Cash App, a popular mobile payment service, partners with Lincoln Savings Bank to process its transactions. Lincoln Savings Bank is the bank that Cash App uses for its services.

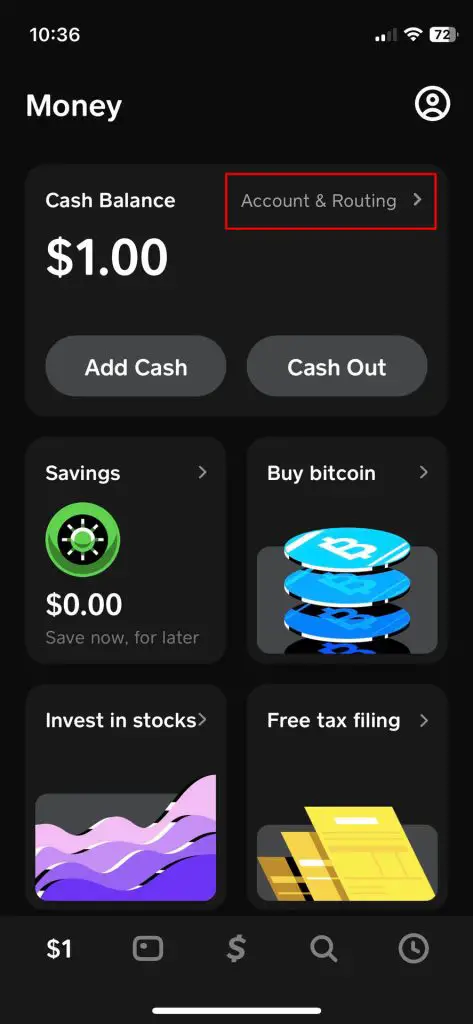

Cash App, a widely used mobile payment service, has revolutionized how people send and receive money. With its user-friendly interface and convenience, Cash App has gained immense popularity in recent years. However, have you ever wondered which bank Cash App utilizes to process its transactions?

Well, the answer is Lincoln Savings Bank. As a trusted financial institution, Lincoln Savings Bank provides the backend infrastructure that enables Cash App users to seamlessly send and receive money. We will explore the partnership between Cash App and Lincoln Savings Bank, delving into the services they offer and the benefits they bring to their users. So, let’s dive in and discover the role of Lincoln Savings Bank in facilitating our day-to-day financial transactions through Cash App.

Introduction To Cash App

What is the Name of the Bank Cash App Uses

Cash App is a mobile payment service that allows users to easily send and receive money directly from their smartphones. With over millions of active users, Cash App has become one of the leading peer-to-peer payment platforms in the United States. The app is designed for simplicity and convenience, making it accessible to users of all ages and tech-savviness levels.

One of the key features of Cash App is the ability to link your bank account to the app. This allows users to transfer money seamlessly between their Cash App balance and their bank account. Cash App supports a wide range of banks, making it easy for users to connect their preferred financial institution.

In addition to bank transfers, Cash App also offers a useful feature called Cash App Card. The Cash App Card functions like a traditional debit card, allowing users to make purchases at any merchant that accepts Visa. Users can also withdraw cash from ATMs using their Cash App Card.

Overall, Cash App provides a simple and convenient way to handle your financial transactions. Whether you need to split a bill with friends, send money to family members, or make purchases, Cash App has you covered.

How Cash App Works

The Cash App is a popular peer-to-peer payment platform that allows users to send and receive money using their mobile devices. To utilize the app, users need to create an account and link it to their bank account or debit card. Once the setup is complete, sending money is as simple as entering the recipient’s $Cashtag, phone number, or email address and specifying the desired amount. Funds can also be received by providing the user’s own $Cashtag or enabling the Auto Cash Out feature. Cash App also offers a unique Cash Card, which functions like a regular debit card and can be used for purchases or ATM withdrawals. It is important to note that Cash App is affiliated with a banking partner and transactions may be subject to their terms and conditions.

The Banking Partner Of Cash App

What is the Name of the Bank Cash App Uses

When it comes to Cash App’s partnership with a banking institution, the exact name of the bank is not publicly disclosed. Cash App, developed and operated by Square, utilizes a licensed bank to hold customer funds. This partnership allows Cash App users to engage in various financial transactions such as sending and receiving money, making payments, and investing in stocks. By leveraging the services of a banking institution, Cash App ensures the safety and security of customer funds, as well as compliance with regulatory requirements. While the details of the banking partner may not be explicitly shared, Cash App prioritizes the protection and seamless experience of its users through its trusted banking relationship.

Partner Bank Features And Benefits

Features and services provided by Cash App’s partner bank:

- Easy and quick account setup process

- Convenient mobile banking app with user-friendly interface

- Secure and encrypted transactions for enhanced privacy

- 24/7 access to account information and balance

- ATM network availability for cash withdrawals

- Mobile check deposit option for hassle-free deposits

- Ability to link external accounts for seamless fund transfers

- Real-time transaction notifications for improved tracking

- Integrated budgeting tools for better financial management

- Increased convenience and accessibility to account information and transactions

- Enhanced security measures to protect your financial data

- Efficient and instant money transfers between accounts

- Convenient cash withdrawal options through the ATM network

- Simplified and streamlined budgeting with integrated tools

- Quick and hassle-free setup process to get started

By utilizing the features and services provided by Cash App’s partner bank, users can experience a seamless banking experience with easy access to their account information, secure transactions, and enhanced financial management tools. The benefits of using the partner bank include increased convenience, improved security measures, efficient money transfers, cash withdrawal options, and simplified budgeting. With a user-friendly mobile banking app, customers can enjoy quick and easy setup, ensuring hassle-free banking at their fingertips.

Security And Safety Measures

Security and safety are top priorities for Cash App and its partner bank. They have implemented various measures to protect user information and transactions. To ensure secure transactions, Cash App uses end-to-end encryption for all data transmitted between users and the app’s servers.

Two-factor authentication is another security measure implemented by Cash App, which adds an extra layer of protection to user accounts. This feature requires users to provide a verification code in addition to their regular login credentials.

Cash App also works with a Federal Deposit Insurance Corporation (FDIC) insured partner bank. This partnership allows users to securely store their funds as the bank adheres to strict regulatory standards and provides safeguarding measures in compliance with industry regulations.

In addition to these security measures, Cash App employs advanced fraud detection algorithms to identify and prevent any suspicious transactions. The app also offers 24/7 customer support to assist users in case of any security concerns or issues.

Customer Support And Banking Services

Availability of customer support for banking inquiries: Cash App has partnered with Lincoln Savings Bank to offer banking services. As a result, if you have any inquiries regarding banking, you can contact Cash App’s customer support. They are available 24/7 to assist you with all your banking-related questions and concerns. You can reach out to them through the app or website.

Additional banking services offered by Cash App’s partner bank: Apart from customer support, Cash App’s partner bank provides various other banking services. Some of these services include direct deposit, the ability to receive and send money from your bank account using Cash App, and even a savings account option. With these additional offerings, Cash App aims to provide a comprehensive banking experience to its users.

Alternatives To Cash App’s Partner Bank

In the world of online banking, there are various options available as an alternative to Cash App’s partner bank. These alternatives offer similar features and services that make managing your finances convenient and efficient. One popular online banking option is Chime. With Chime, you can easily send and receive money, make mobile deposits, and track your spending through the user-friendly mobile app. Another alternative is Simple, which offers fee-free banking and budgeting tools to help you take control of your finances. Revolut is also a notable choice, providing a variety of services including international money transfers and cryptocurrency trading. These alternatives provide a seamless banking experience, making it easier for you to handle your financial transactions and stay on top of your money.

Credit: money.com

Frequently Asked Questions For What Is The Name Of The Bank Cash App Uses

What Is The Name Of The Bank That Cash App Uses?

Cash App uses Lincoln Savings Bank.

How Does The Cash App Work With A Bank?

Cash App works with a bank by partnering with Lincoln Savings Bank to provide its users with banking services, such as direct deposit, debit card, and FDIC insurance for their funds.

Does Cash App Have A Partnership With Any Specific Bank?

Yes, Cash App has a partnership with Lincoln Savings Bank to facilitate banking services for its users.

What Are The Benefits Of Cash App Partnering With A Bank?

By partnering with a bank, Cash App is able to offer its users features like direct deposit and a debit card. Additionally, users’ funds are FDIC insured, providing them with added security.

Conclusion

The bank used by Cash App is Lincoln Savings Bank. As a popular mobile payment service, Cash App has gained immense popularity for its convenience and user-friendly features. By partnering with Lincoln Savings Bank, Cash App ensures secure and seamless transactions for its users.

With this information, you can confidently use Cash App, knowing that your money is in safe hands.