Cash App uses two FDIC-insured bank partners, Sutton Bank and Lincoln Savings Bank, to provide its financial services. These banks handle all the transactions and ensure the security and reliability of Cash App’s services.

Overview Of Cash App As A Financial Services Platform

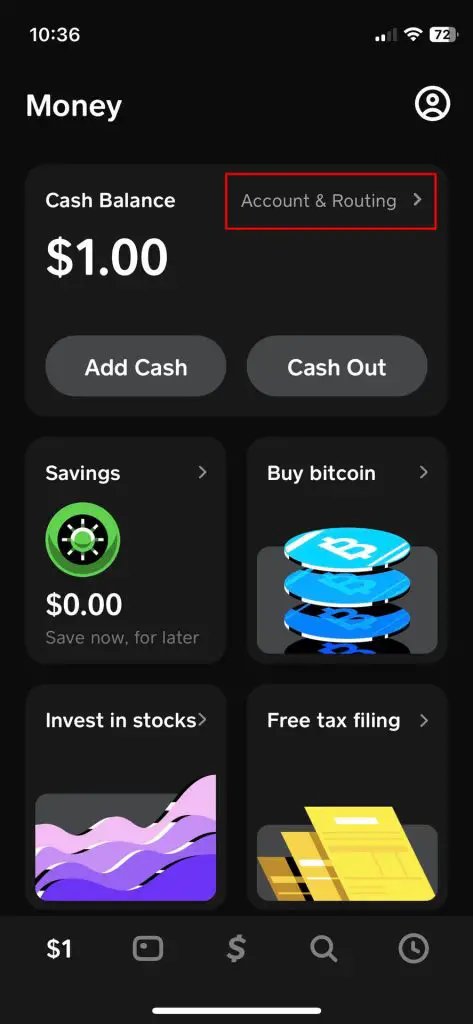

Cash App is a popular mobile payment service that offers a variety of financial services, including direct deposit, bill pay, and Bitcoin trading. Cash App uses two FDIC-insured bank partners to provide its financial services: Sutton Bank and Lincoln Savings Bank. Sutton Bank and Lincoln Savings Bank play a vital role in establishing trust, transparency, and security within Cash App’s financial ecosystem. They handle all the transactions and provide banking services and FDIC insurance to Cash App users. Cash App’s bank name and address are important factors in building trust and confidence in the app. Cash App’s financial platform, in collaboration with its bank partners, provides a faster, simpler way to manage money on mobile devices, making it a convenient choice for many users.

Credit: m.youtube.com

Cash App’s Bank Partners – Sutton Bank And Lincoln Savings Bank

Cash App utilizes Sutton Bank and Lincoln Savings Bank as its bank partners for providing various financial services, such as direct deposit and bill pay. These partner banks ensure the security and reliability of Cash App’s banking services, with FDIC insurance coverage.

Cash App utilizes two FDIC-insured bank partners, Sutton Bank and Lincoln Savings Bank, to provide its users with a range of financial services. These services include direct deposit, bill pay, and Bitcoin trading. The partnership with these banks ensures that users have access to the security and protection offered by FDIC insurance. While Cash App itself is not a bank, it works closely with these bank partners to enable seamless and reliable financial transactions. Through the collaboration with Sutton Bank and Lincoln Savings Bank, Cash App ensures the trust, transparency, and security that its users expect in managing their finances.Importance Of Cash App’s Bank Name And Address

|

Cash App’s bank name and address play a vital role in establishing trust, transparency, and security within the app’s financial ecosystem. Cash App uses two partner banks for its services, Sutton Bank and Lincoln Savings Bank. Sutton Bank and Lincoln Savings Bank are both FDIC-insured, providing a level of protection and assurance to users. By partnering with reputable banks, Cash App ensures that customers’ funds are held securely and in compliance with regulatory standards. Additionally, the bank name and address are essential for transparency. Users can easily verify the legitimacy of Cash App’s banking partners, which fosters trust and confidence in the platform. Furthermore, the inclusion of bank name and address enhances security. It allows users to verify the source of any communication or request related to their financial transactions, preventing phishing scams and fraud attempts. In summary, Cash App’s bank name and address are vital details that contribute to the overall trust, transparency, and security of the platform. |

Faqs About Cash App’s Banking Partners

Cash App uses two FDIC-insured bank partners to provide its financial services: Sutton Bank and Lincoln Savings Bank.

Cash App works with its bank partners to offer banking services, such as direct deposit, bill pay, and Bitcoin trading, to its users.

Yes, Cash App’s banking services are FDIC insured. This means that the funds in a Cash App user’s account are protected up to $250,000.

Yes, Cash App users can access their funds through the partner banks, Sutton Bank and Lincoln Savings Bank. They can also use their Cash Card, issued by Sutton Bank, to make purchases and withdraw cash.

Frequently Asked Questions On What’s Cash Apps Bank

Which Bank Does Cash App Use?

Cash App uses two FDIC-insured bank partners, Sutton Bank and Lincoln Savings Bank. These banks provide the financial services for Cash App, including direct deposit, bill pay, and Bitcoin trading.

What Is A Cash App Bank Account?

Cash App is a financial platform, not a bank. It uses two partner banks, Sutton Bank and Lincoln Savings Bank, for its services. Banking services and FDIC Insurance are provided by these partner banks.

Is Cash App A Sutton Bank?

No, Cash App is not a Sutton Bank. Cash App works with two FDIC-insured bank partners, Sutton Bank and Lincoln Savings Bank, to provide its financial services.

What Is Cash App Bank Name On Plaid?

Cash App’s bank name on Plaid is Lincoln Savings Bank. Plaid is a financial technology company that connects apps and websites to bank accounts. Cash App uses Lincoln Savings Bank as its main bank for this connection.

Conclusion

To provide its wide range of financial services such as direct deposit, bill pay, and Bitcoin trading, Cash App relies on the support of two FDIC-insured bank partners: Sutton Bank and Lincoln Savings Bank. These partnerships ensure that the app operates within a secure banking framework.

While Cash App itself is not a bank, it acts as a financial services platform, making it a convenient choice for users seeking a faster and simpler way to handle their personal finances. With Cash App, you can have peace of mind knowing that your transactions are backed by trusted banking partners.