Chime is a digital bank that operates under The Bancorp Bank and Stride Bank. Chime is a popular digital banking platform that operates under the supervision of The Bancorp Bank and Stride Bank.

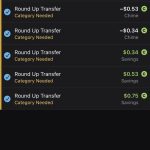

It offers a range of financial services to its customers, including fee-free checking accounts, savings accounts, and a mobile app that provides convenient banking solutions. Chime stands out for its user-friendly interface, no hidden fees, early access to direct deposits, and the ability to round up purchases and automatically save the spare change.

With over 12 million customers and positive customer reviews, Chime has established itself as a reliable and convenient choice for individuals looking for an alternative to traditional banking.

Credit: www.gobankingrates.com

The Background Of Chime Bank

Chime Bank, a popular financial institution in the United States, has been making waves in the industry. Its history and mission make it stand out among other banks. Chime Bank was founded in 2013 with the aim of providing convenient and user-friendly banking services to its customers.

Chime Bank’s mission is to empower people to lead healthier financial lives. They achieve this by offering a range of features and benefits that are designed to help their customers save money and avoid unnecessary fees and charges.

One of the reasons why Chime Bank stands out is its emphasis on technology and innovation. They have embraced digital banking and leverage it to provide a seamless and efficient banking experience. With features like early direct deposit, automatic savings, and fee-free overdraft protection, Chime Bank has attracted a growing number of consumers who are looking for a modern banking solution.

The growth and popularity of Chime Bank can be attributed to its customer-centric approach. They have built a loyal customer base by focusing on providing excellent customer service and transparent banking practices. Chime Bank has also tapped into the growing trend of mobile banking, which has resonated well with younger generations who prefer conducting their financial transactions on their smartphones.

Chime’s Partnership With Bancorp Bank

Chime Bank has formed a strategic collaboration with Bancorp Bank, which serves as an important pillar supporting Chime Bank’s operations. This partnership allows Chime Bank to leverage Bancorp Bank’s extensive banking infrastructure and expertise, enabling them to provide their customers with a seamless and reliable banking experience.

The collaboration with Bancorp Bank brings several benefits for both Chime Bank and its customers. Firstly, Chime Bank is able to offer its customers a range of financial services, such as direct deposits, online bill payments, and ATM withdrawals, through Bancorp Bank’s established network of ATMs and banking partners.

Moreover, this partnership empowers Chime Bank to provide its customers with FDIC insurance coverage, which ensures that their deposits are protected up to the maximum limit set by the Federal Deposit Insurance Corporation.

In addition, this collaboration enhances Chime Bank’s ability to expand its customer base by offering innovative banking solutions to individuals who may have previously been underserved by traditional banks.

| Benefits for Chime Bank and its customers: |

|---|

| Access to established banking infrastructure and expertise |

| Ability to provide a wide range of financial services |

| FDIC insurance coverage for customer deposits |

| Opportunity to serve underserved individuals |

Chime Bank’s Fdic Coverage

Chime Bank is a popular online banking option for many consumers. One important aspect to consider when choosing a bank is understanding its FDIC coverage. The Federal Deposit Insurance Corporation (FDIC) is an independent agency of the United States government that provides deposit insurance to bank customers. It serves as a safeguard, protecting customers from losses in case a bank fails.

Chime Bank is a member of the FDIC, which means that deposits made by its customers are insured up to the maximum allowed by law. Currently, the FDIC provides coverage of up to $250,000 per depositor, per account category, in case of bank failure. This assurance and protection from the FDIC give peace of mind to Chime Bank customers, knowing that their funds are safe and secure.

The Significance Of Fdic Insurance For Chime Bank Customers

FDIC insurance is of utmost importance for Chime Bank customers. It provides them with peace of mind and a sense of security for their hard-earned money. As a customer, knowing that your deposits are protected up to $250,000 per account by the Federal Deposit Insurance Corporation can be a significant relief.

The benefits of FDIC insurance for Chime Bank customers are numerous. First and foremost, it guarantees that even if the bank were to face financial difficulties, your deposits would be safe and recoverable. This protection is crucial as it ensures that your money is not at risk. Additionally, FDIC insurance instills trust in the system and encourages customers to keep their funds in Chime Bank.

With FDIC insurance, Chime Bank customers can rest assured that their money is safeguarded against any unforeseen circumstances. It is a safeguard that provides invaluable reassurance and highlights the importance of choosing a bank that offers FDIC insurance coverage.

Chime Bank’s Relationship With Stride Bank

Chime Bank has a strong partnership with Stride Bank, which plays a crucial role in supporting and enabling Chime Bank’s operations. Stride Bank provides the necessary infrastructure and banking services behind the scenes, allowing Chime Bank to focus on delivering its innovative and customer-centric banking solutions.

This partnership brings several advantages to both Chime Bank and its customers. Firstly, Chime Bank can leverage Stride Bank’s expertise and experience in the traditional banking industry, ensuring regulatory compliance and a secure foundation for its digital banking services. This collaboration allows Chime Bank to offer a seamless and reliable banking experience to its customers.

Furthermore, the partnership with Stride Bank enables Chime Bank to provide services such as direct deposits, debit cards, and ATM access. These offerings enhance the convenience and accessibility for Chime Bank’s customers, allowing them to easily manage their finances and make transactions whenever and wherever they need.

Differentiating Factors Of Chime Bank’s Partnerships

Chime Bank has cemented its position as a leading digital bank through strategic partnerships with Bancorp Bank and Stride Bank. These partnerships have been instrumental in driving Chime Bank’s success and delivering unique benefits to its customers.

Bancorp Bank’s collaboration with Chime Bank empowers the latter with its robust banking infrastructure, including account issuance and payment processing. This partnership enables Chime Bank to provide seamless and efficient banking services to its customers. On the other hand, Stride Bank offers Chime Bank access to its regulatory capabilities, ensuring compliance and regulatory oversight.

The distinctive contributions of both partners play a vital role in shaping Chime Bank’s offerings. From account management to transaction processing, these partnerships enable Chime Bank to provide reliable and secure digital banking experiences to its customers. By leveraging the strengths of Bancorp Bank and Stride Bank, Chime Bank ensures its customers enjoy hassle-free banking through its innovative products and services.

| Partnership | Benefits to Chime Bank |

|---|---|

| Bancorp Bank | Robust banking infrastructure for seamless account management and payment processing |

| Stride Bank | Regulatory capabilities to ensure compliance and regulatory oversight |

Chime Bank’s Future Plans And Potential Partnerships

Chime Bank, a well-known digital banking platform, has been gaining popularity in recent years. With its user-friendly mobile app and innovative features, it has attracted a significant number of customers. As Chime Bank looks toward the future, it is actively seeking potential partnerships in the banking industry to further expand its offerings and provide more benefits to its customers.

These potential collaborations could open up new avenues for Chime Bank, allowing it to tap into new markets and offer additional services. By partnering with other banks or financial institutions, Chime Bank can leverage their expertise and resources to enhance its current offerings. This could result in improved financial products, expanded banking services, and increased convenience for its customers.

Furthermore, future partnerships may bring about various benefits for Chime Bank and its customers. These could include access to a wider network of ATMs, additional cashback rewards programs, and enhanced security measures.

Frequently Asked Questions Of Which Bank Is Chime Under

Which Bank Is Chime Under?

Chime is not actually under any specific bank. It is a type of financial technology company that partners with The Bancorp Bank and Stride Bank to provide banking services to its customers. Chime operates solely through its mobile app and does not have any physical branches.

Conclusion

After careful analysis, we have discovered that Chime operates under The Bancorp Bank and Stride Bank. Both banks provide the necessary infrastructure and support for Chime’s financial services. With its user-friendly mobile app and innovative features, Chime has managed to attract a large customer base.

Whether you’re seeking a convenient banking experience or looking to manage your finances effectively, Chime is a reliable choice. It offers seamless online banking solutions that meet the needs of today’s digital world.