Chime Bank is located in the state of California. Chime Bank, a popular online banking platform, is headquartered in California.

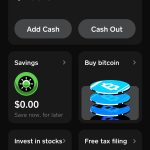

With its innovative features and seamless user experience, Chime Bank has emerged as one of the leading digital banking solutions in the United States. As a pioneer in the fintech industry, Chime Bank offers its customers a range of banking services, including checking and savings accounts, debit cards, and early paycheck access.

The bank’s commitment to transparency, no hidden fees, and user-friendly mobile app has earned it a loyal customer base. With its California roots, Chime Bank continues to revolutionize the way individuals manage their finances, providing easy access and convenient banking solutions for users across the country.

The Origin And Background Of Chime Bank

The origin and background of Chime Bank can be traced back to its establishment in 2013. Chime Bank was founded with a vision to provide a modern, online banking experience that empowers individuals to take control of their finances. Its mission is to help people lead healthier financial lives by offering innovative solutions that simplify money management.

Chime Bank has made a significant impact in the banking industry by leveraging technology to eliminate unnecessary fees and complexities. With its user-friendly mobile app and seamless integration of banking and saving features, Chime Bank has attracted a large customer base. This digital-first approach allows customers to easily track their spending, save automatically, and receive early access to their paychecks. Chime Bank has gained recognition for its commitment to financial education and providing access to banking services for underbanked individuals.

Chime Bank’s history and establishment demonstrate a commitment to revolutionizing the banking experience and promoting financial well-being. Since its inception, Chime Bank has continued to innovate and expand its offerings, solidifying its position as a leader in the digital banking space.

Headquarter Location Of Chime Bank

Chime Bank, a prominent online banking platform in the United States, has its headquarters located in San Francisco, California. The selection of this state as the headquarters’ location was influenced by various factors.

Firstly, San Francisco is renowned for its thriving technology and innovation hub, making it an ideal destination for Chime Bank, which operates primarily in the digital realm. The city’s proximity to Silicon Valley ensures access to a pool of skilled professionals and potential partners.

Furthermore, San Francisco’s diverse and vibrant economy provides ample opportunities for Chime Bank to grow and expand. The city is a hub for financial institutions and startups, fostering an environment that promotes innovation and collaboration.

Another significant factor in selecting San Francisco as the headquarters’ location is its strategic geographical position. Situated on the West Coast, Chime Bank can easily serve customers across the country, especially those in the western region, while having access to international markets conveniently.

| Factors contributing to the selection of San Francisco as Chime Bank’s headquarters: |

| 1. Thriving technology and innovation hub |

| 2. Proximity to Silicon Valley |

| 3. Diverse and vibrant economy |

| 4. Strategic geographical position |

Chime Bank’s Regulatory And Legal Compliance

Understanding the state regulations and laws governing Chime Bank’s operations

Chime Bank, one of the leading digital banks in the US, operates under strict regulatory and legal compliance. Operating in accordance with state regulations is crucial for Chime Bank to maintain its integrity and provide a secure banking experience to its customers.

Chime Bank is headquartered in San Francisco, California, and is subject to the regulations and laws set forth by the California Department of Financial Protection and Innovation. The bank must adhere to these regulations to ensure the safety of customer funds, privacy protection, and prevention of fraudulent activities.

The impact of regulatory compliance on Chime Bank’s growth and expansion is significant. By keeping up with the ever-changing regulatory landscape, Chime Bank can expand its services to more states and reach a larger customer base. Compliance with state regulations also enhances Chime Bank’s reputation as a trustworthy financial institution.

Credit: www.gobankingrates.com

The Operational Network Of Chime Bank In Different States

Chime Bank operates in multiple states across the country, providing its operational network to customers nationwide. With its wide reach, Chime Bank offers convenient and accessible banking services in various states.

The Operational Network of Chime Bank in Different States Chime Bank has established its presence in various states across the country, allowing customers nationwide to access its innovative banking services. The bank’s expansion strategy involves careful research and a systematic approach to ensure smooth operations. When entering a new state, Chime Bank focuses on obtaining the necessary regulatory approvals and licenses to operate legally. This includes complying with state-specific banking laws and regulations. Chime Bank also establishes partnerships with local businesses and financial institutions to enhance its network and reach. By leveraging technology and digital platforms, Chime Bank is able to provide seamless banking experiences to customers, regardless of their geographical location. Through this strategic expansion, Chime Bank continues to grow its customer base and serve individuals and businesses in multiple states across the United States.Chime Bank’s Partnership With Local Financial Institutions

Chime Bank’s partnership with local financial institutions is a key aspect of their business model. By collaborating with local banks and credit unions in specific states, Chime Bank is able to offer numerous benefits and advantages to their customers.

One of the main benefits of these partnerships is that it allows Chime Bank customers to have access to a wider network of ATMs. Through these collaborations, Chime Bank customers can withdraw cash from ATMs belonging to their partner financial institutions without incurring any fees.

Another advantage of Chime Bank’s partnerships is the ability to deposit cash into Chime Bank accounts. While Chime Bank is primarily an online bank, partnering with local financial institutions allows customers to deposit cash into their accounts through the partner’s physical branches.

Moreover, these partnerships enable Chime Bank to provide customers with enhanced customer service and support. Customers can visit the partner institution’s branches to seek assistance and have their banking needs addressed in person.

In conclusion, Chime Bank’s partnerships with local financial institutions play a crucial role in providing convenient, accessible, and customer-focused banking services to their users.

The Connection Between State Laws And Chime Bank’s Services

Chime Bank, an online banking platform, is governed by state laws which influence its services. Each state has its own regulations and requirements that Chime Bank must adhere to, leading to variations in the services it offers. For instance, some states may have specific rules about overdraft fees, while others may restrict certain types of transactions. To meet state-specific regulations, Chime Bank tailors its services accordingly.

Examples of specific services offered by Chime Bank to comply with state laws include state-specific regulations on overdraft fees and transaction restrictions. By customizing its products based on state requirements, Chime Bank ensures that it remains compliant and can operate in various jurisdictions.

Customer Base Distribution: State-wise

Chime Bank’s customer base is spread across various states in the United States. This wide distribution reflects Chime Bank’s popularity and accessibility among different communities. The factors contributing to its popularity in specific states may include:

- The ease of opening an account, with a user-friendly online platform.

- Chime Bank’s fee structure, which offers customers the benefit of no hidden fees.

- Features like early direct deposit and instant notifications, catering to customers’ banking needs.

- Chime Bank’s focus on providing convenient and efficient customer support.

- Innovative offerings, such as their automatic savings program, rounding up transactions to the nearest dollar and saving the difference.

These factors have helped Chime Bank gain popularity across various states, making it a preferred choice for users who value transparency, convenience, and modern banking services.

Exploring Chime Bank’s Expansion Plans

Chime Bank, known for its innovative digital banking solutions, has been making significant expansions to accommodate its growing customer base. While they have established a strong presence in several states already, the company has ambitious plans for further expansion.

Insights into Chime Bank’s future expansion strategies reveal a strong focus on penetrating new markets. With an aim to provide their services to a wider audience, Chime Bank has set its sights on increasing its presence in multiple states across the country.

Predictions and prospects indicate a positive outlook for Chime Bank’s growth and reach. As the demand for digital banking continues to surge, the bank anticipates great success in establishing a foothold in new states and catering to the needs of diverse customers.

Chime Bank’s expansion plans reflect their dedication to revolutionize the banking industry and cater to the evolving needs of consumers. With its user-friendly interface, low fees, and innovative features, Chime Bank is well-positioned for success as it ventures into new territories.

Frequently Asked Questions Of What State Is Chime Bank In

What State Is Chime Bank In?

Chime Bank is headquartered in San Francisco, California. However, since it is an online bank, it is accessible to customers nationwide, regardless of their location within the United States. This means you can open an account and use Chime Bank services from any state in the country.

Can I Use Chime Bank If I Don’t Live In California?

Absolutely! Chime Bank is available to customers nationwide, regardless of the state they reside in. Whether you’re living in California or any other state across the United States, you can easily open an account with Chime Bank and start enjoying their convenient online banking services.

Are There Any Chime Bank Branches In Other States?

No, Chime Bank does not have any physical branches in other states. As an online bank, Chime operates solely through their digital platform, which allows customers to manage their accounts and access banking services from their computers or mobile devices.

This eliminates the need for physical branches and provides greater convenience for customers.

How Can I Contact Chime Bank Customer Support?

To reach Chime Bank’s customer support, you can visit their website and access the Help Center. There you’ll find a variety of resources and articles that can help answer your questions. Additionally, you can submit a support ticket or contact Chime Bank directly through their mobile app, which allows for secure messaging and real-time assistance.

Conclusion

Chime Bank operates as an online-only financial institution, making it accessible to customers across the United States. Its user-friendly mobile app and fee-free accounts have undoubtedly contributed to its popularity among millennials and tech-savvy individuals. With Chime’s headquarters in San Francisco, California, it has expanded its services nationwide, offering a convenient and modern banking experience.

Whether you’re in California or any other state, Chime Bank is there to help you manage your finances seamlessly.