, Chime is a member of the FDIC, meaning deposits are insured up to $250,000 per depositor.

How Can I Deposit Money Into My Chime Account?

You can deposit money into your Chime account in several ways. You can set up direct deposit with your employer or government benefits provider, deposit cash at over 90,000 retail locations (through the Green Dot network), or transfer funds from another bank account.

Chime also allows mobile check deposit through its app.

Can I Use Chime Banking Outside Of The United States?

Yes, you can use Chime banking outside of the United States. However, some features and services may not be available internationally. It’s important to note that Chime charges a 3% foreign transaction fee for ATM withdrawals and purchases made outside of the United States.

Conclusion

Chime Banking offers a convenient and innovative way to manage your finances. With its user-friendly mobile app and fee-free banking services, Chime has attracted millions of customers. From its early direct deposit feature to its automatic savings tools, Chime is revolutionizing the banking experience.

By providing a seamless and hassle-free platform, Chime empowers users to take control of their money. With its wide range of features and commitment to transparency, Chime Banking is definitely worth considering for those looking for a modern banking solution.