Cash App Bank is called Sutton Bank, which is a member of the FDIC. Sutton Bank provides the banking services for the popular mobile payment app, Cash App.

Cash App is a mobile payment app that allows users to send and receive money, as well as make purchases and investments. It is developed by Square, Inc. And offers a range of financial services, including a Cash Card linked to the user’s Cash App account.

To provide these services, Cash App partners with Sutton Bank, a United States-based bank. Sutton Bank is regulated and insured by the Federal Deposit Insurance Corporation (FDIC), which means that funds held in a Cash App account are eligible for FDIC insurance up to the applicable limits. By collaborating with a bank like Sutton Bank, Cash App can offer a more comprehensive and secure platform for its users, ensuring that their funds are protected and easily accessible.

The Rise Of Cash App Bank

With the rapid advancements in technology, financial transactions have become faster and more convenient. Cash App Bank is at the forefront of this revolution, and it is gaining popularity among users. By seamlessly integrating traditional banking services with a user-friendly digital platform, Cash App Bank is changing the way people manage their finances.

1. Simple and Convenient: Cash App Bank offers a straightforward and hassle-free banking experience. Users can easily access their accounts, make transactions, and track their spending, all at the touch of a button.

2. Seamless Integration: Unlike traditional banks, Cash App Bank seamlessly integrates with popular digital payment platforms, allowing users to transfer funds and make payments directly from their accounts.

3. Enhanced Security: Cash App Bank utilizes advanced security measures to protect user data and funds. With features like fingerprint and facial recognition, users can ensure their transactions are secure.

4. Incentives and Benefits: Cash App Bank offers various incentives and benefits, such as cashback rewards and discounts at partner merchants. This encourages users to utilize their accounts for everyday transactions.

5. Financial Empowerment: Cash App Bank aims to empower users by providing them with tools and resources to take control of their finances. Through features like budgeting tools and financial education material, users are better equipped to make informed financial decisions.

In this era of digital transformation, Cash App Bank is revolutionizing the banking industry. With its user-friendly interface, seamless integration, enhanced security, and financial empowerment, it is no wonder why it is gaining popularity among individuals seeking a modern and convenient banking experience.

Credit: m.youtube.com

Features And Benefits Of Cash App Bank Called

Introducing Cash App Bank Called, offering a range of features and benefits that make managing your finances easier than ever. With seamless navigation, secure transactions, and convenient money transfers, Cash App Bank Called is the ultimate banking solution for modern-day users.

Join today and experience the future of banking.

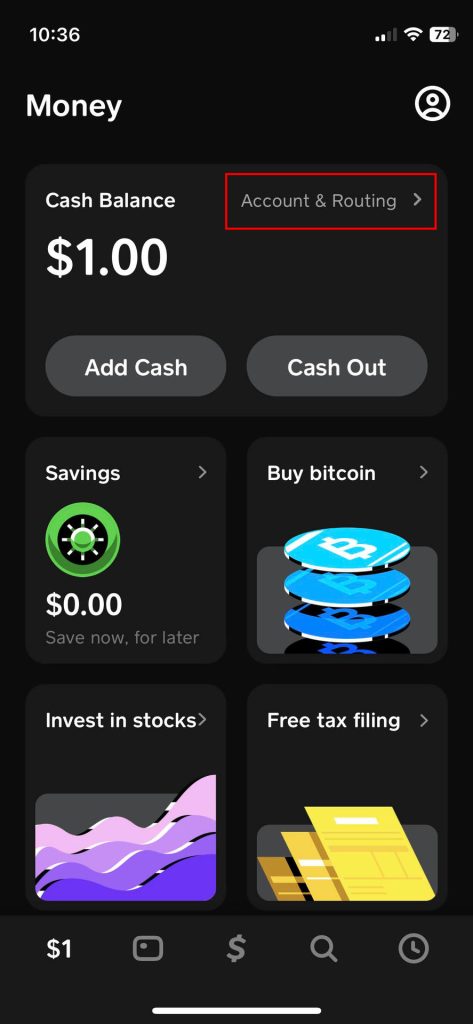

The Cash App Bank offers a convenient mobile banking experience that allows you to manage your finances on the go. With its user-friendly interface, you can easily access your accounts, transfer money, and pay bills with just a few taps.

One of the standout features of the Cash App Bank is its seamless integration with Cash App payment services. This means you can effortlessly move money between your Cash App Bank account and your Cash App balance, making it easier than ever to send and receive funds.

Additionally, the Cash App Bank offers competitive interest rates, helping you grow your savings over time. Unlike some traditional banks, the Cash App Bank is transparent about its fees, with no hidden charges that can eat away at your balance.

How To Sign Up For Cash App Bank Called

Learn how to sign up for Cash App Bank called and start enjoying the convenience of banking on your phone. With simple steps and user-friendly interface, you can easily create an account and manage your finances effortlessly.

Step-by-Step Guide to Opening a Cash App Bank Account

To sign up for a Cash App Bank account, follow these steps:

- Download and install the Cash App on your smartphone.

- Open the app and enter your phone number or email address.

- Create a unique username and password for your account.

- Verify your identity by providing your full name, date of birth, and social security number.

- Agree to the terms and conditions of the Cash App Bank.

- Link your existing Cash App to the bank account by selecting the “Link Bank Account” option.

- Enter your bank account details, including the routing number and account number.

- Verify your account by confirming two small deposits made by Cash App into your bank account.

- Once your account is verified, you can start using your Cash App Bank account for various transactions.

Exploring Cash App Bank Called Features

Cash App Bank Called offers a range of impressive features that make managing your finances easier and more convenient than ever before. One standout feature is the Cash App Bank Card, which functions as a debit card but comes with added benefits. With this card, you can easily access your funds and make purchases at millions of locations worldwide.

Another great feature is the money management tools included with the Cash App. These tools allow you to track your spending, set budgets, and monitor your financial habits in real-time. With the ability to view your transaction history and categorize your expenses, you can gain valuable insights into your spending patterns and identify areas where you can save.

In addition to money management, Cash App excels in peer-to-peer payment options. By using the Cash App, you can conveniently send and receive money from friends, family, or even businesses. Whether you need to split a bill, pay for a service, or simply send money as a gift, the Cash App provides a quick and secure way to transfer funds.

Security And Privacy Measures Of Cash App Bank Called

Cash App Bank called takes the security and privacy of its users very seriously. It implements strong encryption measures to protect sensitive data, ensuring that all transactions and personal information are securely transmitted. Additionally, Cash App Bank called offers two-factor authentication for account protection, requiring users to provide a secondary form of verification, such as a code sent to their mobile device, before accessing their accounts.

The bank takes extensive steps to safeguard personal and financial information. It has a dedicated team that regularly monitors for suspicious activity and uses advanced fraud detection techniques to identify and prevent fraudulent transactions. In the event of any potential security breach, Cash App Bank called has a 24/7 customer support team available to quickly respond to users’ concerns and assist in resolving any issues.

Cash App Bank Called Vs. Traditional Banking Institutions

With the rise of digital banking, Cash App Bank Called has emerged as a compelling alternative to traditional banking institutions. Offering a range of advantages, it provides a secure and convenient way to manage finances.

One of the key advantages of digital banking with Cash App is its low fees. Unlike traditional banks that may charge hefty fees for services such as ATM withdrawals or monthly account maintenance, Cash App offers many of these services for free or at a significantly reduced cost, making it attractive for cost-conscious individuals.

Another perk is the user-friendly interface and features that Cash App offers. Whether it’s instant peer-to-peer transfers, the ability to invest in stocks and Bitcoin, or the straightforward budgeting tools, Cash App provides a comprehensive suite of features designed to meet the modern financial needs of its users.

Moreover, Cash App places a strong emphasis on customer service. They offer 24/7 live customer support through phone, email, and in-app messaging, ensuring that users can get the assistance they need whenever they encounter an issue or have a query.

While traditional banks have stood the test of time and offer a sense of familiarity and trust, Cash App Bank Called is quickly gaining traction as an alternative that offers convenience, competitive fees, and a host of features to simplify financial management.

| Cash App Bank Called | Traditional Banks | |

|---|---|---|

| Fees | Low or reduced fees for many services | May charge higher fees for various services |

| Features | Instant transfers, investment options, budgeting tools | Varying features, may not offer as extensive a range |

| Customer Service | 24/7 live support through multiple channels | Availability may vary, not always available 24/7 |

Personal Finance Tips For Maximizing Cash App Bank Called

Personal Finance Tips for Maximizing Cash App Bank Called

When it comes to managing your personal finances, it’s important to take advantage of every available tool and resource. Cash App Bank Called is an innovative platform that offers a range of features to help you save, budget, and invest more effectively. By utilizing this platform, you can take control of your finances and set yourself up for long-term financial growth.

One of the key benefits of Cash App Bank Called is its saving strategies and investment opportunities. With features like automatic savings, you can effortlessly save a percentage of your income and watch your savings grow over time. Additionally, the platform provides a variety of investment options, allowing you to diversify your portfolio and potentially earn passive income.

Budgeting techniques and expense tracking are also made easier with Cash App. By linking your bank accounts and credit cards, you can easily monitor your spending habits and set realistic budgets. This will help you identify areas where you can cut back and save money.

Ultimately, by utilizing the features of Cash App Bank Called, you can take control of your personal finances and work towards long-term financial success.

Future Innovations And Expansion Of Cash App Bank Called

The future innovations and expansion plans for Cash App Bank called are focused on growth potential and market expansion. The bank aims to integrate with third-party financial services to provide a seamless and comprehensive banking experience to its customers. Integration with these services will allow customers to access a wider range of financial products and services, enhancing convenience and accessibility.

Cash App Bank called values customer feedback and continuously strives for improvement. By actively listening to customer needs and preferences, the bank can tailor its offerings to better meet their expectations. This customer-centric approach ensures that Cash App Bank called remains competitive in the market and can adapt to ever-changing customer demands.

Frequently Asked Questions Of Cash App Bank Called

Can I Use Cash App As My Primary Bank?

Yes, Cash App offers a range of banking services, including direct deposit and debit card access. It’s a convenient option if you’re looking for a digital banking experience without the need for a traditional bank account.

How Do I Open A Cash App Bank Account?

Opening a Cash App bank account is simple. Download the app, sign up with your phone number or email address, follow the prompts to link your existing bank account or provide necessary information, and you’re ready to start using it as your digital bank.

What Are The Benefits Of A Cash App Bank Account?

A Cash App bank account offers several benefits, such as direct deposit, instant transfers, the ability to send and receive money, and access to their Cash Card for making purchases. It’s a convenient and user-friendly option for managing your finances digitally.

Conclusion

The Cash App Bank offers a convenient and secure way to manage your finances. With its user-friendly interface and fast transactions, it has become a popular choice for individuals and businesses alike. Whether you need to send or receive money, deposit checks, or track your spending, the Cash App Bank has got you covered.

Explore its features and start banking with ease today.