Venmo is not a bank. It is a mobile payment app that allows users to send and receive money securely.

Venmo is owned by PayPal and operates as a subsidiary of the company. It functions as a digital wallet, where users can link their bank accounts or credit cards to make transactions.

Venmo: Bridging The Gap Between Social Media And Banking

Venmo, a popular digital payment platform, has quickly gained momentum in recent years, revolutionizing the way people send and receive money. With its seamless integration into social media platforms, Venmo has bridged the gap between social networking and banking, creating a unique and convenient way to make peer-to-peer payments.

Unlike traditional banking methods, Venmo offers a user-friendly interface and connects with users’ social media accounts, enhancing the social aspect of financial transactions. With just a few taps on their smartphones, users can split bills, pay friends back, or even make purchases seamlessly.

With the rise of digital payment platforms, Venmo leads the pack with its innovative features and ease of use. Its ability to provide a social and interactive platform for monetary transactions sets it apart from other payment apps. People are embracing this new way of banking, making Venmo a household name and a necessary tool for the modern digital age.

Understanding The Basics Of Venmo

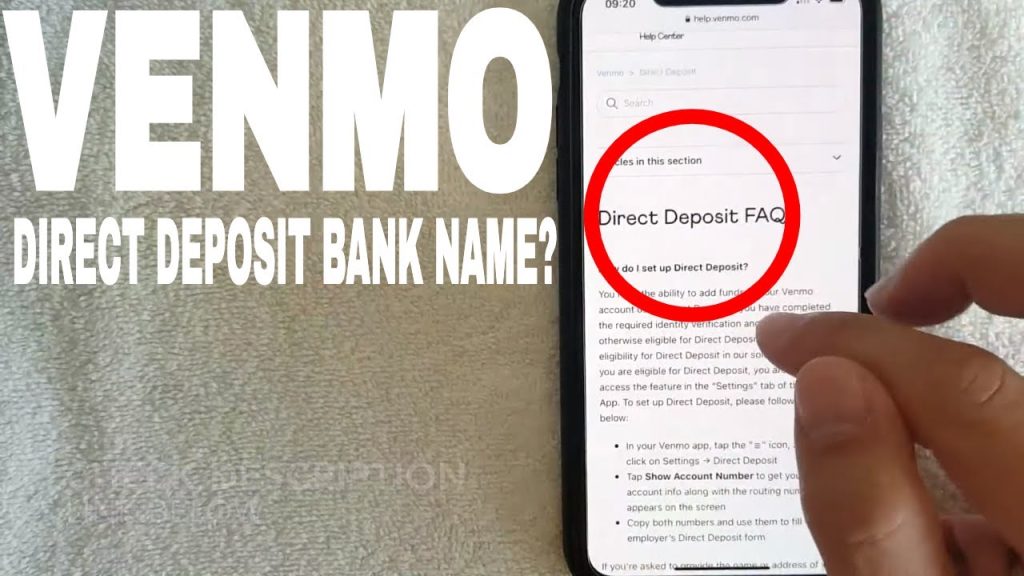

Venmo is what bank: Venmo is a popular digital payment app that allows users to send and receive money from their friends, family, or merchants. It offers a convenient way to transfer funds without the need for cash or checks.

- Creating a Venmo account: To get started with Venmo, you need to download the app and sign up for an account. Provide your basic information and create a unique username.

- Linking your bank account or credit card: Venmo requires you to link a bank account or credit card to add funds or make payments. This ensures a reliable source of funds for transactions.

- Making payments and requesting money: Once your account is set up, you can easily send money to your contacts by entering their username or scanning their Venmo QR code. You can also request money from others and split bills effortlessly.

- Setting up notifications and privacy settings: Venmo offers various notification and privacy settings to enhance your user experience. You can choose to receive alerts on transactions, manage privacy preferences, and control the visibility of your transactions.

The Key Features And Benefits Of Venmo

Venmo is revolutionizing the way we handle our financial transactions with its seamless integration with social media platforms. By allowing users to connect their accounts with platforms like Facebook and Instagram, Venmo enables easy sharing of payment experiences and splitting of bills among friends. Whether you are dining out, going on a trip or simply organizing a group event, Venmo simplifies the process of splitting payments.

One of the standout features of Venmo is its robust security and fraud protection measures. With advanced encryption and secure payment processing, users can feel confident that their transactions are protected. Additionally, Venmo provides support for unauthorized transactions, ensuring that users are not held liable for any fraudulent activity on their accounts.

Venmo also offers instant transfers and withdrawal options, giving users the flexibility to access their funds whenever they need them. Whether you want to transfer money to a friend or withdraw cash, Venmo’s quick and convenient options make it easy.

Exploring The Venmo Card And Rewards Program

Have you ever wondered if Venmo can replace a traditional bank? Well, with the introduction of the Venmo Card and Rewards Program, it’s definitely a possibility. The Venmo card is a debit card that allows users to access their Venmo balance for spending in-store and online. With a seamless integration between the Venmo app and the Venmo card, users can easily manage their finances and make purchases with just a tap.

One of the major benefits of using the Venmo card is the cashback and rewards offered through the Venmo Rewards program. Users have the opportunity to earn cashback on eligible purchases made with the card. This means that every time you use your Venmo card, you can earn a percentage of the purchase amount back in cash, which is then automatically deposited into your Venmo account.

Overall, the Venmo card and Rewards Program provide users with a convenient and rewarding way to manage their finances. Whether you want to simplify your spending or earn cashback on purchases, the Venmo card is definitely worth considering.

The Future Of Venmo In The Banking Industry

Venmo, the peer-to-peer payment platform, has been making significant waves in the banking industry. Its user-friendly interface and seamless integration with social networks have attracted millions of users. What sets Venmo apart from traditional banking institutions is its ability to offer a more convenient and streamlined payment experience. With the expanding range of services and partnerships, Venmo continues to assert itself as a dominant player in the financial technology sector.

Venmo’s impact on traditional banking institutions cannot be understated. As more customers turn to Venmo for their financial needs, banks are feeling the pressure to adapt. Many traditional banks are now integrating similar features into their own mobile banking apps to remain competitive. However, Venmo’s user base and brand recognition give it a distinct advantage in this space.

The prospects for Venmo’s growth and innovation are promising. With its parent company, PayPal, backing its operations, Venmo has the financial resources to expand its services and pursue new opportunities. The platform has already introduced features like Venmo Card and Pay with Venmo, further increasing its utility and convenience for users. As Venmo continues to evolve, it will likely influence the future of banking experiences for both consumers and financial institutions.

Credit: www.forbes.com

Cautions And Considerations When Using Venmo

When using Venmo, it is important to stay vigilant against potential scams. Venmo has become increasingly popular for its convenience and ease of transferring money to others. However, with this popularity comes the risk of fraud and unauthorized transactions. It is crucial to regularly review your Venmo transactions and keep an eye out for any suspicious activity. Be cautious when making transactions with unfamiliar individuals and ensure that you are sending money to the correct person. Understanding Venmo’s transaction limits and fees can also help prevent any unexpected charges or limitations on your account. Additionally, taking security measures to protect your Venmo account such as using a strong and unique password, enabling two-factor authentication, and regularly updating your account information can help safeguard your funds and personal information.

Frequently Asked Questions On Venmo Is What Bank

What Is Venmo And How Does It Work?

Venmo is a mobile payment service that allows users to send and receive money. It works by linking your bank account or credit card to your Venmo account and then transferring funds to other Venmo users through the app.

Is Venmo Safe To Use?

Yes, Venmo is safe to use. It employs encryption techniques to secure your personal and financial information. It also offers security features such as PIN codes and two-factor authentication to protect your account.

Can You Use Venmo Without A Bank Account?

Yes, you can use Venmo without a bank account. You can link a debit card or credit card to your Venmo account and use it to send and receive money. However, if you want to transfer money to or from your bank account, you will need to link it to your Venmo account.

Conclusion

Venmo has revolutionized the way we handle our transactions, transforming itself into a reliable digital alternative to traditional banks. Its user-friendly interface and seamless money transfer capabilities have become increasingly popular among individuals and businesses alike. With its strict security measures and fast processing times, Venmo offers a convenient and efficient banking experience.

From splitting bills to making online purchases, Venmo has quickly solidified its place as a trusted financial tool in today’s digital age. Say goodbye to lengthy bank visits and embrace the simplicity and convenience of Venmo.